Americans remain steady in their financial outlook — but growing caution could temper future travel spending. While most households still plan to travel in the coming year, ongoing economic worries continue to push a more watchful mindset. As we look to the upcoming holidays, travel rates are pacing similar to last year, with the large share of uncommitted travelers representing an opportunity for marketers to inspire last-minute bookings. Meanwhile, strong interest in mega-events such as America 250 and the 2026 FIFA World Cup offers clear evidence of optimism for the year ahead.

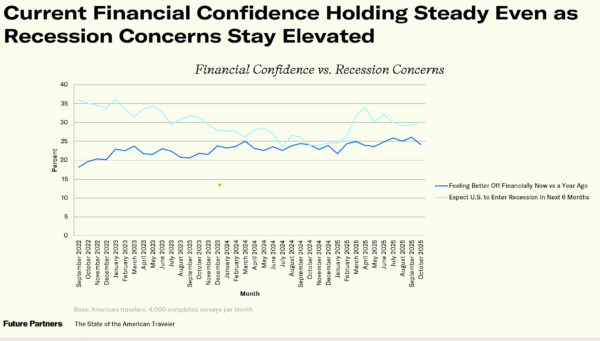

Recession Concerns Remain Elevated, but Financial Sentiment Holds Steady

American travelers continue to show remarkable steadiness in their financial outlook, even as economic uncertainty — now heightened by the ongoing federal government shutdown — lingers in the background. Just under one in three (32.3%) travelers this month say they are currently better off financially than a year ago. While this is slightly below last month’s reading (-2.5 points), it aligns closely with the same time last year (32.9%) and represents an improvement compared to early 2025 levels. Similarly, travelers’ outlook for the year ahead remains consistent. Nearly half (46.9%) expect their household finances to improve in the next 12 months, up +1.2 points from October and down just -2.2 points from last year. These findings mark six consecutive months of stability following a sharp springtime decline. Generational differences remain significant: more than six in ten Millennials (63.1%) and Gen Z travelers (61.3%) anticipate being better off next year, compared to 46.2% of Gen X and only 30.3% of Boomers. At the same time, recession concerns remain elevated, with 48.5 percent of travelers expecting a U.S. economic recession within the next six months. This is +14.0 points higher than the same time last year, though down -8.4 points from the April 2024 spike (56.9%). The figure has hovered near the same level since May (47.9%), suggesting travelers have remained on alert for half a year — even as their personal financial outlooks hold steady.

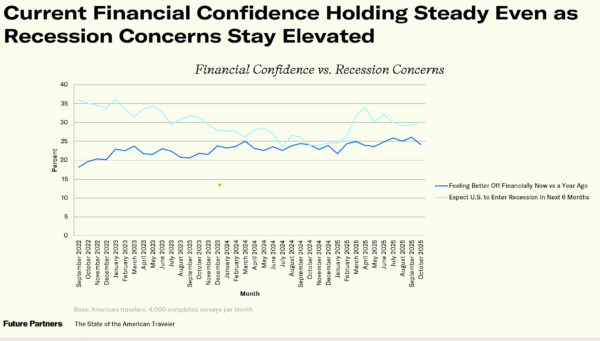

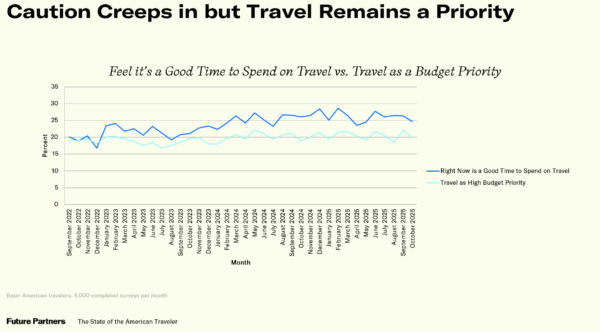

Willingness to Spend on Travel Softens, but Budgets Remain Strong

Despite relatively stable financial sentiment, the sustained concern about a potential U.S. recession — and now the disruptions tied to the ongoing government shutdown — appear to be subtly eroding travelers’ near-term confidence to spend on travel. This month, only one in three (32.8%) Americans consider now to be a good time to spend on travel, continuing a four-month decline since June’s rebound to 37.1 percent. That mid-year uptick had followed a spring slump that mirrored the spike in recession fears. The last time Future Partners observed such a prolonged downward trend was in early 2022, when high inflation first began to impact travel decisions. Nevertheless, other key spending indicators remain resilient. More than half (56.4%) still list travel as a high budget priority, and the average maximum annual travel budget ($5,973) remains steady — and elevated — relative to recent years. These figures suggest Americans are not abandoning travel spending, but rather signaling caution about timing and value amid the broader economic unease.

Travel Activity Levels Out After Summer’s Highs but Planning Pace Continues

Following the summer surge, leisure travel cooled modestly in October. 48.2% of Americans took an overnight leisure trip, down slightly from September and nearly six points below July’s peak. Day trips remain strong (52.2%), an indicator that even amid budget caution, Americans continue seeking ways to experience travel, even in smaller doses. Looking ahead, travelers maintain ambitious plans: over nine in ten (91.8%) still plan to take at least one leisure trip in the next year, averaging 3.8 trips — consistent with the higher range seen since late 2024. Predictably, higher-income travelers project the greatest frequency (4.9 trips among those earning $200K+), followed by 4.3 trips for middle-income ($100K–$199K) travelers. Younger Americans continue to travel less often, with Gen Z averaging 3.1 trips, compared to 3.7–3.9 among older generations.

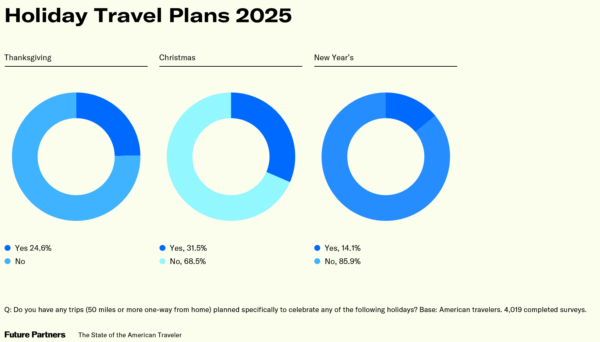

Holiday Travel Outlook

As November begins, most Americans have yet to finalize their holiday travel plans — 54.0% currently report no specific holiday trip planned. Among those who do, Christmas leads (31.5%), followed by Thanksgiving (24.6% and New Year’s (14.1%)–and notably all these holidays are up 2 points from 2024. Demographic differences tell a clear story. Parents (33.3%) and Millennials (29.1%) are the most likely to travel for Thanksgiving, while Southerners (27.4%) outpace Midwesterners (20.1%). The same groups lead for Christmas, where Gen Z (45.4%) and Millennials (41.3%) are far more likely to travel than Boomers (22.7%). Parents (43.9%) again stand out, significantly more likely than non-parents (26.2%) to have trips planned. Regional differences exist, with 34.5% of Southerners planning Christmas travel versus 27.4% in the Midwest. Given the government shutdown and lingering economic uncertainty, this measured approach may reflect travelers waiting for stability before booking; however, history suggests at least some proportion will make last-minute of spontaneous decisions to travel for the holidays.

Eyes on 2026: America 250 and FIFA World Cup Offer Optimism

Even as short-term caution sets in, longer-term excitement continues to build— especially for the milestone events ahead. More than half (51.0%) of American travelers say they are interested in taking a trip for America 250, the nationwide celebration of the country’s 250th Independence Day in 2026. Interest peaks among parents of school-aged children (62.9%), Millennials (57.3%), and middle-income households ($100K–$199K; 54.8%) — groups that will likely drive early planning and destination demand. Meanwhile, three in ten (30.0%) American travelers express interest in traveling for the 2026 FIFA World Cup. That enthusiasm is markedly higher among certain segments: half of parents to school-age children(50.0%), 46.1% of Gen Z, and 45.6% of Millennials say they are interested, compared to just 14.8% of Boomers. Higher-income Americans also show elevated intent (41.9% of $200K+ travelers; 35.7% of $100K–$199K), as do residents of the West (37.0%) and Northeast (34.9%). Together, these data points suggest that even amid short-term hesitation, travel ambition for marquee events is strong — offering destinations a clear opportunity to begin cultivating intent now for 2026.

For the complete set of findings, including data on your audience segments and historic brand performance of your travel brand or destination, subscribe to The State of the American Traveler Insights Explorer tool.

Learn more about the latest trends during our monthly livestream.

To make sure you receive notifications of our latest findings, you can sign up here.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.