The State of the American Traveler in January 2026—Early Signals for the Year in Travel

American Travelers Start 2026 with Established but Muted Financial and Travel Expectations

Back in February 2024, Future Partners published a blog post titled “Watch Out World, Here Comes the Gen Z Traveler” to showcase this up-and-coming new generation of independent travelers. Now that we are well into 2025, we’re sharing an update on how Gen Z is approaching travel in this age of economic and travel policy uncertainty. This month, we’re focusing on data collected in the first four months of 2025, to shed light on Gen Z’s travel sentiment, how they are traveling, and how marketers can best reach them effectively, particularly in digital spaces.

Gen Z travelers (47.2%) are more likely to say they are currently better off financially compared to non-Gen Z travelers (31.1%). Similarly, more than half (55.6%) of Gen Z travelers are optimistic about their future finances, +11.2 points higher than older travelers. However, this does not necessarily mean that they are wielding the same amount of spending power for leisure travel as older travelers – yet. When calculating the average of the maximum leisure travel budget reported by American travelers between January and April 2025, Future Partners found that Gen Z travelers have a smaller maximum leisure travel budget of $3,781 for the next 12 months compared to $5,768 for their older traveling counterparts.

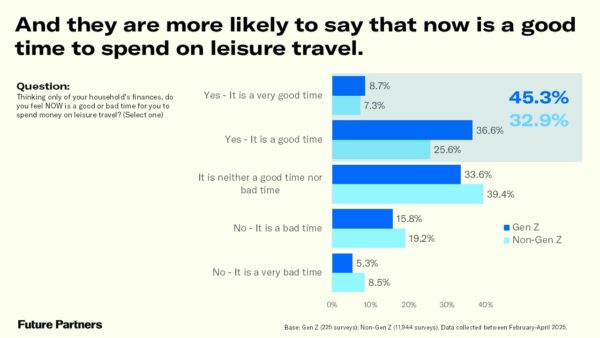

But Gen Z nevertheless are prioritizing travel as a near-term budget item at the same rates as older travelers, with 58.8% of Gen Z travelers saying they consider leisure travel to be a high spending priority for them in the next three months, on par with 59.8% of non-Gen Z travelers. Even more telling? Gen Z travelers (45.3%) are significantly more likely to say that now is a good time to spend on leisure travel than non-Gen Z travelers (32.9%). In other words, Gen Z travelers are eager to travel and optimistic about their finances, but they are still working on achieving the same level of spending power as Millennials, Gen X, and Baby Boomers.

Looking at their recent travel behavior, Gen Z are much more likely to have taken at least one overnight trip in the past month (79.9% vs. 62.0% of non-Gen Z travelers), but they are less likely to have recently traveled by plane (56.5% vs. 66.0%). Gen Z are particularly more likely to cite social media content-making as a motivator for their most recent overnight trip (21.1% vs. 8.5%) but they were also more likely to have been motivated by shopping (29.7% vs. 19.0%), attending a special event or sporting event, as well as outdoor summer water sports. Given their event-driven travel motivation, it’s unsurprising that Gen Z travelers are also more likely to have traveled for a sporting event in the past year (34.5% vs. 26.0%), as well as for special events (56.6% vs. 46.2%). Notably, Gen Z travelers are much more likely to have traveled in the past year to attend a semi-professional sporting event (17.6% vs. 9.3%) or an e-sports event (17.7% vs. 7.0%). They were also significantly more likely to have attended a parade than non-Gen Z travelers in the past year (16.3% vs 7.2%). Compared to older generations, they are also more likely to have taken a solo leisure trip (41.9% vs. 31.5%), likely due to the fact that they are less likely to be married or to have children.

When it comes to Gen Z travel booking windows, they are more likely to be booking their trips less far out (8.9 weeks vs. 11.1 weeks for non-Gen Z travelers). Over one in four (28.7%) Gen Z travelers reported using AI to help them prepare for travel in the past year (vs. 15.8% of non-Gen Z travelers).

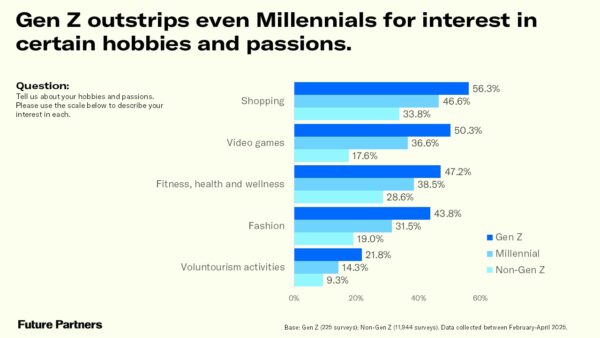

Finally, with Millennials making up a large share of digital-forward travelers, this begs the question of how to differentiate Gen Z from Millennials when it comes to digital spaces. In terms of their interests, while Gen Z and Millennials share many commonalities as the two younger generational cohorts, there are passion areas where Gen Z travelers outstrip even Millennials. Specifically, half of Gen Z travelers (50.3%) say they are passionate about video games compared to about one in three Millennial travelers (36.6%). Similarly, while generally Gen Z and Millennial travelers are more likely to over-index for social media channels as effective destination marketing platforms, Gen Z travelers surpass Millennial travelers for TikTok (40.5% vs. 23.3%) and X/Twitter (25.4% vs. 13.7%). They were also more likely than Millennial travelers to say that they have used TikTok (44.8% vs. 26.5%) or YouTube (48.3% vs. 36.5%) to plan for a trip in the past year. Notably, they were also more likely than any other generation to use a DMO’s online official visitor guide (26.7% vs. 15.1% of all non-Gen Z and 18.3% of Millennial travelers) in the past year.

For further insights into Gen Z travelers, such as what kind of media they are consuming, what other travel planning resources they use, and what destinations they are interested in visiting, please reach out to our research team at [email protected].

For the complete set of findings, including data on your audience segments and historic brand performance of your travel brand or destination, subscribe to The State of the American Traveler Insights Explorer tool.

Learn more about the latest trends during our monthly livestream.

To make sure you receive notifications of our latest findings, you can sign up here.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.