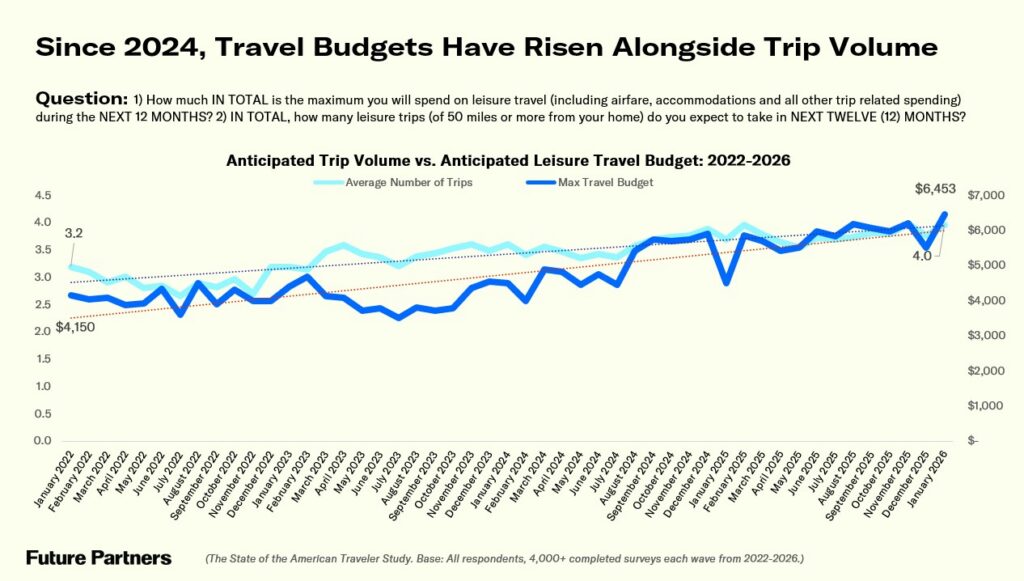

Though recession fears continue to cool for a third consecutive month, American travelers remain cautious about their financial future as 2026 unfolds. One-third reported feeling financially better off than a year ago (a modest rebound both month-over-month and year-over-year) while optimism about the year ahead remains meaningfully below early 2025 levels. Despite this financial restraint, commitment to travel remains strong. The share of travelers who say now is a good time to spend on travel has held steady, nearly six in ten rank travel as a high near-term priority, and average anticipated annual leisure travel budgets reached a new record high of $6,453.

These signals point to a traveler who is increasingly deliberate, but still deeply motivated to travel. Meanwhile, political dynamics are increasingly shaping destination comfort levels in uneven ways, underscoring a polarization that is already influencing destination avoidance decisions. At the same time, in-market travel behavior continues to shift toward slower, more immersive experiences, particularly among younger travelers, who are prioritizing single-destination stays, local engagement, and exploration of lesser-known places.

American Travelers Continue to Display Financial Caution, But Demand and Budgets for Travel are Strong

- The American traveler we see emerging this month is one that is financially cautious but behaviorally confident. Though recession fears have declined for the third consecutive month and current financial sentiment is slowly improving, optimism about the year ahead remains meaningfully below where it stood at the start of 2025, suggesting Americans are feeling stable, but not secure. Currently, 33.4 percent of American travelers feel that their household is financially better off now compared to a year ago, a minor rebound compared to both the previous month (+2.2 points) and the same time last year (+4.3 points). But while current finances continue to be relatively stable, the outlook for household finances in the next year has not recovered from the downturn that began in early 2025. This month, 44.9 percent of American travelers said they expect to be better off financially a year from now, a nominal increase of +1.0 points over last month but down -6.6 points compared to January 2025 (51.5%). Nevertheless, despite indicators that Americans remain watchful when it comes to the nation’s economic forecast, their commitment to travel is unfaltering, as indicated by the consistently steady share of those who say that now is a good time to spend on travel (34.8%). In fact, nearly six in ten (58.5%) this month said travel will be a high priority for them in the next three months, which is an increase of +3.2 points month-over-month and +4.3 points compared to January 2025.

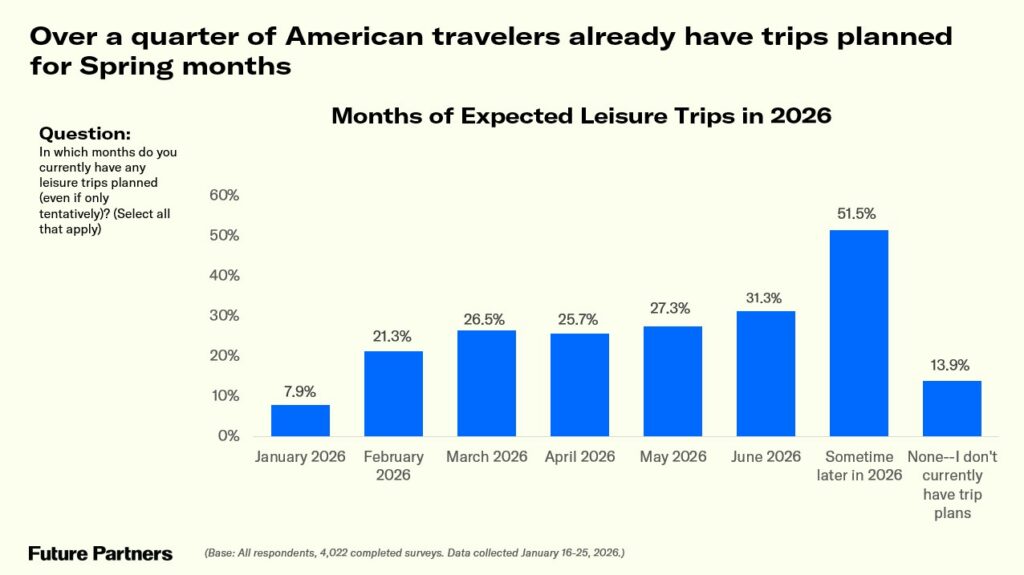

Recent Travel Volume and What’s Ahead

- Past month overnight leisure travel was flat (49.7% vs 49.7% last month), sustaining the strong holiday season travel initially projected following the Thanksgiving holiday and a modest increase of +2.1 points compared to the same period in 2025. Overnight trips to visit friends and relatives outpaced purely leisure trips this month at 50.3 percent, but was on par with levels reported the previous month and the same time last year. On the other hand, day trips trended slightly downward this month both for leisure day trips (49.6%, down -0.8 points month-over-month) and day trips to visit friends and family (45.0%, down -1.1 percent month-over-month). Both metrics for day trips represent a steeper decline year-over-year, with leisure day trips reporting a -1.9-point decrease and day trips to visit family and friends at -4.4 points compared to January 2025.

The Impact of Politics on Travel Behavior

- Beyond economics, political and social dynamics are increasingly shaping where—and whether—travelers feel comfortable visiting in 2026. To help the industry understand potential impact of recent events Future Partners included questions around increased federal agency presence in certain U.S. cities in this month’s survey. American travelers were asked to share whether the increased presence of federal immigration, military, or law-enforcement personnel in public spaces for some U.S. cities has changed how comfortable they feel visiting those destinations. While nearly half (47.0%) said they feel somewhat or much less comfortable, a notable one in four (24.0%) said the presence of federal agencies makes them feel somewhat or much more comfortable visiting those areas. Among the generations, Baby Boomers were the most likely to say they feel less comfortable at more than half (52.3%). Looking at other demographics, parents to school-aged children were more likely to feel more comfortable (29.7%), while notably large shares of Asian (58.2%) and LGBTQIA+ (65.6%) travelers were more likely to say this makes them feel less comfortable. Travelers were also asked if they plan to avoid traveling to any cities in the next year due to federal agency activity, to which nearly one in four (22.8%) respondents said yes.

Recent In-Market Travel Priorities

- Future Partners also asked a set of questions around recent travel behaviors and preferences this month, to dig deeper into how Americans are traveling as we enter 2026. Travelers were asked to rate how well the statement “I have generally stayed in one place rather than hopping between many” in the past year. More than half (52.7%) of American travelers said that this describes them well. Gen Z travelers (67.2%). were the most likely to align with this practice of dedicating their trip to a single destination. In a similar vein, respondents were asked to share how closely the statement “I’ve tried to immerse myself in local culture, nature, and daily life” on their travels in the past year, which just over half (50.9%) said describes them well. There was a much more striking divide across the generational cohorts for this preference for local immersion on trips, with 66.2 percent of Gen Z and 59.1 percent of Millennials aligning with this statement, compared to just 43.5 percent of Baby Boomers. We see similar results when we asked American travelers how often they have gone out of their way to explore lesser-known places on their trips in the past two years; over four in ten Gen Z (40.9%) and nearly one-third of Millennials (32.3%) said they have done so on all or many of their trips, while less than a quarter of Baby Boomers (24.3%) said the same.

In Summary:

Together, these findings underscore a consistent theme: even amid financial caution and external uncertainties, demand for travel remains resilient, well-funded, and increasingly purposeful.

For the complete set of findings, including data on your audience segments and historic brand performance of your travel brand or destination, subscribe to The State of the American Traveler Insights Explorer tool.

Learn more about the latest trends during our monthly livestream.

To make sure you receive notifications of our latest findings, you can sign up here.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.