The State of the American Traveler in December 2025

American travelers are showing renewed optimism with expected trip volume climbing back to 4.0 trips—matching early-year levels and signaling a recovery from spring’s tariff-induced uncertainty.

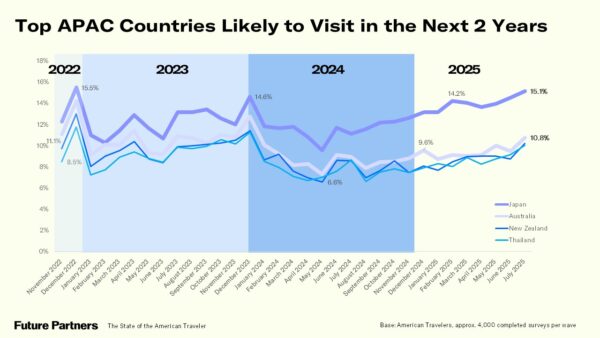

One in four (25%) American travelers are likely to visit an Asia Pacific (APAC) destination in the next two years. Of the individual APAC countries, Japan is the most popular, followed by Australia, Thailand, and New Zealand. In fact, looking at the percent of overall American travelers over time who have selected any of these top four APAC destinations as a place they are likely to visit in the next 2 years, Japan has increasingly outstripped the other countries over the past year in likelihood to visit. Let’s look at who these travelers are and why they’re worth talking to.

APAC likely travelers are significantly more financially better off, with an average income of $135,153, compared to the average American traveler’s income of $118,885. In fact, nearly one in three (32.0%) have an income of $150,000 or more, versus 24.8 percent of overall American travelers. They are more ethnically diverse than the overall American travelers, being significantly more likely to be Asian (12.4% vs. 5.1%) or Black/African American (12.3% vs. 9.5%) and also less likely to be White (63.4% vs. 76.2%). Four in ten APAC likely travelers are parents of school-aged children (41.1% vs. 30.7%), and also similarly skew urban residents (41.3% vs. 30.1%).

This group’s financial outlook is extremely robust, with nearly half stating that they are currently better off financially now than they were a year ago (46.7% vs. 34.1%), and a majority stating that they expect to be even better off financially in the next year (55.6% vs. 46.4%). This also means they are more likely to feel that now is a good time to spend on leisure travel (47.5% vs. 37.1%), and three in four say leisure travel is a high spending priority for them in the near term (75.4% vs. 61.1%). In more concrete terms, this translates to strong projected spending on leisure travel in the next year, at an average of $8,087 budgeted, over $2,000 more compared to the average American traveler’s annual leisure travel budget estimate of $5,979.

Given their robust financial and travel spending outlook, it is perhaps no surprise that luxury is an important leisure travel consideration for APAC travelers, with more than six in ten (60.9%) saying that having some kind of luxury travel experience is usually an important part of their leisure trips. In contrast, fewer than half (45.6%) of overall American travelers said the same. This affinity for luxury leisure travel products is reflected in their recent lodging preferences; APAC travelers are much more likely to have stayed in a luxury or 5-star hotel or resort in the past year at 36.3 percent, compared to just 24.7 percent of overall American travelers.

When asked to write in which international destinations they most want to visit in the next year, nearly one in four APAC travelers (23.3%) wrote in Japan. This is more than double the amount of overall American travelers who mentioned Japan (11.1%). Notably, Japan has generally been a top-of-mind destination for American travelers recently, and it is the only APAC nation to make the top 10 unaided list of desired international destinations among overall American travelers. This is likely due in part to the perceived affordability of Japan with the weaker Japanese yen against the American dollar. APAC travelers were also generally more likely than overall American travelers to write in other APAC destinations such as Australia (7.4% vs. 4.3%), South Korea (5.0% vs. 2.1%), China (4.9% vs. 2.4%), New Zealand (4.9% vs. 2.5%) and Thailand (4.8% vs. 2.2%).

In terms of how marketers can best reach these APAC travelers, they are generally high social media consumers when it comes to travel planning, with the vast majority (74.4%) using at least one social media channel to plan their travels in the past year. Instagram is their top social media platform for travel planning, with 45.3 percent saying they used this platform in the past year, followed by YouTube (28.9%). More than half (53.1%) have also used a travel planning resource from an official destination marketing organization in the past year, with over one in three (34.1%) saying they used the official destination website. They are also much more likely than the average American traveler to be regular podcast listeners at 45.1 percent compared to 34.9 percent, with health/fitness podcasts topping their list of preferred genre types, followed distantly by entertainment/pop culture, comedy, and sports podcasts.

For further insights into APAC travelers, such as what kind of media they are consuming, what other travel planning resources they use, and what destinations they are interested in visiting, please reach out to our research team at [email protected].

For the complete set of findings, including data on your audience segments and historic brand performance of your travel brand or destination, subscribe to The State of the American Traveler Insights Explorer tool.

Learn more about the latest trends during our monthly livestream.

To make sure you receive notifications of our latest findings, you can sign up here.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.