Americans are still making room for travel that restores and excites, even as they keep one eye on their wallets. We see American travelers stepping into late summer with cautious optimism—financial confidence is inching up, recession concerns are easing, and overnight leisure travel just hit a post-pandemic high. Beyond just the numbers, wellness is central to travel decision-making right now: two-thirds say it’s very important that their trips support their well-being, with Millennials and Gen X leading the charge. Even as spending intent holds steady rather than surging, travel remains a top budget priority, and younger generations are showing strong interest in fresh experiences like Netflix House and big events on the horizon, from the 2026 FIFA World Cup to America 250.

American Travelers are Cautiously Optimistic about Finances, Travel Spending Intent Remains Steady

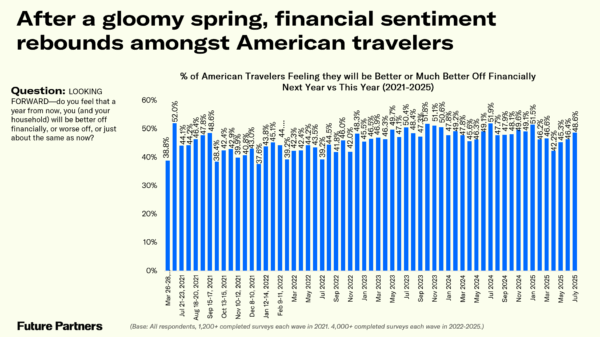

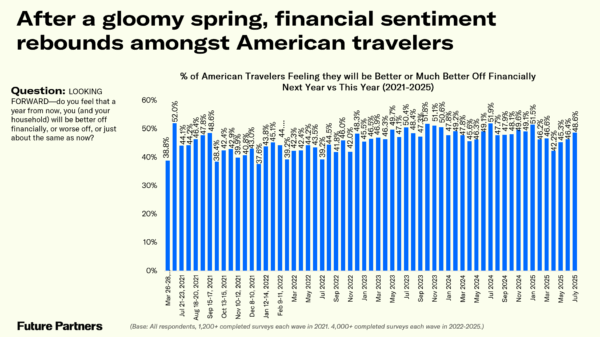

- After a gloomier financial outlook among American travelers over Spring, sentiment around current and future household finances is trending upward. Continuing to build on last month’s rebound, 35.9 percent of American travelers in July reported that they are currently better off than they were a year ago, up +1.8 points over last month and +2.0 points over the same time last year. In further good news, after little movement last month, expected financial improvement in the next year increased +2.2 points this month to 48.6 percent, the highest this metric has been year-to-date, but still -3.3 points down compared to the same time last year. Consistent with the previous month, Millennial travelers continue to be the generational cohort feeling best off financially (47.6%, compared to 40.1% of Gen Z, 36.0% of Gen X, and 25.2% of Boomers). Millennials this month were also more likely to report anticipating they will be better off a year from now (63.9%, compared to 55.1% of Gen Z, 50.1% of Gen X, and 33.6% of Boomers). Overall, the older generations continue to display signs of more financial pessimism compared to the younger generations. Complementing the financial sentiment metrics this month, the share of American travelers expecting a U.S. recession in the near-term is trending downwards. This month, 46.3 percent of respondents said they expect the country’s economy to enter a recession in the next six months, down -2.8 points from last month. However, note that this sentiment is still well above the 38.6 percent reported at the same point in 2024.

- The improved financial and economic outlook metrics did not translate into markedly greater enthusiasm about leisure travel spending this month, although it remains strong. The share of American travelers who said that now is a good time to spend on travel remained relatively flat at 36.0 percent, -1.1 points behind last month but still ahead of the 33.8 percent reported the same time last year. Similarly, while a majority of Americans (58.2%) continue to say that travel will be a high budget priority for them in the next three months, this is down slightly (-1.9 points) compared to last month; this metric has not seen significant shifts since early 2024. Echoing this, the average maximum annual travel budget remains high with a year-to-date average of over $5,600, but has held steady throughout 2025 after seeing significant gains in the second half of 2024. These indicators holistically suggest that travel continues to hold high value among American travelers and as such leisure travel spending intent remains strong for now amidst continued cautious optimism around American travelers’ financial future.

Recent Travel Volume and What’s Ahead

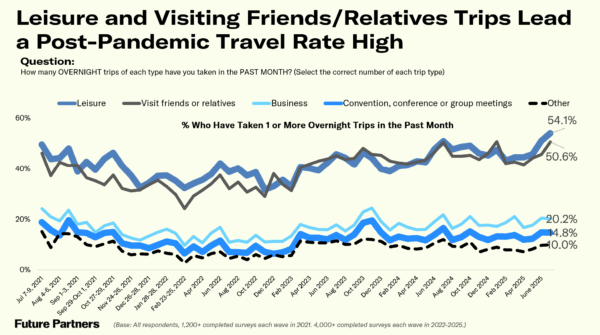

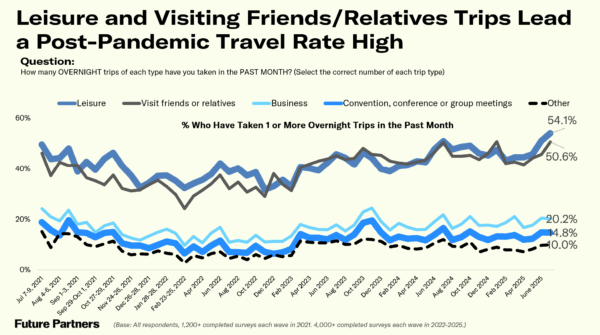

- Reported overnight leisure trips taken in the past month reached a post-pandemic record this month, with 54.1 percent of Americans saying they took an overnight leisure trip. This outpaces the previous record held by last month by +3.0 points and is also +3.2 points higher than the same time last year. Overnights trips to visited friends and family saw a strong upswing at 50.6 percent, up +5.1 points compared to the same time last month. This is on par with the highs reported in both July 2024 in the midst of last year’s summer season as well as January 2025 following the holidays, suggesting that American travelers are traveling more for overnight leisure, but travel volume for visiting friends and relatives is tracking along historical seasonality trends. Also of note, day trip volume did see an uptick month-over-month as well (54.1%, +2.8 points compared to June 2024), but mirrors travel volume trends for the summer seen in 2024 and 2023. Additionally, day trips to visit friends and family is trending upward for the summer at 47.1 percent (+2.4 points compared to last month’s 44.7%) but tracks below the 50.7 percent reported the same time last year. This indicates overnight leisure travel volume is outperforming day trips and visiting friends and family so far this summer.

- Looking at projected trip volume, more than half (53.9%) of American travelers this month said they expect to travel the same amount for leisure in the next year, with 91.0 percent reporting they expect to take at least one leisure trip in the next year at an average of 3.7 leisure trips planned in that time period. This latter metric is flat month-over-month, but up slightly compared to the average of 3.4 trips reported the same time last year. There is little variation across the generational cohorts in terms of how many leisure trips they expect to take in the next year, however Baby Boomers unsurprisingly continue to have significantly more days available for leisure travel compared to younger travelers (18.7 days on average, compared to 14.2 days for Gen X, 13.0 days for Millennials, and 11.8 days for Gen Z).

A Wellness Check on American Travelers

- This month, Future Partners asked American travelers questions about their overall well-being and whether their desire for wellness impacts their travel decisions. To start, travelers were asked how satisfied they are with their life right now, to which the majority (71.8%) said they are satisfied or very satisfied. That being said, there was significant variance to these responses by demographics, with Gen Z travelers significantly less likely to report being satisfied with their life currently (57.9% vs. 77.9% of Baby Boomers, 70.2% of Millennials, and 68.1% of Gen X). Also, the higher the traveler’s income, the more likely they were to report feeling satisfied with their life. 91.1 percent of those who make $200,000 or more said they are satisfied with their current life, while only 52.6 percent of those who have a household income of less than $50,000 said the same. Gen Z travelers were also the most likely to say they feel stressed in their day-to-day life at 51.0 percent, while just 19.2 percent of Baby Boomers reported feeling stressed often or always. Notably, while elevated stress levels among middle and high income travelers held relatively closely to the national average (35.7%), lower income travelers who make less than $50,000 were much more likely (42.9%) to say they often or always feel stressed in their day-to-day life.

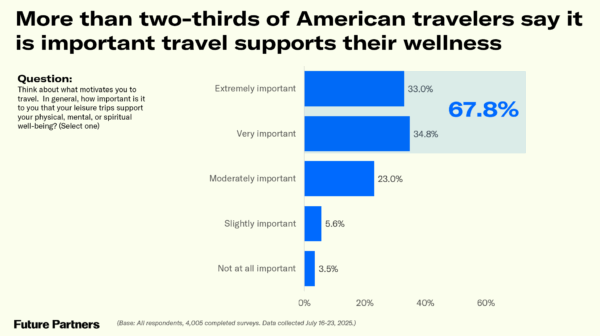

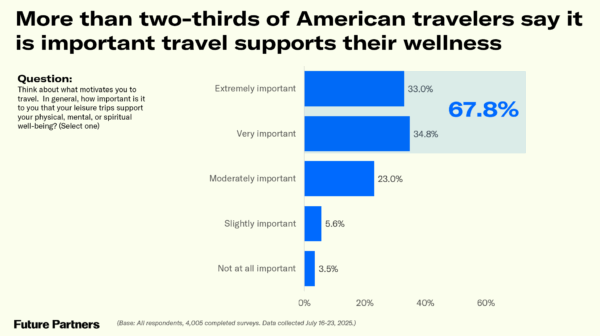

- Well-being – whether it is physical, mental, or spiritual – is largely considered to be an important factor in travel motivation for American travelers, with 67.8 percent saying that it is very or extremely important to them that their leisure trips supports their well-being. Interestingly, Gen Z (65.8%) and Baby Boomers (61.5%) are less likely to say that this is important compared to Millennials (72.2%) and Gen X (71.8%). Also of note, while lower income travelers were more likely to report feeling unsatisfied with their life and higher day-to-day stress levels, they were the least likely to say that it is important to them that travel supports their well-being.

Travel Interest in Upcoming Special Events & Attractions

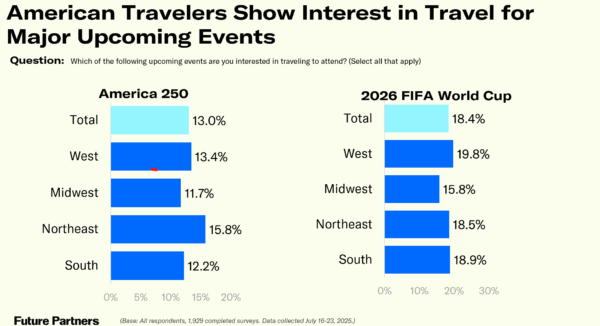

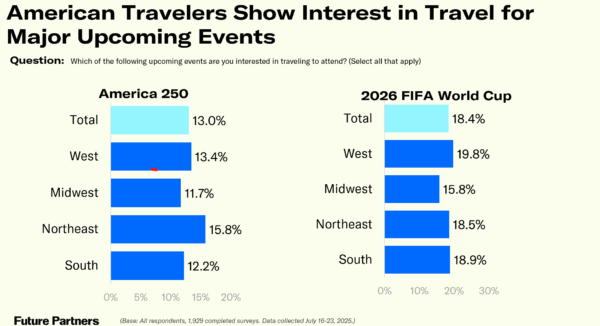

- With exciting new major events such as the 2026 FIFA World Cup and America 250 happening next year, and the opening of Netflix’s new entertainment concept venue “Netflix House” – defined as year-round, new entertainment venue concept that features immersive experiences (e.g., games, theaters, restaurants) based on popular Netflix programs – Future Partners is conducting an ongoing study of American travelers’ interest in visiting destinations for these events and attractions, which will run through early 2026. In addition to understanding general interest in these events and attractions among travelers, we’ll also be double-clicking into interest in visiting specific destinations for events like the World Cup and America 250, where multiple destinations will be hosting events and related activities. Looking at our initial data from July 2025, just under half of Americans are currently interested in traveling to visit a Netflix House and/or to travel for an upcoming special event. With Netflix Houses opening this year in Philadelphia and Dallas and another in Las Vegas in 2027, there is notably interest in visiting one of these locations if they were traveling to one of the Netflix House host cities at 44.1 percent of total American travelers. Interest in Netflix Houses is highest among Millennial travelers (58.3%) followed closely by Gen Z (56.0%) and just under half of Gen X (49.1%). However, only 26.9 percent of Baby Boomer travelers said they would be interested in visiting a Netflix House.

- In regards to key upcoming events, the majority of American travelers are aware of the 2026 FIFA World Cup (59.0%), while one-third are aware of America 250 (33.4%). Nearing a quarter of American travelers are expressing interest in traveling for 2026 FIFA World Cup events, while 13.0% are currently interested in a trip related to America 250.

For the complete set of findings, including data on your audience segments and historic brand performance of your travel brand or destination, subscribe to The State of the American Traveler Insights Explorer tool.

Learn more about the latest trends during our monthly livestream.

To make sure you receive notifications of our latest findings, you can sign up here.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.