IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency. Every week since March 15th, Destination Analysts has surveyed 1,200+ American travelers about their thoughts, feelings, perceptions and behaviors surrounding travel in the wake of the coronavirus pandemic. The findings presented below represent data collected June 12th-14th.

Key Findings to Know:

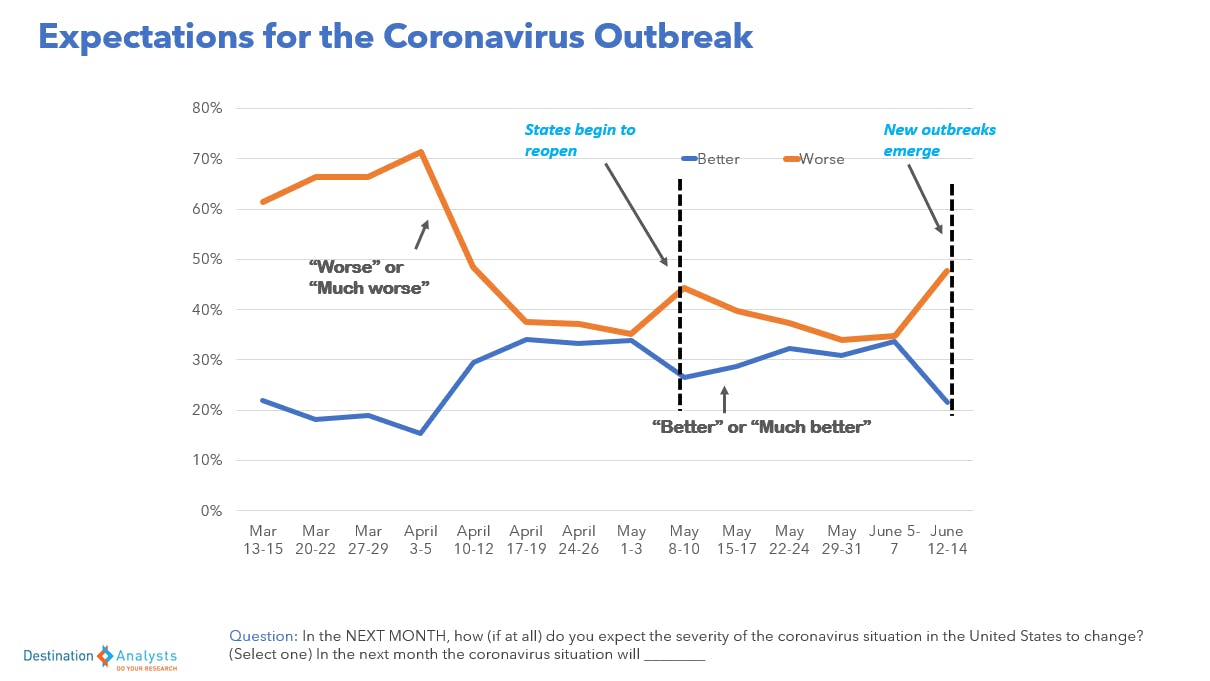

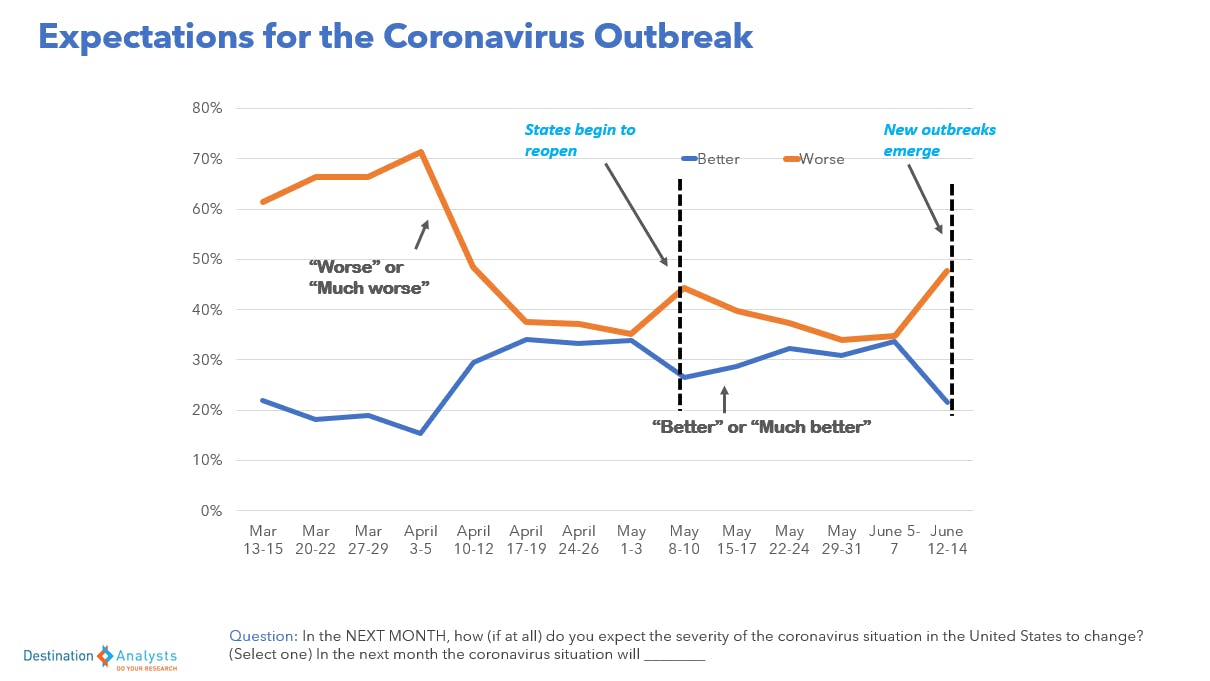

- Expectations about the virus’ course have dampened.

- Still, nearly 70 percent will take at least one leisure trip this year.

- The majority of American travelers feel they are informed about potential Coronavirus-related risks involved with traveling.

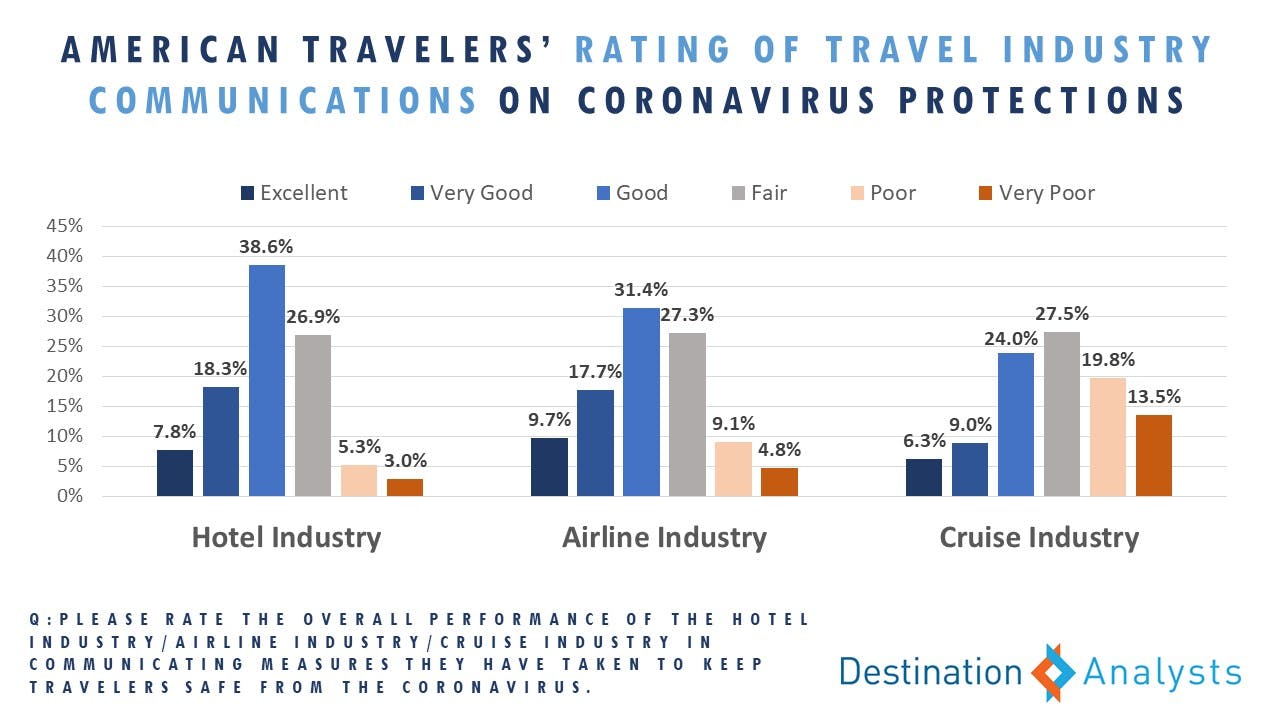

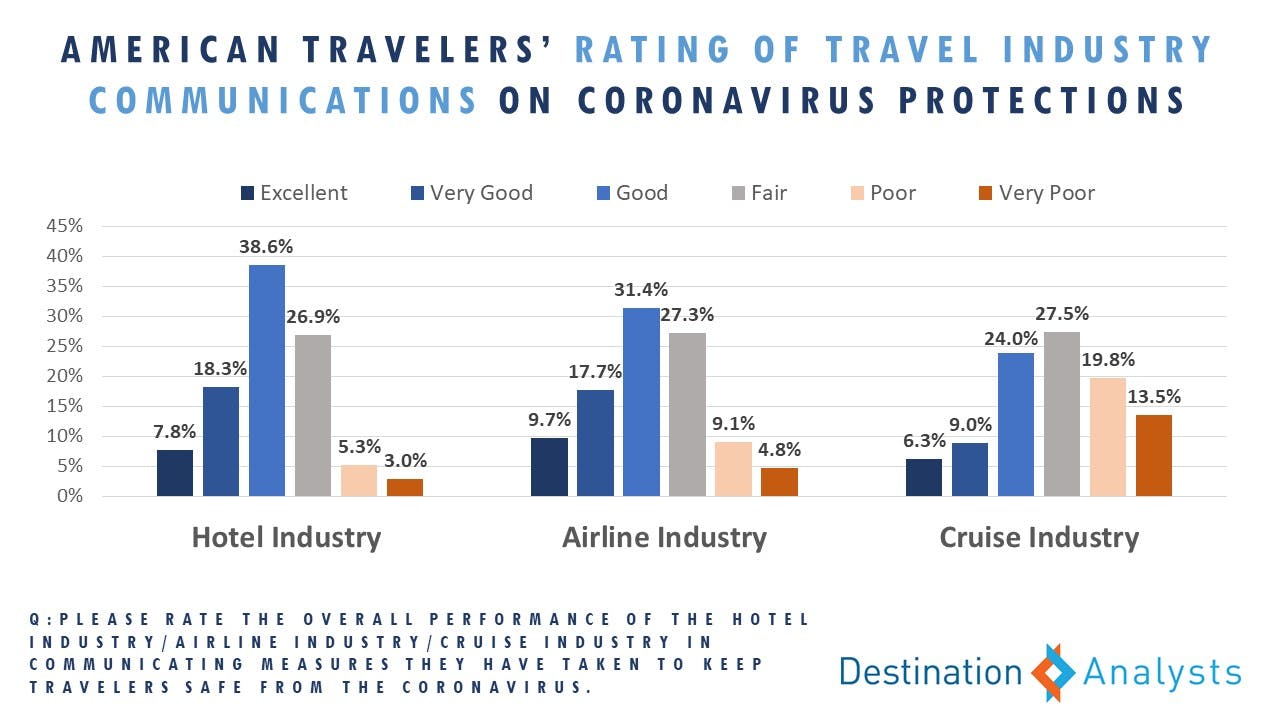

- American travelers generally give a thumbs up to the hotel and airline industries’ communication about measures they are taking to protect consumers.

- Some 4 in 10 American travelers remain lacking in confidence that they can travel safely in the current environment.

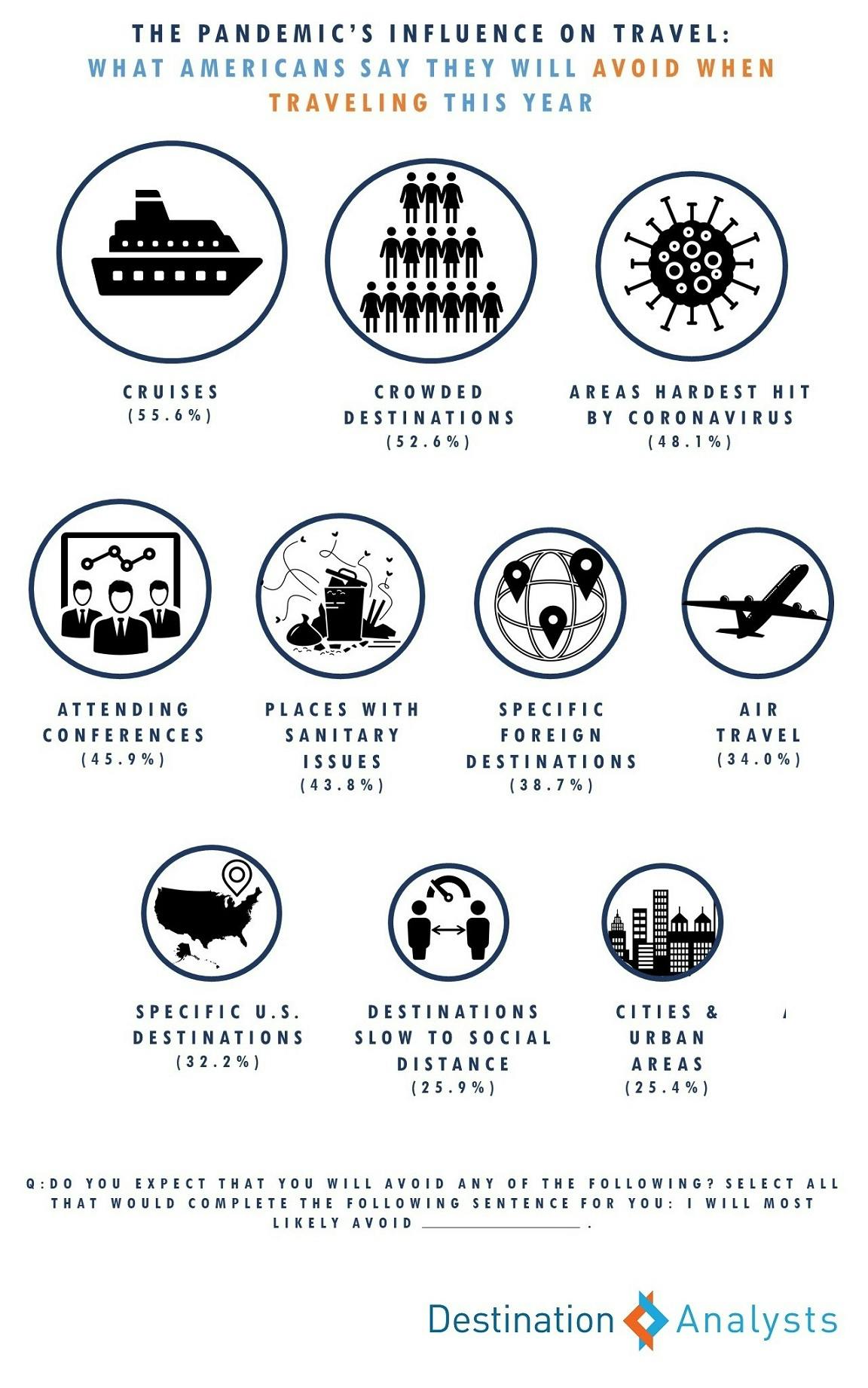

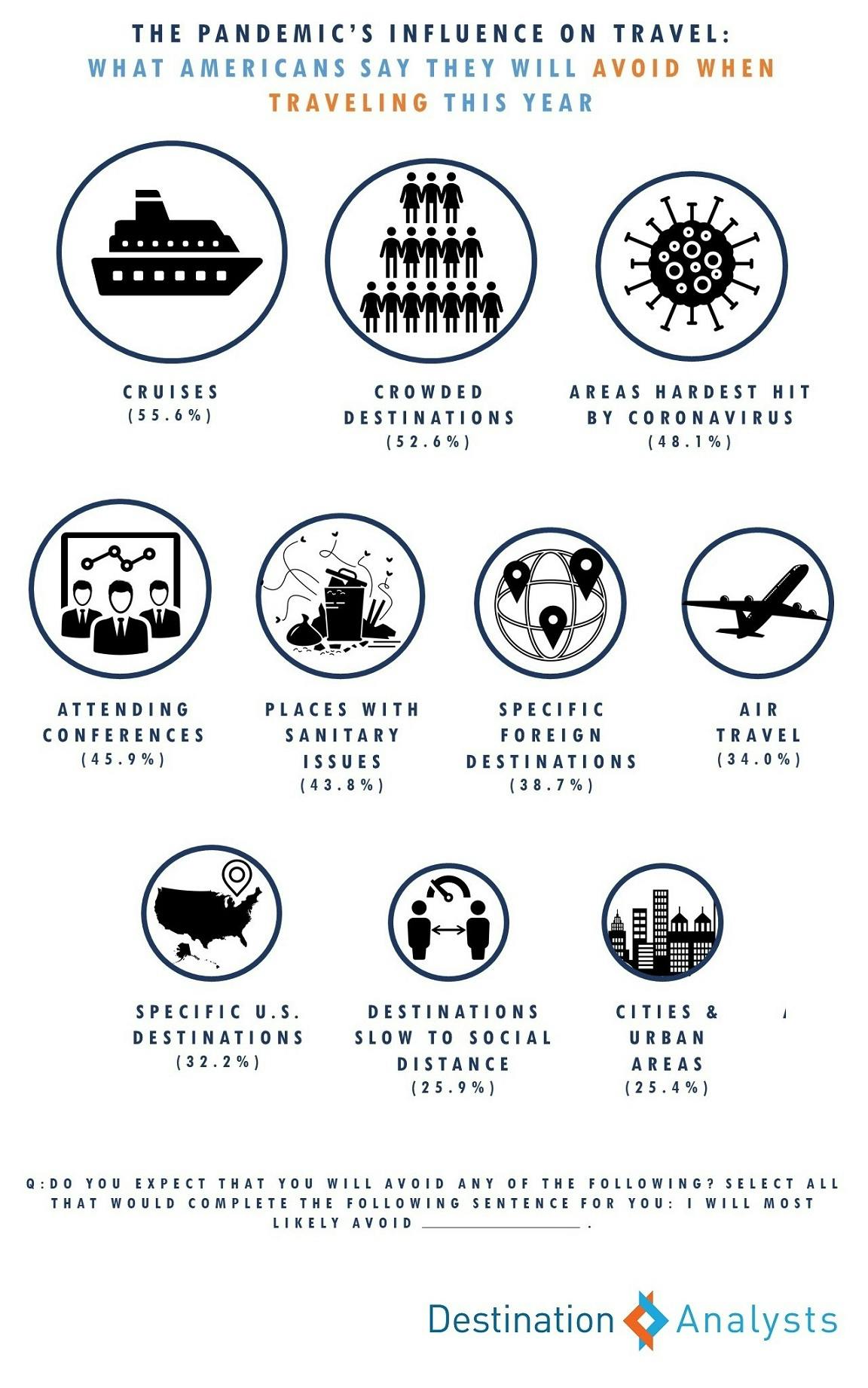

- A majority of Americans who will be traveling in 2020 say they will avoid crowded destinations.

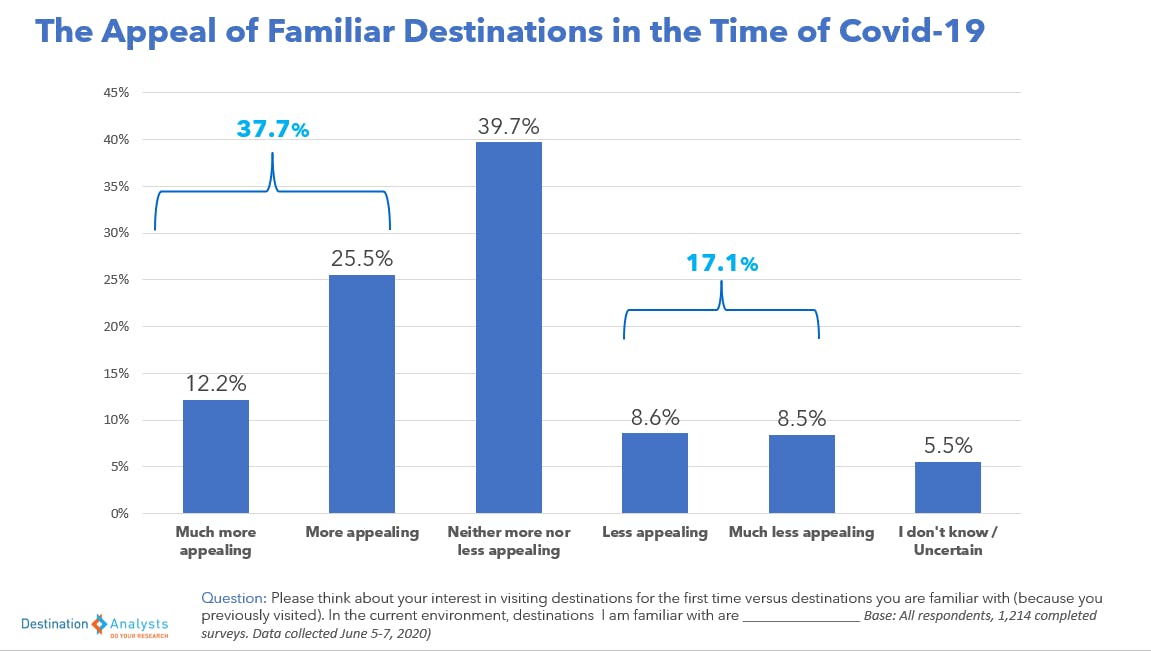

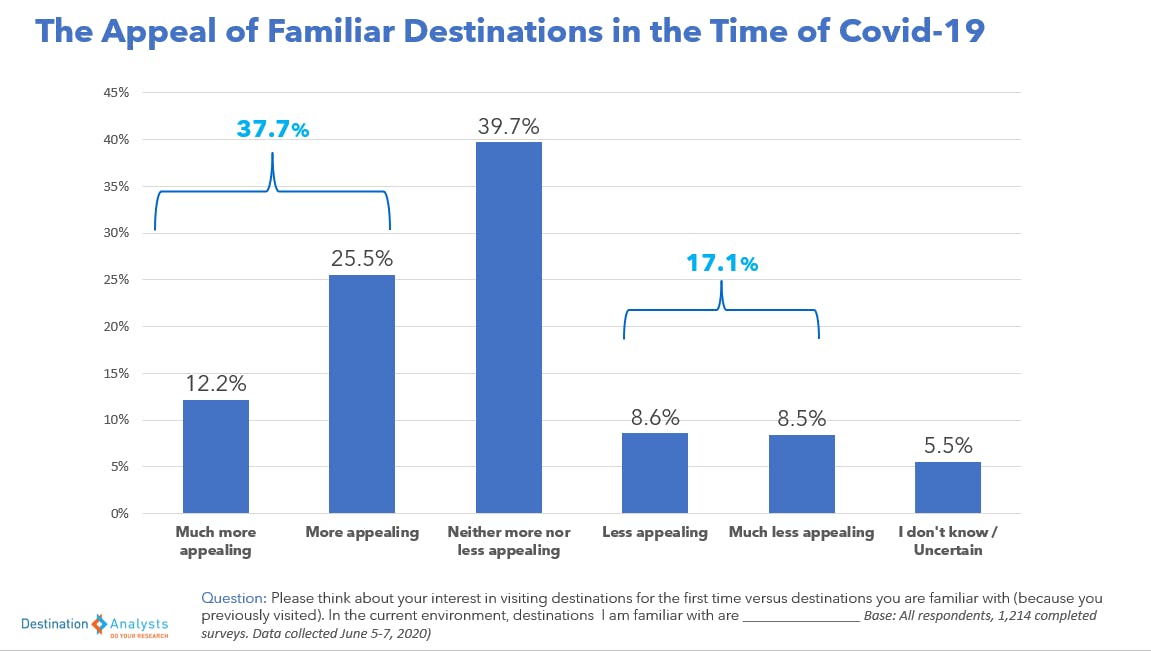

- Many travelers are feeling drawn to destinations they are familiar with, rather than the siren of exploration.

- Poor “pandemic etiquette” behavior, which is then outed in media, will indeed adversely affect the desirability of and aspiration for travel destinations.

As a number of coronavirus outbreaks have recently emerged, expectations about the virus’ course in the United States have dampened. The optimism gap has widened again, with more Americans expecting the situation to get worse and fewer expecting it will get better. Some travelers that thought they would take trips this year have walked that back for now—this week there is an uptick in Americans saying they have no plans to travel in 2020 (although, about 70 percent still say they will take at least one leisure trip this year).

The majority of American travelers feel they are informed about potential Coronavirus-related risks involved with traveling. Heightened feelings of being informed are correlated to increased travel confidence. Still, some 4 in 10 American travelers remain lacking in confidence that they can travel safely in the current environment.

How do traveling consumers currently rate the travel industry’s performance in communicating measures they have taken to keep travelers safe from this coronavirus? While it is understood that the hotel, airline and cruise industries don’t necessarily speak in collective voices, overall the hotel industry is seen as generally doing a good job communicating, and a majority also rate the airline industry highly. The cruise industry appears to need more widespread communication about their evolving health and safety practices. Those travelers who demonstrate high degrees of travel readiness rate the communication of the travel industry much better.

In terms of the deeper impact of the COVID-19 pandemic on travel behaviors—at least in the near-term—a majority of Americans who will be traveling in 2020 say they will avoid cruises and crowded destinations.

In addition many travelers are feeling drawn to destinations they are familiar with, rather than the siren of exploration. Over 60 percent said it was likely that the primary destination of their next leisure trip is one they have visited before. When asked about their interest in visiting destinations for the first time versus destinations they are familiar with, 37.7 percent reported that, in the current environment, destinations they are familiar with are more—or much more—appealing.

Finally, poor “pandemic etiquette” behavior by others—and a perceived lack of official control over tempering that behavior—which is then outed in media will indeed adversely affect the desirability of and aspiration for travel destinations. When asked to think of a destination they are interested in visiting, then imagine if they saw saw media coverage of that destination being crowded or people not maintaining appropriate distance from each other, and then asked how that would affect their interest in visiting, 61.2 percent of American travelers said it would consequently make them less or much less interested in visiting that destination. This week, two-thirds of American travelers report seeing such kinds of coverage in the media.

Follow us on social for infographics of these and other key findings. Need assets for a presentation or something else? Find all the presentation decks from our ongoing traveler research here. And please join us monthly for a live presentation of the latest insights into traveler perceptions and behaviors.

We appreciate your support of this research from our small but mighty team of devoted tourism researchers.

Have a question idea or topic you would like to suggest we study? Let us know!