American travelers are heading into the peak summer travel months with surprising financial steadiness and a renewed willingness to spend on travel—near-term travel spending sentiment has jumped to its highest point in over two years, while average annual travel budgets are returning to record-setting highs. Despite lingering recession concerns, trip-taking is on the rise again and international travel interest is rebounding. As the country looks ahead to America’s 250th birthday, younger generations and families are emerging as the most engaged audiences, revealing a clear opportunity for destination marketers to tap into patriotic travel in the year ahead.

American Travelers’ Financial Outlook Continues to Hold Steady After Last Month’s Recovery

- With summer 2025 in full swing, American travelers’ financial sentiment and outlook continued to hold steady after trending downward in the spring. American travelers’ current financial situation actually rebounded this month after stabilizing last month, currently tracking at over one in three (34.1%) American travelers saying their household is better off financially now compared to a year ago (+3.5 points over last month, up +1.6 points over same time last year). On the other hand, future financial outlook remained relatively flat month-over month at 46.4 percent expecting to be financially better off this time next year (+1.1 points). Compared to June 2024, however, this is actually down -2.7 percentage points. Looking at how financial sentiment and outlook differs across generational cohorts, Millennials continue to be the generation of travelers most likely to feel better off currently (48.3% compared to 23.1% of Boomers, 31.6% of Gen X, and 45.7% of Gen Z). In terms of outlook, Gen Z travelers are the most likely by far to feel optimistic about their future finances (65.1% compared to 31.5% of Boomers, 47.5% of Gen X, 60.7% of Millennials)

- Echoing these financial sentiment metrics, expectations of a U.S. recession in the next six months have levelled off at 49.5 percent of American travelers (+1.6 points over last month), suggesting the cautious, not-quite-optimism around the U.S. economic outlook from last month has continued to hold going into the summer. However, this is still +8.7 percentage higher than the over same time last year. So, while economic fears continue to abate somewhat compared to the earlier months of 2025, they are still very much present in the minds of American travelers. In similar fashion, the share of American travelers who report exercising financial caution due to recession fears is at 48.5 percent this month, down -2.2 points compared to last month.

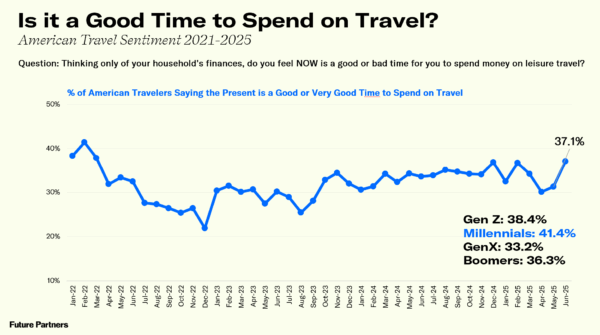

Near-Term Travel Spending Sentiment is Strong Going into the Summer

- Bearing in mind the aforementioned, economic and financial sentiment markers among American Travelers in June 2025, near-term perceptions of whether or not how is a good time to spend on travel have recovered notably this month. In fact, over one in three (37.1%) say now is a good time to spend on travel, up +6.8 points over last month and up +3.4 points over the same time last year. This is the highest this metric has been since February 2022, suggesting American travelers may be willing to spend more on travel going into this summer. Among the generations, Millennials travelers continue to be the most likely to agree that now is a good time to spend on travel at 41.4 percent, compared to 33.2 percent of Gen X, 36.3 percent of Boomers, and 38.4 percent of Gen Z travelers.

- Looking also at how high of a priority leisure travel will be as a budget item for American travelers, over six in ten (61.1%) American travelers this month said they will prioritize leisure travel spending in the next three months, up +4.0 points over last month and +2.8 points over the same time last year. As with perceptions around now being a good time to spend on travel, Millennial travelers are also the most likely generation to be prioritizing travel as a budget item in the near-term at nearly two in three (64.6% compared to 55.4% of Gen Z, 58.7% of Boomers, 61.8% of Gen X).

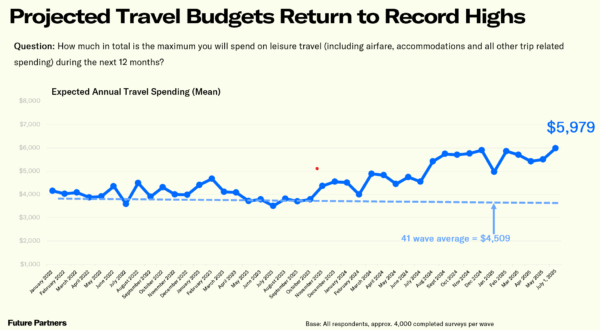

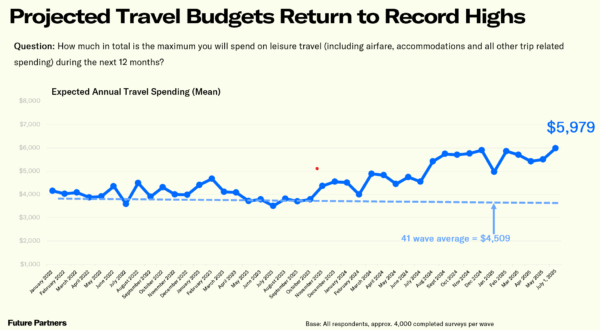

- Turning next to the average maximum annual travel budget among Americans, this also recorded an uptick this month to $5,979, compared to the $4,750 reported the same time last year. This marks a return to record-setting travel budgets among American travelers. Among the generations, Boomers have the highest budgets at an average of $7,318, while Gen Z has the lowest at $3,734, followed by Millennials at $4,768 and Gen X at $5,892. In terms of outbound travel, likelihood to travel abroad in the next 12 months also rebounded to 47.8 percent this month, up +6.2 points compared to last month and up +13.0 points compared to June 2025, but still below the record set in February 2025 (48.2%).

Past Month Travel Volume and What’s Ahead

- Overnight trips have increased for both leisure and visiting friends and relatives this month compared to last month, with more than half (51.1%) of American travelers reporting at least overnight leisure trip in the past month, up +5.4 points over May 2025 and +3.3 points over same time last year). Overnight trips to visit friends and relatives tracked at 45.7 percent of American travelers this month, up +1.5 points over last month, but down -0.8 points compared to May 2024.

- Looking forward at projected trip volume, the number of expected leisure trips in the next year is at 3.7 trips this month, rebounding slightly from last month’s average of 3.5 trips, but still below the highs recorded at the start of the year (expected 4.0 trips on average reported in February 2025). Older generations continue to report a higher number of days available for leisure travel (19.3 days for Boomers, 14.8 for Gen X, 13.1 for Millennials, 11.6 for Gen Z travelers).

- Future Partners asks American travelers we survey about how personal politics plays into where travelers decide to go for leisure trips. Politics is more polarizing for younger generations when it comes to choosing leisure destinations, with Gen Z (29.8%) and Millennials (27.5%) being the most likely cohorts to say they often avoid a destination based on their personal political beliefs, compared to 16.4% of Boomers and 17.9% of Gen X travelers.

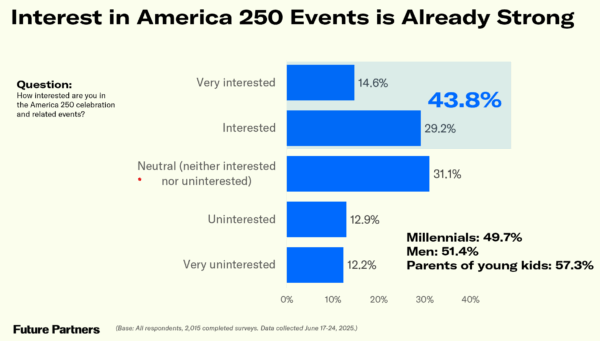

A Sneak Peek at America 2025 Travel Trends

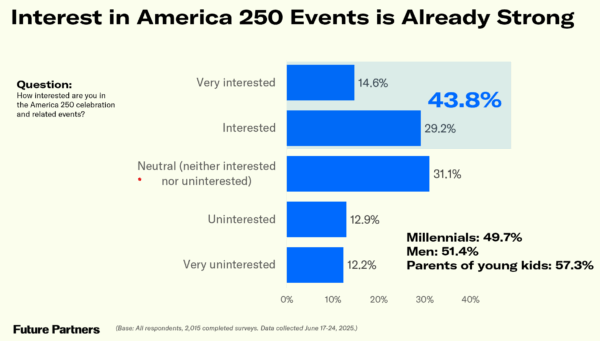

- Finally, the Future Partners team hopes everyone had a safe and fun Fourth of July holiday this year! As we approach America’s Semiquincentennial, better known as America 250, The State of the American Traveler study has begun tracking awareness of, interest in, and likelihood to travel for events, attractions, and destinations in celebration of America’s 250th birthday. As of now, only 3 in 10 (29.0%) American travelers have heard of America 250. Over half (51.9%) of American travelers have not heard of it and 19.1 percent are unsure. Given their proximity to the actual locations where the American Revolution occurred, it is perhaps unsurprising that awareness of America 250 was highest for Northeast residents (36.9%), while awareness was lowest in the West (25.6%). The share of American travelers who are interested in American 250 celebrations and related events is higher than awareness at 43.8% of overall, suggesting an opportunity to educate American travelers on upcoming celebrations. Among the generational cohorts, Millennial travelers are most interested (49.7%) while Gen Z travelers are least interest (28.5%). Young families are a prime market for attracting potential visitors for America 250-related events, with more than half (57.3%) of parents to school-aged children saying they are interested in these celebrations.

- However, a smaller share of 28.2 percent of American travelers reported they are likely to take a trip for an America 250 destination, event or attraction. This was highest in the Northeast (30.5%) and South (31.6%), while American travelers based in the Midwest is least likely (22.1%), followed by the West (26.2%). Millennials (39.3%) are the most likely age group to travel for this, while Boomers are least (20.1%), and again parents to school-aged children represent the strongest market for America 250 travel events, with nearly half (45.5%) saying they are likely to take a trip for America 250-related celebrations, attractions, and destinations. Future Partners will be sharing more insights around American travelers’ likely growing interest in America 250 in the coming months as we approach this milestone anniversary.

For the complete set of findings, including data on your audience segments and historic brand performance of your travel brand or destination, subscribe to The State of the American Traveler Insights Explorer tool.

Learn more about the latest trends during our monthly livestream.

To make sure you receive notifications of our latest findings, you can sign up here.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.