Although more than one-third of American travelers consider travel to be essential spending, with angst about tariffs and an increasingly pessimistic financial outlook, travelers are starting to make adjustments, including sticking to stricter trip budgets and selecting destinations they deem affordable.

American Travelers’ Financial Outlook Dips Further as Tariffs Shake Confidence on Economic Security

- In a continuation of the trends Future Partners reported last month around American travelers’ financial sentiment and outlook, while assessments of their current financial situations remains relatively stable, expectations for their future finances have worsened again this month. Just over three in ten (30.9%) American travelers said they feel better off now compared to a year ago, only marginally down (-1.6 points) compared to last month. However, the share of those who anticipate their finances will be worse off in the next year has grown to 18.7 percent, an +8.3-point increase compared to the start of the year and the highest this metric has been since January 2022. Amongst the two-thirds of American travelers who report having stock investments, 55.8 percent say recent volatility in the stock market has decreased their sense of financial security. In a similar vein, the number of travelers who expect the U.S. to enter an economic recession in the next six months continues to climb, coming in at 56.9 percent this month, a +4.8-point increase over last month and the third consecutive month that this metric has increased. When asked if they are being careful with their money right now because they are concerned about an upcoming recession, 55.4% agreed this caution has increased. Negative financial sentiment and outlook likely plays a significant role in the continued decline of the share of American travelers who feel that now is a good time to spend on travel: currently at 30.1 percent, down -4.1-points from last month.

- Given the onslaught of news around tariffs and shifts in U.S. foreign trade policy over the past months, this month’s The State of the American Traveler Study survey included questions around the role U.S. tariffs plays—if any–on American travelers’ declining financial and travel sentiments. We found that the vast majority of American travelers have been following the recent news about U.S. tariffs and trade policy changes closely (73.3%). More importantly, most American travelers (71.3%) reported that they believe these tariffs will increase their cost of living in the coming year. Notably, the impact of tariffs on expectations for increased costs of living is more significant for Gen X (73.6%) and Millennials (72.2%) compared to Gen Z (60.8%) and, to a lesser degree, Baby Boomers (70.6%). Interestingly, travelers with an average household income of $200,000 or more (78.6%) are actually much more likely to anticipate tariffs will increase their cost of living.

How Americans are Adjusting their Behaviors to Remain Committed to Travel

- A bright spot right now for travel marketers is that despite the perceived economic headwinds, 34.3 percent of American travelers–more than one-third–consider spending money on travel to be essential, and over half (53.2%) agree that even in a recession, they consider travel to be a worthwhile investment. Those that consider travel essential spending skew Millennial-age (37.6%), Western U.S. residents (38.3%), those with household incomes above $100K (41.3%), parents to school-aged children (43.0%) and urban dwellers (42.1%). American travelers also continue to prioritize leisure travel as a near-term budget priority. Six-in-ten (60.5%) said they expect leisure travel will be a high budget priority for them in the next three months, up slightly (+1.2 points) compared to last month.

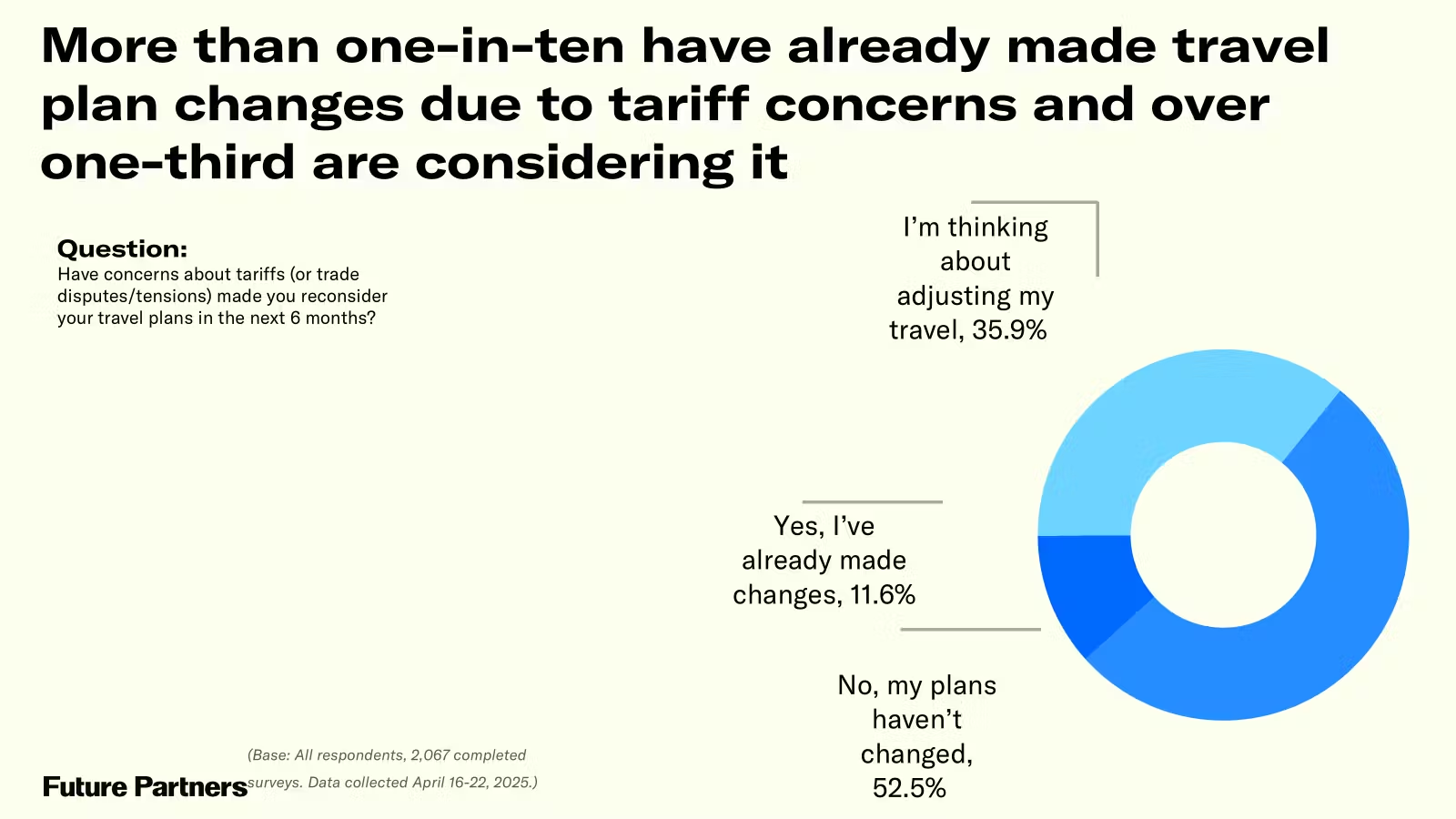

Travel marketers can expect demand for travel to remain robust for the near term, however there will likely be notable shifts in how much American travelers are will to spend on leisure travel as well as where they are likely to venture. In fact, tracking around annual leisure travel budgets and anticipated international travel in the next year both trended downwards this month. While overall travel budgets are still high compared to the same time last year, at an average of $5,417, this month’s reported annual leisure travel budget marks the second consecutive month that this figure has decreased. Similarly, after steadily increasing over the past 12 months, the share of American travelers who said they are likely to take an overseas leisure trip in the next year declined month-over-month by -2.5 points, dropping from 48.2 percent last month to 45.7 percent this month. Notably, nearly half (47.6%) of American travelers said they are hesitant to travel internationally now because they are worried about how Americans will be received overseas due to recent U.S. trade and tariff policies - When asked specifically about the impact of tariffs on travel plans, 11.6 percent of American travelers said they have already made changes to trips, while 35.9 percent said they are considering adjusting their travel plans for the next six months. Looking at generational and income breakouts, there is minimal variance across the different demographic groups.

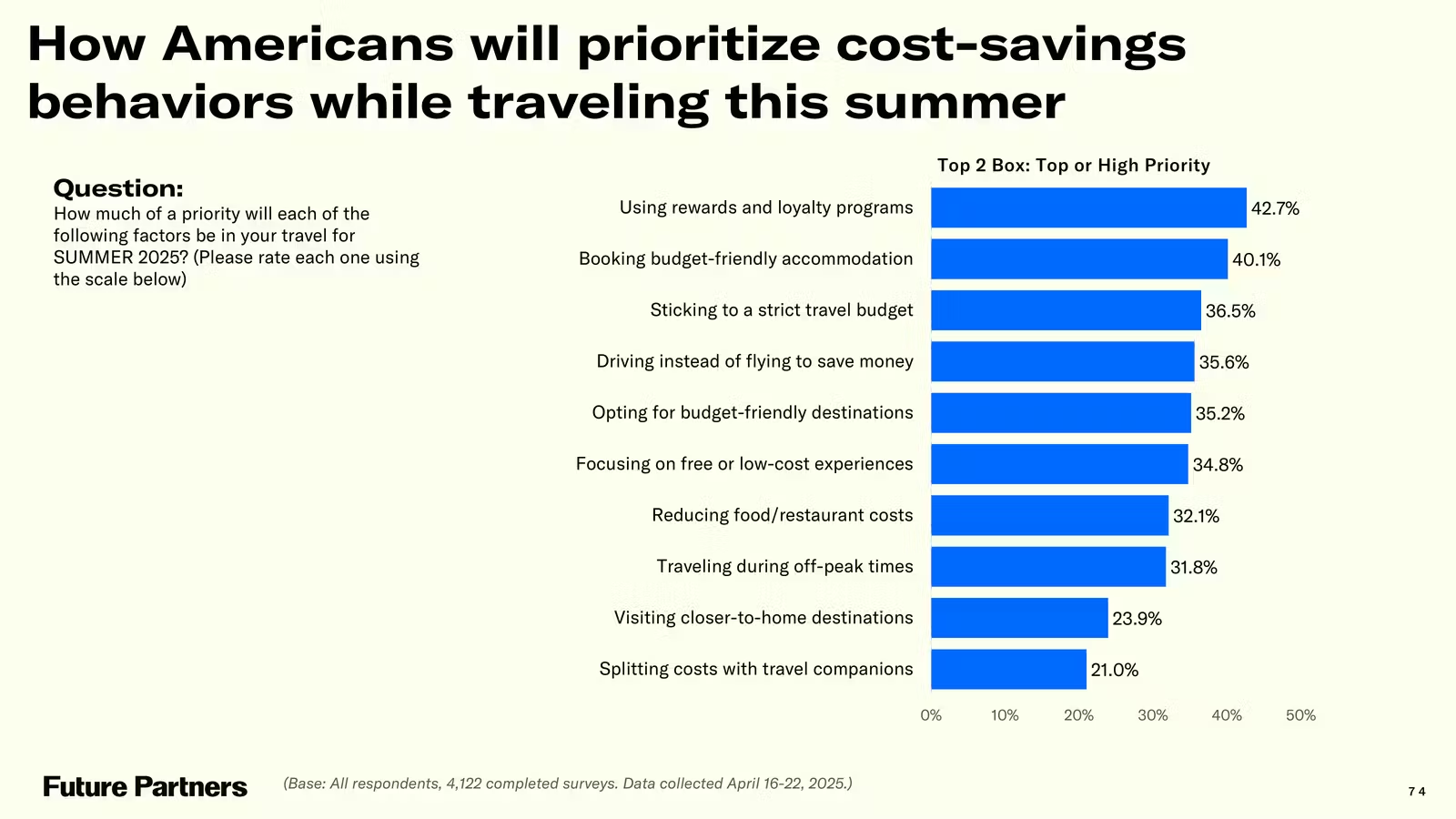

- Future Partners also asked American travelers whether they will be prioritizing certain cost efficiency measures during their summer travels this year, and we found that over one in three said they would be sticking to a strict travel budget (36.5%), driving instead of flying to save money (35.6%), opting for budget-friendly destinations (35.2%), and/or focusing on free or low-cost experiences (34.8%).

Recent Travel Volume and What’s Ahead

- Looking at recent travel volume among American travelers, leisure travel remains relatively steady thus far with 44.5 percent reporting taking an overnight leisure trip in the past month, actually slightly ahead of the same time last year (43.0%). Similarly, the share those who took an overnight trip to visit friends or family this past month (41.5%) is relatively on par with April 2024 (42.7%). Past month day trip volume is also flat year-over-year, with just under half of American travelers (48.7%) saying they took a leisure day trip, down slightly compared to April 2024 (50.1%), while day trips to visit friends or family declined year-over-year more substantially at 42.3 percent, down -3.8p points from the 46.1 percent recorded the same time last year.

- However, the aforementioned economic factors have also likely continued to contribute to the decrease in number of anticipated leisure trips in the next year, with American travelers reporting an average of 3.7 months expected, down slightly from last month’s average of 3.8 trips and the post-pandemic record of 4.0 trips reported in March. Just 24.8 percent report they expect to travel more for leisure in the next year compared to last Nevertheless, Americans’ excitement for travel remains at 8.2 on a scale from 0-11.

For the complete set of findings, including data on your audience segments and historic brand performance of your travel brand or destination, subscribe to The State of the American Traveler Insights Explorer tool.

Learn more about the latest trends during our monthly livestream.

To make sure you receive notifications of our latest findings, you can sign up here.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.