Why Air Travelers Matter

For this post, we define “American Air Travelers” as those who have traveled by air within the last 12 months.

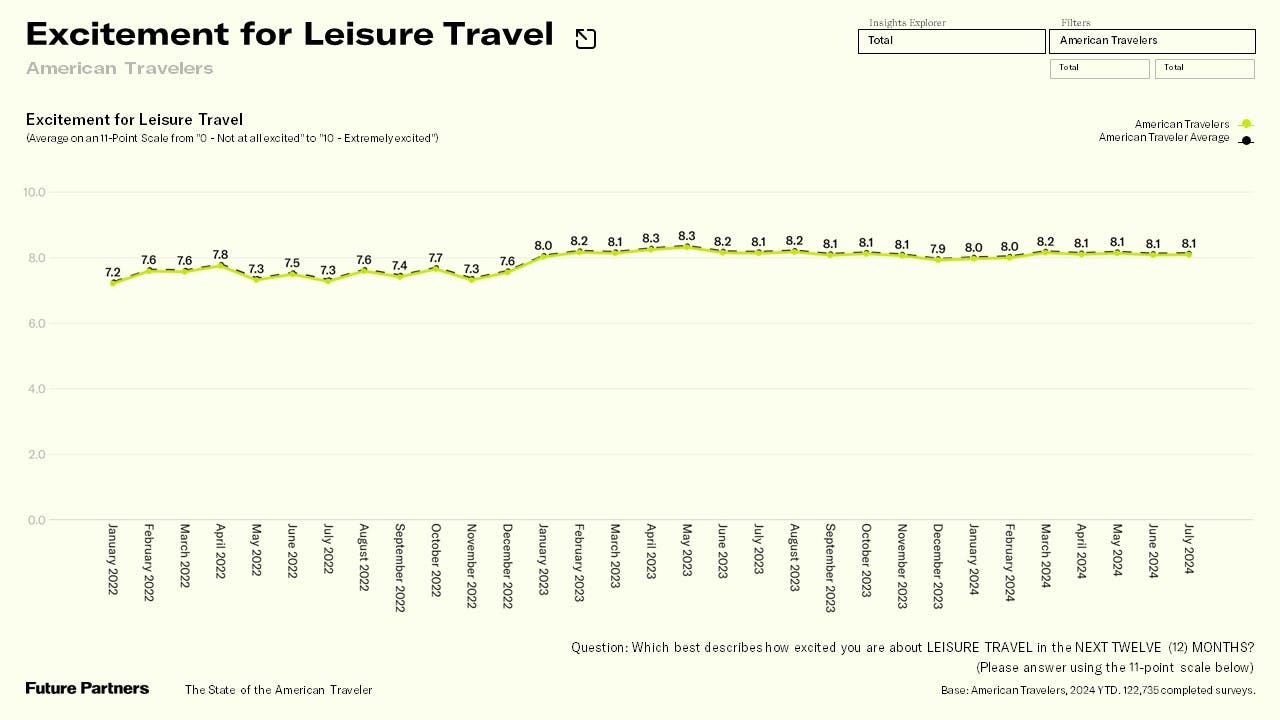

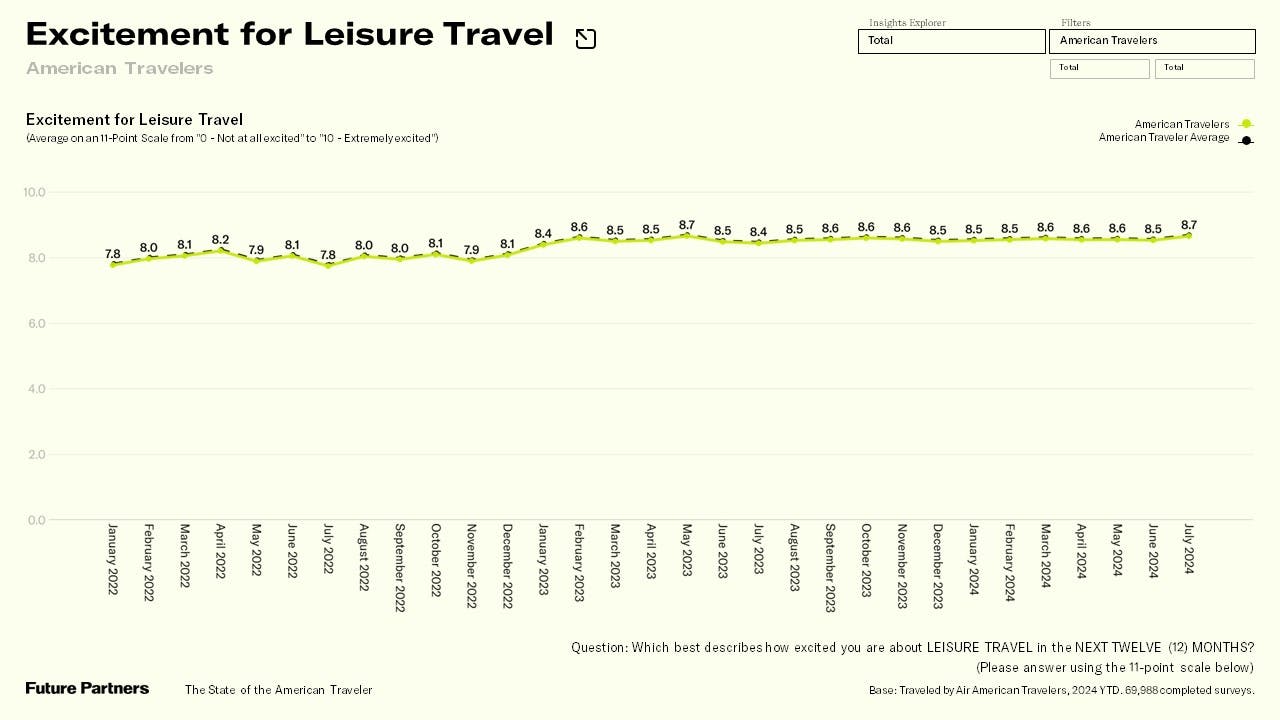

Air travelers represent a particularly lucrative market segment. They are significantly more enthusiastic about leisure travel than the average American traveler, scoring an excitement level of 8.7 on a 10-point scale, compared to the national average of 8.1. Moreover, nearly three-quarters (71%) of air travelers say travel is a high or extremely high priority in their budget, compared to just over half (57%) of all American travelers.

This prioritization translates into spending: air travelers allocate an average of $5,811 to leisure travel annually, a 33% increase over the $4,368 spent by the average American traveler.

Elevate Your Marketing to Attract Valuable Air Travelers

Elevate Your Marketing to Attract Valuable Air Travelers

At Future Partners, we are constantly exploring the diverse behaviors of American travelers. One of our recent inquiries focused on the differences between roadtrippers and air travelers, a discussion we hosted in our July livestream. Today, we’re diving deeper into air travel trends, as outlined in The State of the American Traveler report, to uncover the significance of air travelers and how your brand can tap into this valuable segment of the market. Contact us for a personalized demo of The State of the American Traveler or ask about international air travel trends.

It’s not just about the money; air travelers are also taking more trips. In the past two years, air travelers took 8.9 trips, compared to the 7.7 trip average among all American travelers. These trips break down into 3.6 leisure trips, 2.7 visits to friends or family, 1.6 business trips, and 1.0 for conventions or group meetings. This increased frequency is enabled by air travelers typically having 17.7 days available for leisure travel over the next 12 months, with nearly one-third (27.6%) reserving between 8-14 days for leisure travel.

The Event-Driven Traveler

American air travelers are drawn to events and festivals, with over half (51.2%) attending at least one in the past year. Music tops the list of reasons for these trips, with 52.7% of travelers attending concerts, 26.8% going to music festivals, and 22.4% participating in cultural events.

These findings highlight that American air travelers are more optimistic about travel and consistently prioritize it, both financially and in how they spend their time.

Brand Preferences that Stick

American air travelers are loyal to their preferred airline brands. Since 2022, the top airlines—American, Delta, Southwest, and United—have maintained their dominance. However, smaller players are making gains: Hawaiian Airlines grew its market share from 0.9% to 3.1%, and Air Canada increased from 2.6% to 3.5%.

Their loyalty extends to hotel brands as well. Two out of five air travelers (40.9%) are Hilton Honors members, and one-third of their stays in the past year were at Hilton properties. Marriott follows closely with 31.9% of air travelers belonging to Marriott Bonvoy, and 30.7% of their stays occurring at Marriott locations.

Align your brand with preferred partners and leverage loyalty programs to build your marketing strategy by understanding how airline and hotel preferences work together, like “Southwest flyers tend to stay at this hotel chain at a higher rate, etc” with a subscription to The State of the American Traveler.

How to Capture the Air Traveler Market

Now that we’ve established the value of air travelers, let’s look at how you can successfully market to them. The first step is to engage with them where they spend a significant portion of their travel time—airports. The top five airports frequented by air travelers are Atlanta’s Hartsfield-Jackson International (17.4%), Los Angeles International (17.0%), Dallas/Fort Worth International (16.8%), Chicago O’Hare (16.4%), and Las Vegas’s Harry Reid International (16.3%). There’s more to discover, contact us for regional trends and airport preferences based on region or state of origin.

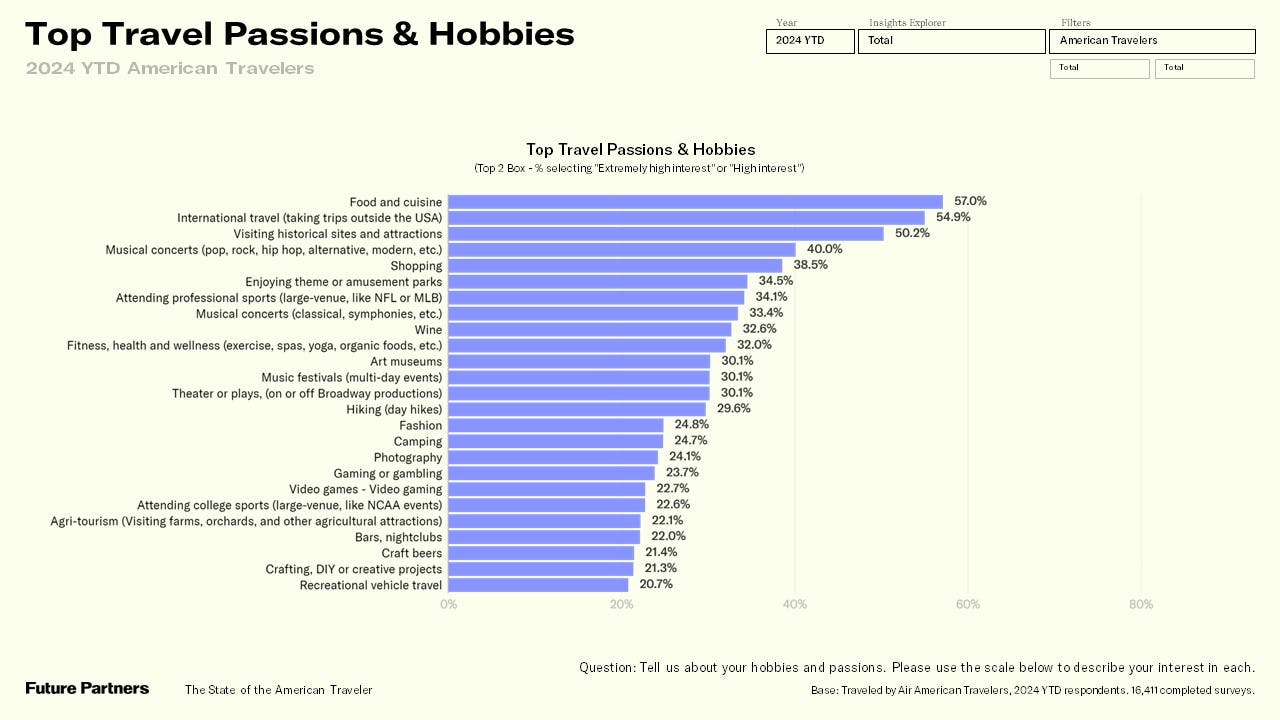

Understanding their passions also helps. In 2024, food and cuisine (57.0%), international travel (54.9%), and visiting historical sites and attractions rank as top hobbies for air travelers. Interests such as camping, RV travel, and gaming have seen declines in recent years, making room for other interests to rise in prominence.

In terms of travel planning, air travelers rely heavily on digital tools. Email, search engines, and Facebook continue to be the top resources. However, between 2022 and 2024, we’ve seen growing influence from articles and blogs (up 4 percentage points), Instagram (up 5 pp), TikTok (up 4 pp), and travel podcasts (up 3 pp).

In terms of travel planning, air travelers rely heavily on digital tools. Email, search engines, and Facebook continue to be the top resources. However, between 2022 and 2024, we’ve seen growing influence from articles and blogs (up 4 percentage points), Instagram (up 5 pp), TikTok (up 4 pp), and travel podcasts (up 3 pp).

Reaching Air Travelers Through Social and Podcasts

Social media platforms are essential to the travel planning process for air travelers. YouTube leads the pack with 31.5% of air travelers using it for trip planning in the past year. Facebook follows at 39.9%, while Instagram (27.1%) and TikTok (16.8%) continue to grow in popularity, particularly among younger generations.

Podcasting is another key medium. Two in five air travelers (40.8%) regularly listen to podcasts, with platforms like Spotify (20.0%) and YouTube (19.0%) being the most popular. Their preferred genres range from entertainment and pop culture (14.1%) to health and fitness (13.8%) and sports (12.4%), with travel podcasts also holding significant appeal (9.5%).

Unlock More with Custom Insights

There’s still much more to uncover within the American air travel market. With our customized city and state-level analyses available in The State of the American Traveler subscription, you can elevate your brand’s marketing strategies and capture the attention of this high-value audience. Contact us today to discover how our tailored insights can help your brand soar.