Its mid-January and the Future Partners team is prepping for the 2024 The State of the International Traveler. We wanted to take a fresh look at 2023’s data and provide some insights on what to expect for 2024.

About the Study

The State of the International Traveler study has been conducted annually since 2014. It is based on an online survey of international travelers in 15 top international feeder markets for tourism to the United States. More than 800 international travelers in each of those 15 markets are surveyed, making for a total sample of 12,000 travelers. In addition to sentiment, media consumption, travel desires, opinions and perceptions, we use this research to track brand aspiration and performance of more than 65 US destinations and brands. In 2024, we are adding every U.S. state to this list.

These are the markets of study in this research: Canada, Mexico, Columbia, Brazil, Argentina, the UK, France, the Netherlands, Germany, Italy, India, China, South Korea, Japan, and Australia. The report of this study yields over 200 pages of findings and insights from specific markets and trends, and if you’re interested in learning more about the study visit our The State of the International Traveler page.

Global Sentiment in 2023

We asked international travelers about their agreement with certain predictions for 2023. In light of global inflationary challenges and record revenues recorded by some hotels and airlines, nearly 40% of travelers globally believe that price gouging will become more common in the industry. And indeed, we believe they were right. While overall annual U.S. inflation increased prices 3.4%, food away from home rose higher over the year at 5.2%, according to BLS’s CPI update. Sadly, over 27% believe that labor shortages will continue to plague the industry 23% feel travel will generally become more frustrating.

In terms of technology, 30% predict that AI will begin to replace travel advisors this year—although on the flip side, 27% say travel advisors will be used more. One in five predict a souring on home rental services like AirBnB. In terms of the geo-political, about 22% predict the war between Russia and Ukraine will expand to other countries. About one in five say the appeal of social media travel influencers will decline.

Expectations for international trips and spending

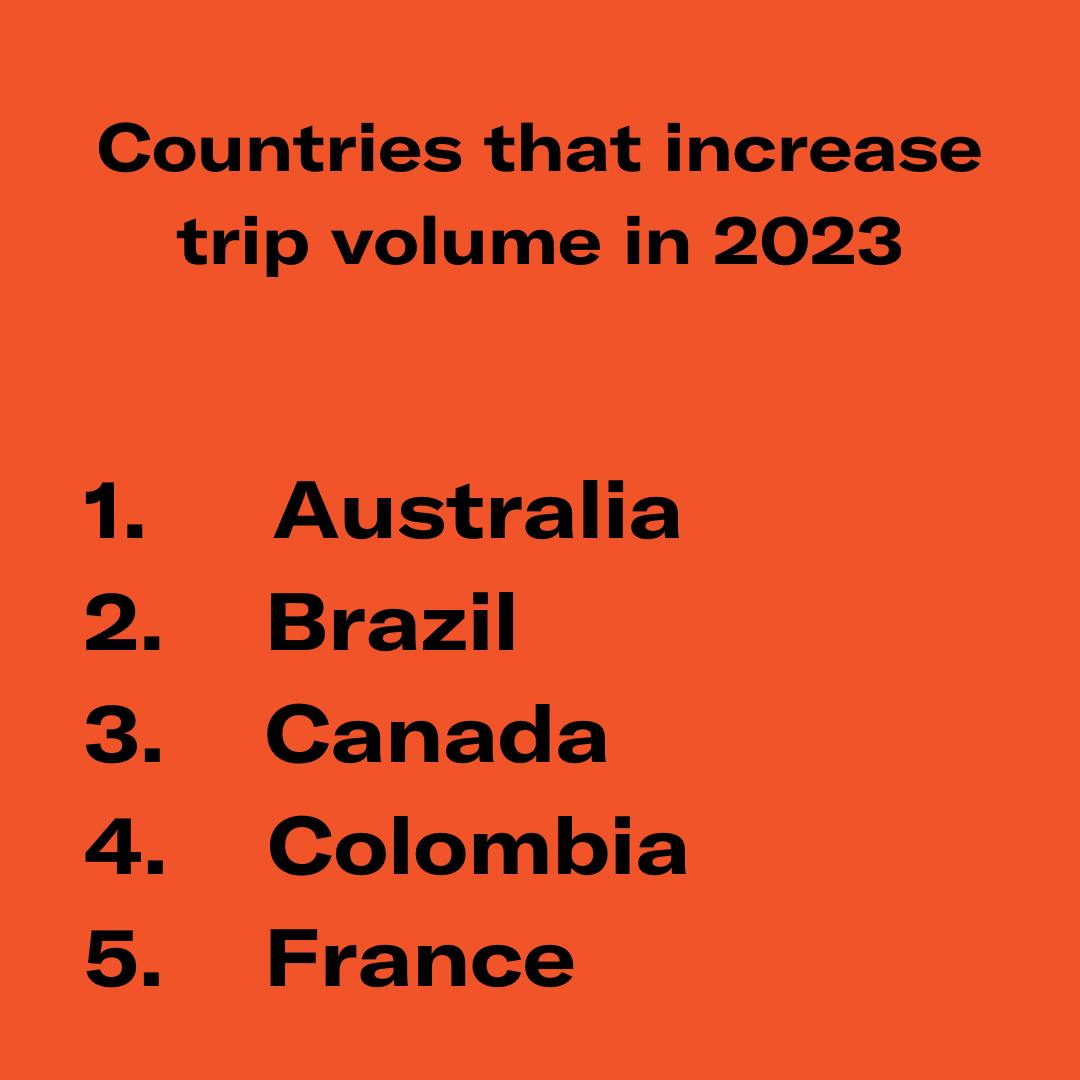

Before looking at what travelers predicted for their international trip volume and spending in 2023, let’s take a look at what they did in 2022. International travelers across these 15 markets took an average of 2.2 international trips in 2022—up from 1.9 in 2021. Markets with above-average international trip volume in 2022 include India, Brazil, Germany, the UK, and the Netherlands. Japan, Italy, China, and Australia increased their international trip volume over 2021.

In 2023, 81% of global travelers are likely to travel internationally this year—up 6 points from 2022. We are expecting even more trips in 2024 despite continuing logistical challenges with visas and infrastructure.

We ask whether international travelers’ expectations for the next 12 months on whether they will take more, less, or the same number of trips and plan to spend the same, more, or less. International travelers expected to take more trips in 2023 and to spend more of their budget on international travel.

We have found that optimism to be a good indicator of actual travel behavior to come. Compared to 2022, both the number of trips and the spending are lower. But they are all trending higher than 2021. We don’t quite expect to meet 2019 travel expectations in 2024, but we’ll be even closer.

Compared to 2022, the aggregate findings from these 15 top global markets studied show a decline of 5 percentage points in the number of trips they expect to take and a 4 percentage point decrease in the total spending. For time context, in 2023, we are about where the USA was in 2016.

There is a similar story of mixed optimism across the world with international trip spending. European countries expect to spend less on international leisure travel while countries in Asia (including India) all expect to spend more. Interestingly, despite expecting to take more trips, spending expectations in Latin American countries are declining.

Economic Expectations in 2023

Because travel is largely not free, the economy is always an underlying factor in travel decision-making. And the global economy has certainly been in the news. How are international travelers feeling about the economy impacting travel sentiment?

On average, they don’t appear to be too negatively impacted and the average across all markets in 2023 is 15.4, up nearly one day in the last year (14.6).

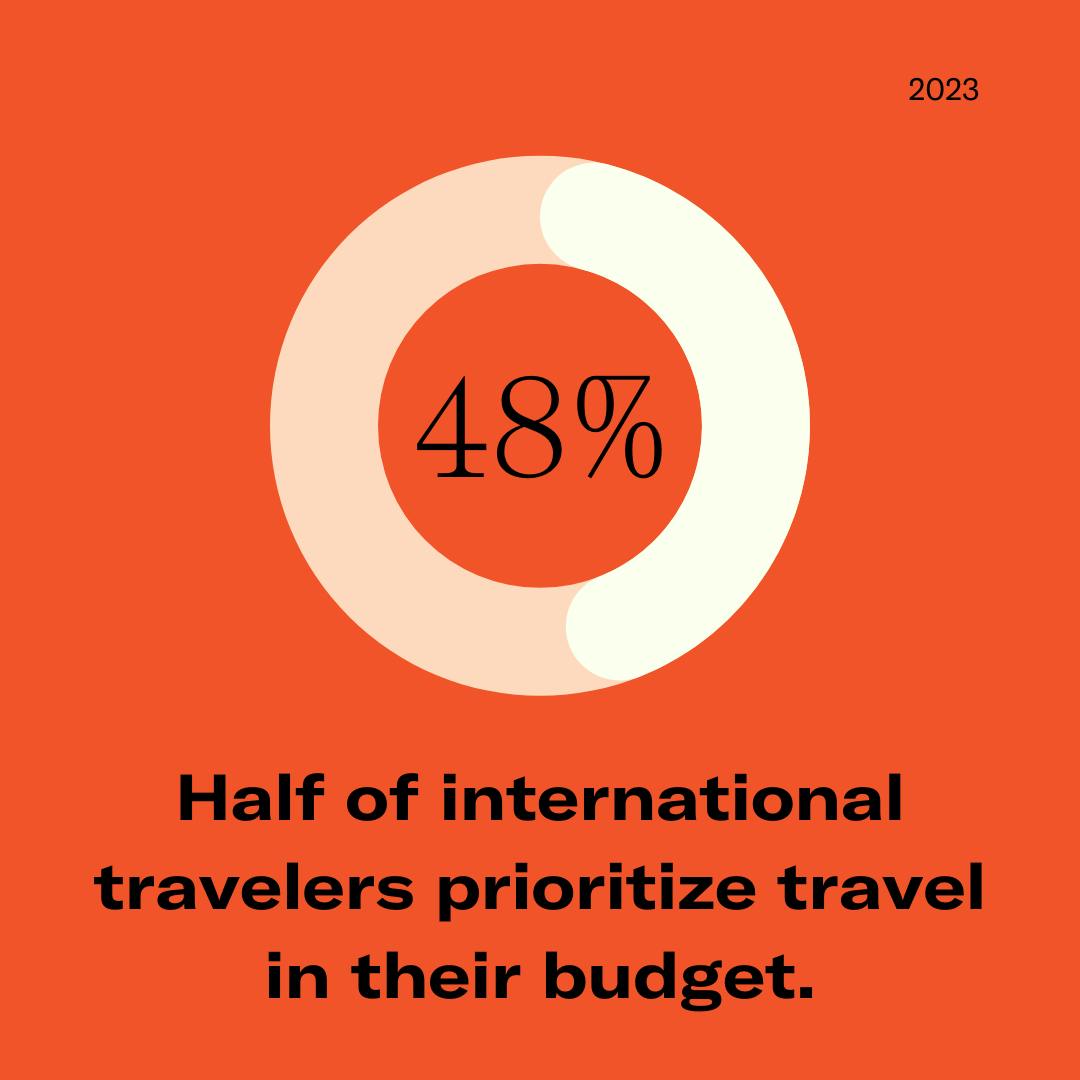

Also, perhaps most importantly, global travelers are still making international travel a priority in their budget. Half (48%) of global travelers say international travel will be an essential or high priority in what they will choose to spend their money in 2023. Notable markets above that average include Mexico and Brazil, India, and Germany. The majority of the top 15 markets show an increase.

Although the average reported budget, when converted to USD, has slightly decreased this year by approximately $100 to $3,878, eight out of the 15 markets surpass this average, demonstrating particularly robust budgets in Europe, Australia, and China. Throughout 2023, we observed a significant trend of substitution in domestic travel, where travelers continue to embark on trips and prioritize trip taking as part of their budget, but domestic travelers were more inclined to bring their own lunches or cut down on souvenir expenses. We anticipate that this shift in consumer behavior will manifest in the 2024 global study.

Europe continues to be the top global competitor, while trailing behind in the #2 spot, 24% said the United States, with Asia right on the USA’s heels. The US is certainly in the tourism consciousness across the world. 43.4% of the 12,000+ international travelers surveyed recalled seeing tourism promotions for the USA.

And as the marketers know, this kind of recall increases aspiration to book. Interest in visiting the United States increased three percentage points in 2023 to 70% of travelers across all markets. While interest in the USA did experience some declines across Latin America China, and France, it has gained in all other countries.

Global travelers reported strong likelihood to visit the United States within the next two years is at 49.2%–the second highest record year in our study with last year being the highest at 51%. Its an over 5 point increase from 2019.

USA Tourism Brand

What aspects of the USA tourism brand drive interest? When we look at those who rate their interest in visiting the USA at the top level, food & cuisine is a top driver, with a significant second tier of relaxation & rejuvenation, shopping, arts & culture, and the general atmosphere.

What deters these travelers from visiting the USA?

Number 1: Costs—specifically airfare and the exchange rate–remain, of course, at the top.

Number 2: Concern Regarding Gun Violence is at the statistically same level as costs.

Number 3: Personal safety concerns closely follow the specific fear of gun violence.

Number 4: Visa wait times and the visa process is cited by 16.5% and 15.8% respectively in total—with these numbers obviously sharply rising in the countries in which visas are actually required.

More positively, the USA offers international travelers a brand and an experience. What else do international travelers have to say about the USA?

What is most important to international travelers when selecting destinations?

Outside of cost, the convenience of planning, the ease of obtaining a visa, and a welcoming environment to people of diverse identities are critical considerations for the strong majority of international travelers when considering destinations for their trips abroad. Note that there is an increasing consideration of the destination’s cultural diversity (of both visitors and residents), as well as consideration for sustainability and carbon footprint. We expect this to continue to grow in 2024.

And more broadly, internationally oriented travelers are looking for a way to escape their daily lives and hope to use travel –and experiencing other cultures–to do so. They want to travel to get rest and relaxation, explore new things, take a break, treat themselves, and live life to the fullest. Check out our blog on the fusion of travel and wellness for more.

Food & cuisine, visiting historical sites, and shopping are the most common travel desires among these travelers. Also significant passions: theme parks, musical concerts, fitness & health, photography, hiking, fashion (so they know what to shop for) and wine to go with all that food.

And when we ask about the details of their ideal trip to the USA: they say they will start planning 12.6 weeks prior, will spend 12.9 days here visiting 4 different destinations. Their top lodging choice is a full service hotel, but mid priced hotels and vacation rentals are also popular. 71% will be visiting with their spouse. About one in four will bring along their younger children – 16% say they will take their trip accompanied by their teenager.

The most important information they say they need to make their trip decisions are hotel & lodging, restaurants and food, safety, beaches, shopping, and national parks. In a nod to the desire for convenience, 73% say they feel comfortable independently planning this trip.

How to Reach International Travelers

Future Partners asked global travelers how they get their inspiration for the destinations they want to visit internationally. These travelers primarily use the opinions of friends and relatives through direct contact as well as online media such as articles, reviews, blogs, podcasts, and video. Additionally, the opinions and experiences of digital influencers rises to the top, considered by more than 1/3 of respondents as a source for destination inspiration.

When it comes to planning the trip, several different resources come into play, including both online and offline resources. Online search continues to be the top resource used for international trip planning followed by online travel agencies and official visitor’s bureau’s websites. In terms of traditional offline travel planning resources, the opinions of friends/relatives and traditional travel agents are top.

The top social media channels used to plan an international leisure trip are Instagram, YouTube, and Facebook. TikTok and Twitter follow, but for 2024 we expect X (Twitter) to continue to fall and TikTok to grow.

For the many amazing DMOs and state tourism offices, one-in-three (34%) likely travelers indicated that they would use a DMO website over social media to plan an international trip. International travelers lean heavily on official destination brands and information, with the exception of Japan which equally favors social media.

We know it’s not always enough to look at the global market broadly, so in 2024 we’ve included all 50 states for custom analysis in addition to many cities and locations across the USA. If you are interested in learning more about The State of the International Traveler or specific markets we would love to help.

If you have questions click here to get in touch with us.