Despite a subtle softening in travel spending enthusiasm as summer winds down, American travelers continue to show signs of underlying strength: financial sentiment remains stable, overnight leisure trip volume still outpaces last year, and interest is building around historic travel moments like the Route 66 Centennial and mega-events like the FIFA World Cup. While younger travelers are more likely to be watching their budgets, Boomers are planning more trips—and parents of school-aged children remain a key audience to watch heading into the Fall.

As Summer Draws to a Close, Americans’ Travel Spending Sentiment Sees Minor Shifts

- American travelers’ financial outlook this summer continues to hold relatively steady this month, with about one in three (33.1%) saying they are financially better off now compared to a year ago. While this is a slight dip (-2.8 points) compared to last month, this outpaces the lower numbers reported in late spring and also tracks above the same time last year (+1.2 points). Expectations for household finances remain most positive at 47.1 percent reporting they anticipate being better off in the next 12 months, though this is also nominally below the share reported in July (-1.5 points) and relatively flat year-over-year (-0.6 points). In a continued trend from last month’s generational breakouts, in August 2025 the two younger cohorts had the strongest reported shares of travelers who expect to be better off financially a year from now (61.2% of Gen Z, 61.2% of Millennial travelers), compared to 46.7 percent of Gen X and 33.6 percent of Baby Boomers, though this financial pessimism has not deterred older travelers from projecting higher numbers for their anticipated leisure travel budgets. In fact, Millennials were the most likely to have implemented a cost-saving measure for their travels in the next six months, while Boomers were the least likely to have done so. In another indicator that American travelers’ financial outlook remains cautious but steadied, expectations for a near-term U.S. economic recession also remained steady this month at 46.2 percent, (-0.1 points compared to last month), though this remains notably higher than the same time last year (+5.2 points).

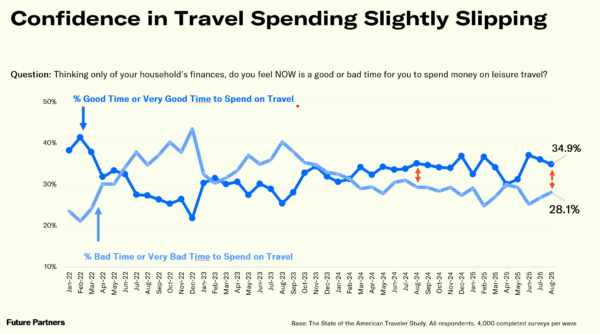

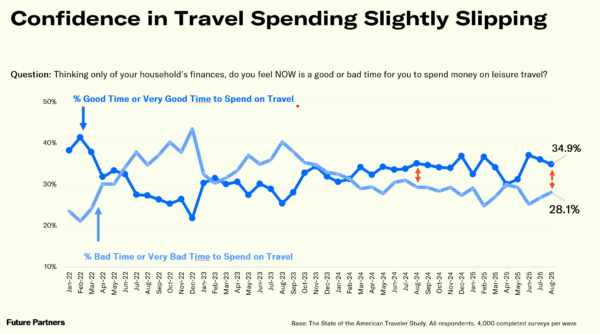

- In the wake of these financial and economic indicators, perceptions that now is a good time to spend on travel has dipped incrementally to 34.9 percent (-1.2 points month-over-month) and is flat year-over-year (-0.3 points). When asked how much they are prioritizing leisure travel in their budgets for the next three months, the share of American travelers who said leisure travel is a high budget priority fell -1.6 points to 56.5 this month compared to last month. This latter metric’s movement may be at least in part due to the shift away from the summer travel mindset as we approach fall and the new school year, given that the prioritization of leisure travel spending in the near-term has dropped more significantly compared to June 2025 by -4.6 points.

Recent Travel Volume and the Outlook for the Future

- After the record highs reported last month for recent overnight travel, just about half (50.8%) of American travelers reported taking an overnight leisure trip in the past month, down -3.2 points compared to last month but still outpacing the same time last year (+3.2 points). Overnight trips to visit friends and family had a similar story in August 2025, with 47.0 percent reporting taking such a trip, down -3.7 points compared to July 2025 but up +2.1 points compared to a year ago.

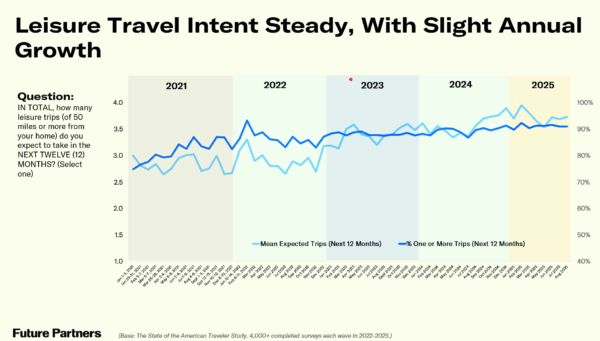

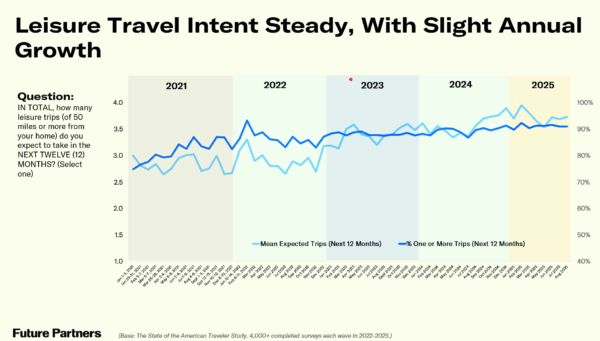

- Turning next to expected travel volume for the coming year, 91.0 percent of American travelers said they will take at least one leisure trip in the next twelve months, at an average of 3.7 trips, on par with the numbers reported last month but slightly ahead of the same time last year (+1.4 points). Baby Boomer travelers have the most leisure trips planned at an average of 4.0, compared to 3.6 trips reported by both Millennials and Gen X travelers and 3.3 trips for Gen Z. Baby Boomers also less likely to say they were deterred by financial or time constraints when it comes to recent travel.

Interest in Travel for Upcoming Mega-Events

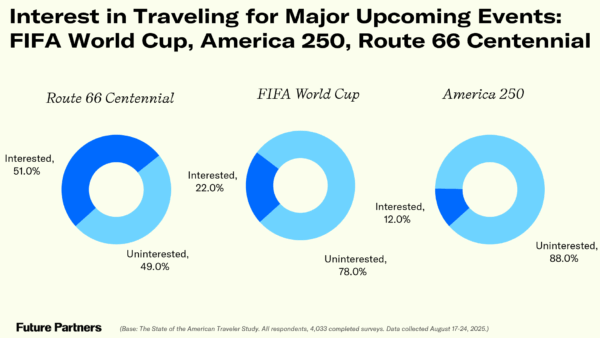

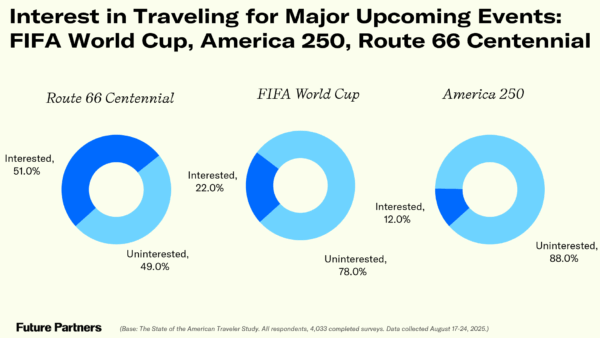

- Route 66 is celebrating its centennial anniversary in 2026, marking 100 years since its establishment, with each of the eight states along Route 66 planning its own celebratory events and activities, including car shows, festivals, and cultural experiences. Given this upcoming anniversary, this month Future Partners asked American travelers to share how interested they would be in traveling to some of these celebration events. Just over half of all American traveler surveyed (50.9%) said they are interested. The most interested travelers by generation are Millennials (58.0%) followed by Gen X (52.6%) and Gen Z (49.4%), while Baby Boomers are least likely to say they are interested (44.5%). In fact, over one in four Baby Boomer travelers (28.1%) said they are uninterested in traveling to Route 66 events. Looking at other demographic groups, interest is stronger among travelers in the West (55.6%) and urban dwellers (59.8%), with rural residents being significantly more neutral (32.1%) and suburban dwellers significantly less likely to be interested (47.2%) in these events. Parents to school-aged children (61.6%) were also significantly more likely to be interested in traveling for Route 66 anniversary celebrations compared to those who are not parents of school-aged children (46.2%). Interestingly, there was no significant difference across income groups in interest levels for Route 66.

- Future Partners also continues to track interest in traveling for America 250 events. As of August 2025, interest remains relatively flat at 11.5 percent this month saying they would be interested in traveling for related events. However, not all American history travelers share the same interests, so we did find that the demographics of these American 250 interested travelers were notably different from those interested in traveling for Route 66 events. For America 250 events, Gen X travelers were the most likely to say they would be interested in traveling for these events (14.4%) and Gen Z travelers were by far the least likely to be interested (3.2%). The strongest interest by geographic region comes from the Northeast region (25.9%). However, there is overlap in interest in both historical events among urban dwellers and parents of school-aged children, who were the two demographic groups to over-index for interest in traveling for both America 250 and Route 66 events.

- With the 2026 FIFA World Cup on the horizon, the travel industry is paying close attention. More than one-in-four Americans have traveled in the past year to attend a sporting event, and over 1-in-5 say they’re interested in traveling for World Cup events. These travelers are wealthier, more diverse, more likely to travel with children, and highly influenced by digital platforms like YouTube, Instagram, and TikTok. They skew younger and male, favor peak seasons, and show a strong openness to multi-generational travel—offering DMOs and brands a powerful opportunity to tailor campaigns that drive both impact and inclusion.

For the complete set of findings, including data on your audience segments and historic brand performance of your travel brand or destination, subscribe to The State of the American Traveler Insights Explorer tool.

Learn more about the latest trends during our monthly livestream.

To make sure you receive notifications of our latest findings, you can sign up here.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.