IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted, or influenced by any advertising or marketing agency. The key findings presented below represent data from over 4,000 American travelers collected in June 2024.

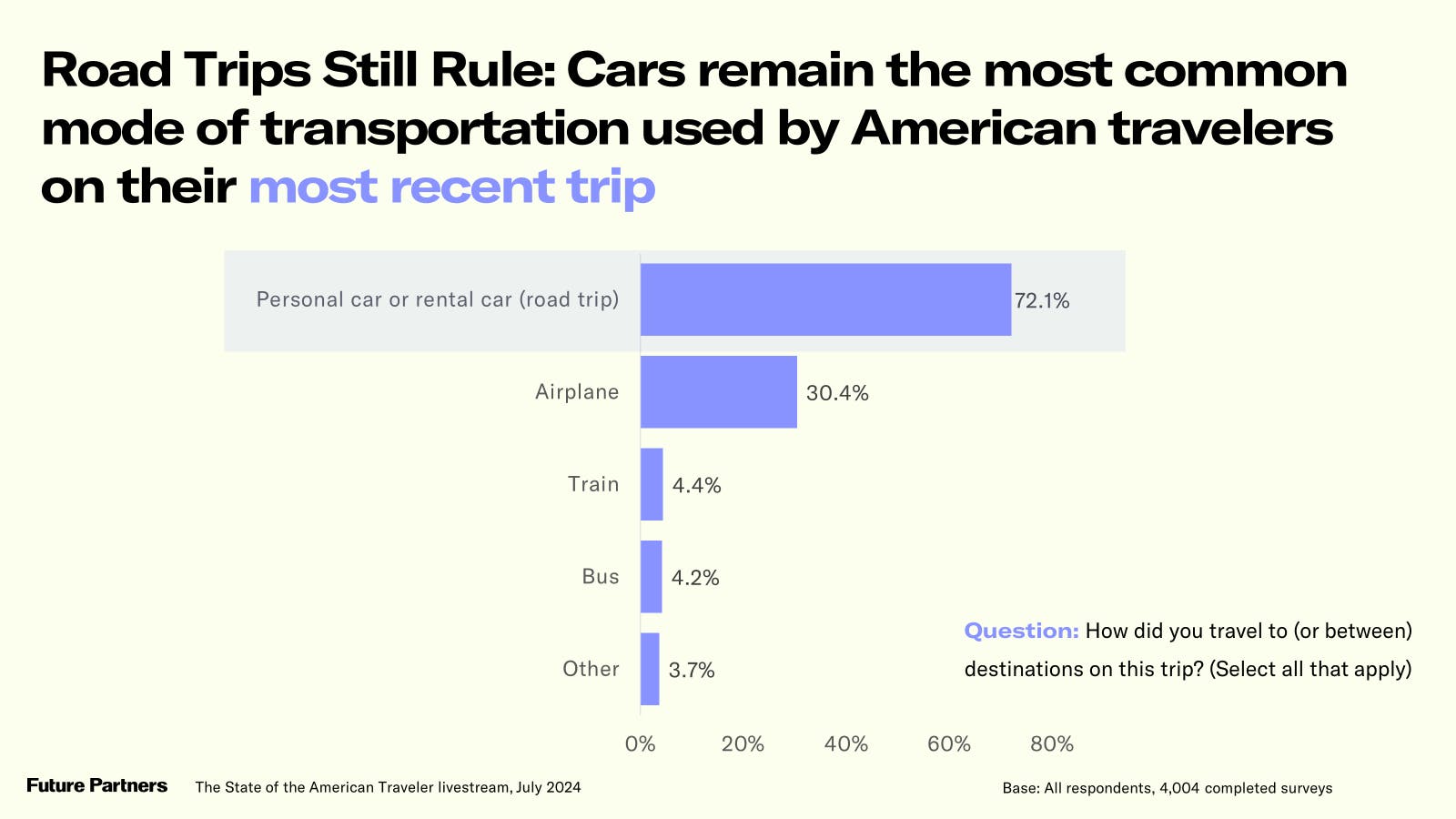

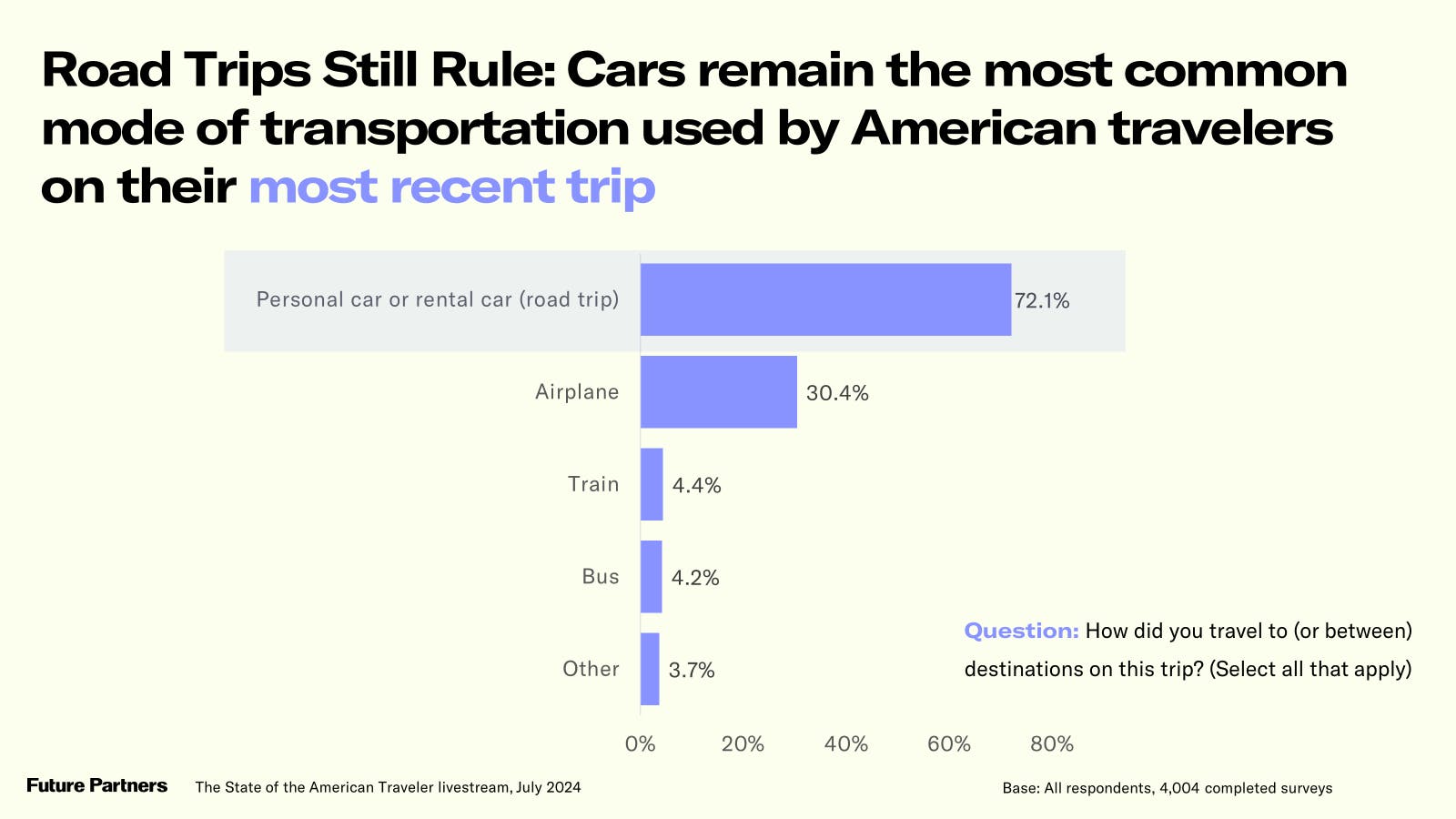

Americans—particularly GenX and Boomers—continue to fuel a summer travel surge, with 50.7% of travelers reporting they have at least one trip planned in July and/or August. And with a placidity in their financial sentiment, the travel outlook beyond summer looks to be healthy. A deeper look into Hispanic/Latino American travelers shows robust travel spending (an average of $1,925 on their most recent overnight trip, compared to the $1,320 national average) and heavy social media and video content usage for trip inspiration. While concerns about flight cancellations have dropped since last summer, road trips still dominate trip volume with 72.1% of American travelers reporting the car as their mode of transportation for their most recent trip. When it comes to moving towards high-tech cars, safety and infrastructure are top concerns.

A Midsummer Check-In

- Now that we are nearing the middle of the summer travel season, let’s look at where the remaining summer months stand in terms of trips planned. Last month, 73.5 percent of American travelers said they were likely to take at least one trip between June and August. With just July and August left in the season, just over half (50.7%) of American travelers said they have a trip planned during either of those months. These mid- to late-summer travelers are more likely to be Gen X (54.5%) or Baby Boomers (53.8%), while just under half of Millennials (46.9%) and just over a third of Gen Z (35.9%) have a trip planned in July or August.

- Looking further into these travelers who still have trips planned for the remaining months of summer, these are – unsurprisingly – more likely to be higher-income households, with six in ten of travelers with an income over $200k (61.6%) saying they currently have travels on the calendar for July or August. The majority of households with an income between $100k-$199k (57.6%) also will travel during these months, while fewer than half of those with an income of $50k-$99k (49.0%) or less than $49k (43.7%) said the same. Parents of school-aged children (54.1%) are slightly more likely than other travelers (49.3%) to report having any trips planned for the remainder of the summer season.

American Travelers’ Financial Outlook Remains Steady

- As we head into the latter half of Summer and begin to think about the Fall travel outlook, fortunately, this month sees a continuation of last month’s trend of a stable financial outlook for American travelers. There was a nominal upward shift in the share of American travelers who said their current household finances have gotten better compared to a year ago (+2.0-point increase vs. last month), which is also a slight improvement when we look at data from the same time last year (+1.6-point increase). But overall, we continue to see minimal movement on that front. In terms of American travelers’ expectations around their future finances, the data tells a similar story. There was a slightly notable increase compared to last month in the number of Americans who expect their finances to improve in the next year (+2.8-point increase), as well as compared to the same period in 2023 (+1.9-point increase), but no significant swings in sentiment. This overall financial placidity among American travelers is also reflected in the continued plateau we see in the share of those who reported financial deterrents to their leisure travel in the past six months. Gen Z continues to be the most impacted by perceptions around travel being too expensive. Concerns about flight cancellations have also dropped compared to last summer.

- As is to be expected, given that the financial outlook tends to be reflected in travel sentiment, there has also been minimal movement in the past few months in terms of how Americans feel about travel spending. The share of American travelers who said that now is a good or very good time to spend on travel has not seen significant month-over-month movement since the beginning of the year, with just a -0.7-percentage point drop compared to last month. Next 12-month expectations for travel volume continue to hover at just over one-quarter of Americans who say they will travel more (28.8%, +0.9 points above last month). A slightly higher three in ten American travelers expect to spend more on travel in the next year (31.2%), a meager -0.8 percentage point decrease compared to the previous month. That being said, there was a more significant drop in the share of American travelers who said leisure travel will be a high budget priority in the next three months (58.3%, -3.8 points below last month), though this is still +3.8 points higher than the same time last year.

Hispanic/Latino American Travelers are Spending More on Travel

- This month, we’re double-clicking into travel sentiment among Hispanic/Latino Travelers. Financially, this traveler segment is in slightly better shape than overall American travelers, with four in ten (39.9%) saying they are better off now than they were a year ago (compared to 32.5% of total American travelers). They are even more optimistic about their future finances, with two-thirds (65.4%) saying they anticipate their finances to improve in the next year, significantly higher than the 49.1 percent of overall American travelers who said the same. They are also slightly more likely to say that travel will be a high-budget priority for them in the near term (63.1% of Hispanic/Latino travelers vs. 58.3% of overall American travelers).

- This financial robustness is already translating into more travel spending among Hispanic/Latino travelers, who reported spending $1,925 on average in their most recent overnight trip, compared to the $1,320 reported by overall American travelers. The average number of people covered by this spending was 2.2 persons for Hispanic/Latino travelers, only slightly more than the 2.0 persons covered by the spending reported by overall American travelers. Hispanic/Latino travelers are more likely to have taken this most recent overnight trip outside of the U.S., with one in five (20.1%) saying they left the country for that trip (+7.4 points more than total American travelers).

- In terms of where they can be reached, Hispanic/Latino travelers are much more likely to have used Instagram (42.7% of Hispanic/Latino travelers, +20.0 points higher than overall American travelers), YouTube (39.3%, +12.4 points), and/or TikTok (34.4%, +19.1 points) to plan their travels in the past year. They are also much more likely to regularly watch programming on the ad-free tiers of Netflix (60.2%, +17.5 points), Disney+ (32.6%, +10.1 points), and/or HBO Max (29.9%, +9.1 points).

As Road Trips Still Dominate Trip Volume, Safety and Infrastructure are Top Concerns for High-Tech Cars

- On their most recent trip, 72.1% of American travelers traveled by car to the destination(s) of their trip. In comparison, 30.4% traveled via airplane and 4.4% by train.

- We asked American travelers this month to share their thoughts on high-tech cars, including self-driving vehicles and electric vehicles, as well as their plans around road trips for this summer. Interestingly, nearly one in three (31.6%) Americans said that they find self-driving vehicles to be a somewhat or very attractive personal transportation option. But this was dwarfed by the 50.9 percent who said that they find these autonomous automobiles to be somewhat or very unattractive. Self-driving cars fare even worse when directly compared to traditional vehicles, with just 25.8 percent of American travelers saying they find self-driving cars more attractive, while 52.4 percent said they are less attractive. The driving factors behind these perceptions are primarily issues around safety (81.8%) as well as concerns about not being able to personally control the vehicle (69.1%). Among American travelers who rated self-driving vehicles as more attractive, this was mostly due to the ability to multitask or relax instead of driving (47.3%), although notably a similar share (45.9%) said they feel these cars are actually safer than traditional vehicles. This demonstrates that there are currently two camps dividing American travelers – one that feels self-driving cars are safer, and the other that cars are safer with a human at the wheel.

- This month’s survey also included questions about the type of vehicles that American travelers own or lease, with the vast majority (84.0%) saying they have a traditional gas-fueled car, while 12.4 percent have a hybrid, and just 5.0 percent said they have a fully electric vehicle. Among those who have an EV, three in five (74.5%) said they have used their EV to take a trip more than 50 miles away from home. The majority (70.5%) also said they would be comfortable taking their electric vehicle on a road trip of 300 miles or more from home. Among those who said they would not be extremely comfortable doing so, the main issues were the time-consuming nature of charging (48.0%), as well as related anxieties around running out of battery power (43.6%), and/or limited or inconvenient charging infrastructure (40.0%). In the coming weeks, Future Partners will be doing a deeper dive into these EV drivers and the American road trip on our blog, including a comparison to last summer’s data, so stay tuned!

For the complete set of findings, including historic data and custom information on your destination or business, purchase a subscription to The State of the American Traveler study.

Sign up for the next livestream below.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.