As 2025 draws to a close, American travelers are showing renewed optimism with expected trip volume climbing back to 4.0 trips—matching early-year levels and signaling a recovery from spring’s tariff-induced uncertainty. Meanwhile, generational differences represent interesting opportunities for travel marketers, with Millennials emerging as the cohort most likely to prioritize wellness-driven travel, and Gen Z pioneering “connection travel” to meet online friends in person for the first time.

Travel Spend Remains a High Priority Amidst Steady Financial Sentiment

As we approach the end of the calendar year, American travelers’ financial sentiment continues to hold steady, maintaining the recovery seen over the summer following uncertainty brought about by conversations around U.S. tariffs in the spring. More than a third of American travelers (34.9%) said they feel better off financially now compared to a year ago—a notable +5.6 percentage points higher than the same time last year and a nominal increase of +2.6 points compared to last month. Financial outlook remains essentially flat month-over-month, with 45.5% saying they expect to be better off a year from now (-0.4 points versus last month). However, this represents a decrease of -4.1 points compared to November 2024.

American travelers continue to hold fears of a near-term U.S. economic recession at bay, with 45.4% this month reporting they expect a recession in the next six months. This is down slightly from last month’s 48.5%, but largely unchanged since these concerns first abated after a sudden spike—likely fueled by heavy coverage of U.S. tariffs—in March and April. Still, sentiment around a potential recession remains mostly negative compared to November 2024, which holds the record for the lowest share of American travelers anticipating a near-term recession at just 34.4%.

Willingness to Spend on Travel Ticks Upward

In the wake of this continued wary-but-steady financial sentiment, perceptions that now is a good time to travel made a modest recovery this month after a four-month decline. This November, 35.4% of Americans said now is a good time to travel, up +2.6 points compared to last month and a slight increase of +1.3 points versus the same time last year. Travel as a high budget priority (56.7%) for the near term remains flat month-over-month and has been largely unchanged throughout 2025. Similarly, maximum annual travel budgets continue to hold at just around $6,000. This is good news heading into the end of the year, suggesting Americans are willing to spend on travel as we approach the upcoming holiday season.

Recent Travel Volume and What’s Ahead

Looking at recent travel volume, past month overnight trips continue their seasonal decline, with 46.7% of American travelers reporting an overnight leisure trip in November—down -1.5 points from last month and -7.4 points from summer’s peak in July. On the other hand, overnight trips to visit friends and family remained flat at 44.3% this month, just -0.1 points down from last month.

For day trips, less than half (48.7%) of American travelers in November took a leisure day trip, down -2.5 points from October. However, day trips to visit friends and family maintained the same level as last month at 44.0% (+0.6 points up from October). This indicates that while leisure travel volume this quarter has reflected seasonal fluctuations, visiting friends and family has remained a steady draw for both overnight and day trips throughout fall.

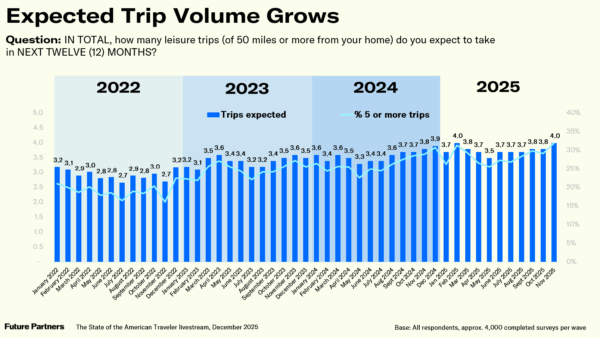

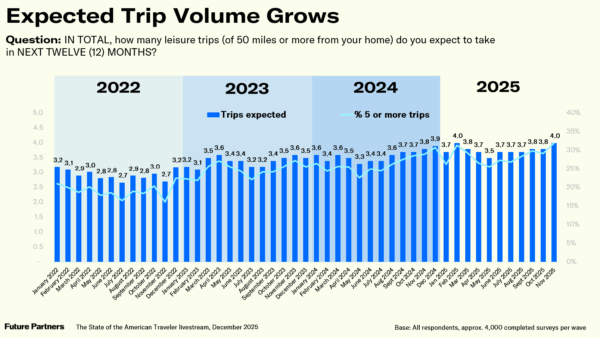

Future Trip Volume Rebounds to Early-Year Highs

Here’s the most encouraging signal for the industry: the average expected number of trips in the coming year came in at 4.0 trips this month, up from the 3.8 trips reported in both September and October. This marks the first significant uptick and recovery to levels reported at the start of 2025 prior to recessionary concerns—a positive indicator for travel heading into not only the holiday season but also 2026.

Travel outlook is notably more positive among high-income travelers, with those earning $200,000 or more reporting an average of 5.2 expected trips in the next year, followed by 4.4 trips among those earning between $100,000 and $199,999. Also worth noting: parents of school-aged children reported a higher average of 4.2 expected trips, compared to 3.9 trips among non-parents.

Wellness as a Pivotal Consideration for Younger Travelers

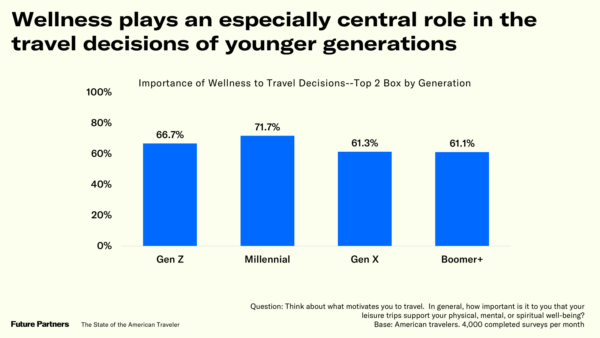

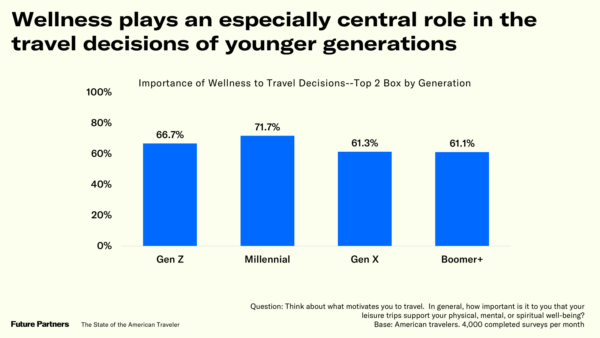

Future Partners continues to examine the relationship between day-to-day stress, mental wellness, and travel as part of The State of the American Traveler study. One undeniable differentiation between younger travelers—particularly Millennials—and older travelers is the role of travel in helping them manage their well-being.

The Stress-Life Satisfaction Gap

Gen Z (63.8% satisfied or very satisfied) and Millennials (69.4%) have significantly lower life satisfaction compared to Boomers (80.7%). On the flip side, they’re much more likely to report elevated daily stress levels: 46.8% of Gen Z and 43.0% of Millennials say they always or often feel stressed, in stark contrast to just 18.2% of Boomers.

Travel as Wellness Solution

When asked how important it is that their leisure trips support their physical, mental, or spiritual well-being, over seven in ten (71.7%) Millennial travelers said leisure travel is important—versus 61.1% of Boomers. These younger travelers are also taking action: more than half of both Gen Z (52.6%) and Millennials (52.6%) say they often or always plan leisure trips specifically to help manage their well-being.

A Look at the Travel Trends Shaping 2026

As Future Partners does every year, we examined the popularity of travel trends among Americans as we enter a new year.

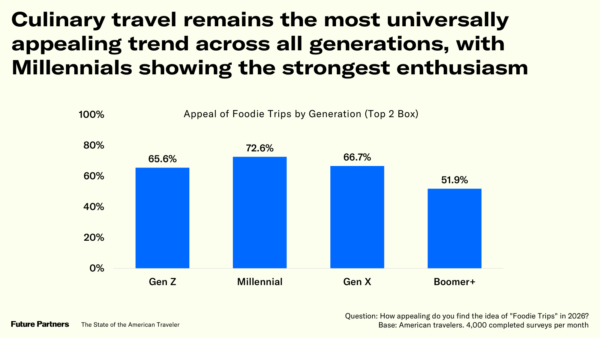

Culinary Travel: The Undisputed Champion

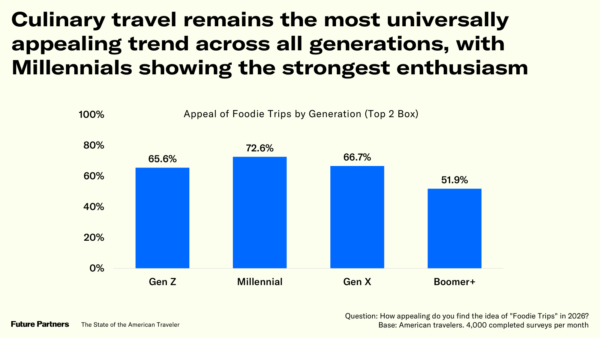

The undeniable stalwart—so much so that it may be time to call it a fact of travel rather than a trend—is foodie trips or culinary travel, which holds high appeal among 62.8% of American travelers. Culinary travel is most appealing among Millennials (72.6%), but the majority of all generational cohorts find food-focused trips appealing.

Millennials Lead Emerging Trends

Millennials are generally more likely than other age groups to find different types of travel appealing, but particularly:

- Slowcations (64.7%) – extended, slower-paced trips focused on relaxation

- Experiential travel (61.1%) – immersive, hands-on experiences that connect travelers with a destination’s culture, history, or environment

- Noctourism (61.1%) – destinations chosen for their nighttime appeal such as stargazing, dark-sky parks, night safaris, or late-night cultural/urban experiences

Gen Z Pioneers “Connection Travel”

As a hallmark of their status as the first digital native generation, Gen Z travelers (48.1%) were most likely to find “connection travel” appealing—referring to trips taken specifically to meet face-to-face for the first time a new friend or romantic partner first met online. This significantly outpaces Millennials (44.5%), Gen X (22.6%), and Boomers (12.1%), highlighting yet another way generational divides are reshaping travel motivations and behaviors.

Key Takeaways for the Travel Industry

- Trip volume recovery is real: The rebound to 4.0 expected trips matches early-year optimism and suggests momentum heading into 2026.

- High earners and families are your volume drivers: With 5.2 trips planned among $200K+ households and 4.2 among parents, these segments warrant focused attention.

- Wellness isn’t optional for younger travelers: With over 70% of Millennials prioritizing well-being in travel and more than half actively planning wellness-focused trips, marketing must speak to this motivation.

- Culinary travel has transcended trend status: At 62.8% appeal across all ages, food experiences should be central to destination marketing.

- Watch emerging trends by generation: Noctourism for Millennials and connection travel for Gen Z represent untapped opportunities for differentiation.

As 2025 closes, the signals point toward cautious optimism and strategic spending—Americans are planning to travel, but they’re being intentional about where, when, and why.

For the complete set of findings, including data on your audience segments and historic brand performance of your travel brand or destination, subscribe to The State of the American Traveler Insights Explorer tool.

Learn more about the latest trends during our monthly livestream.

To make sure you receive notifications of our latest findings, you can sign up here.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.