IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency. Every week since March 15, 2020, Destination Analysts has surveyed 1,200+ American travelers about their thoughts, feelings, perceptions and behaviors surrounding travel in the wake of the coronavirus pandemic, and explored a variety of topics. The findings presented below represent data collected April 16-18th.

Key Findings to Know:

- Although coronavirus cases are rising in nearly half of the U.S., Americans’ COVID anxiety grew only mildly. Even in the Midwest, which is particularly affected by the latest growth in cases, levels of COVID concern remained relatively stable; in fact, it is those in the Northeast who continue to exhibit the highest levels of COVID concerns.

- Ongoing vaccinations combined with optimism about the future have contributed to another week of record setting in travel readiness and safety. Americans’ confidence in their ability to travel safely reached a pandemic record, as did the perception of travel activities as safe. Now 72% say they are in a ready-to-travel mindset—up nearly 20 percentage points since the start of the year.

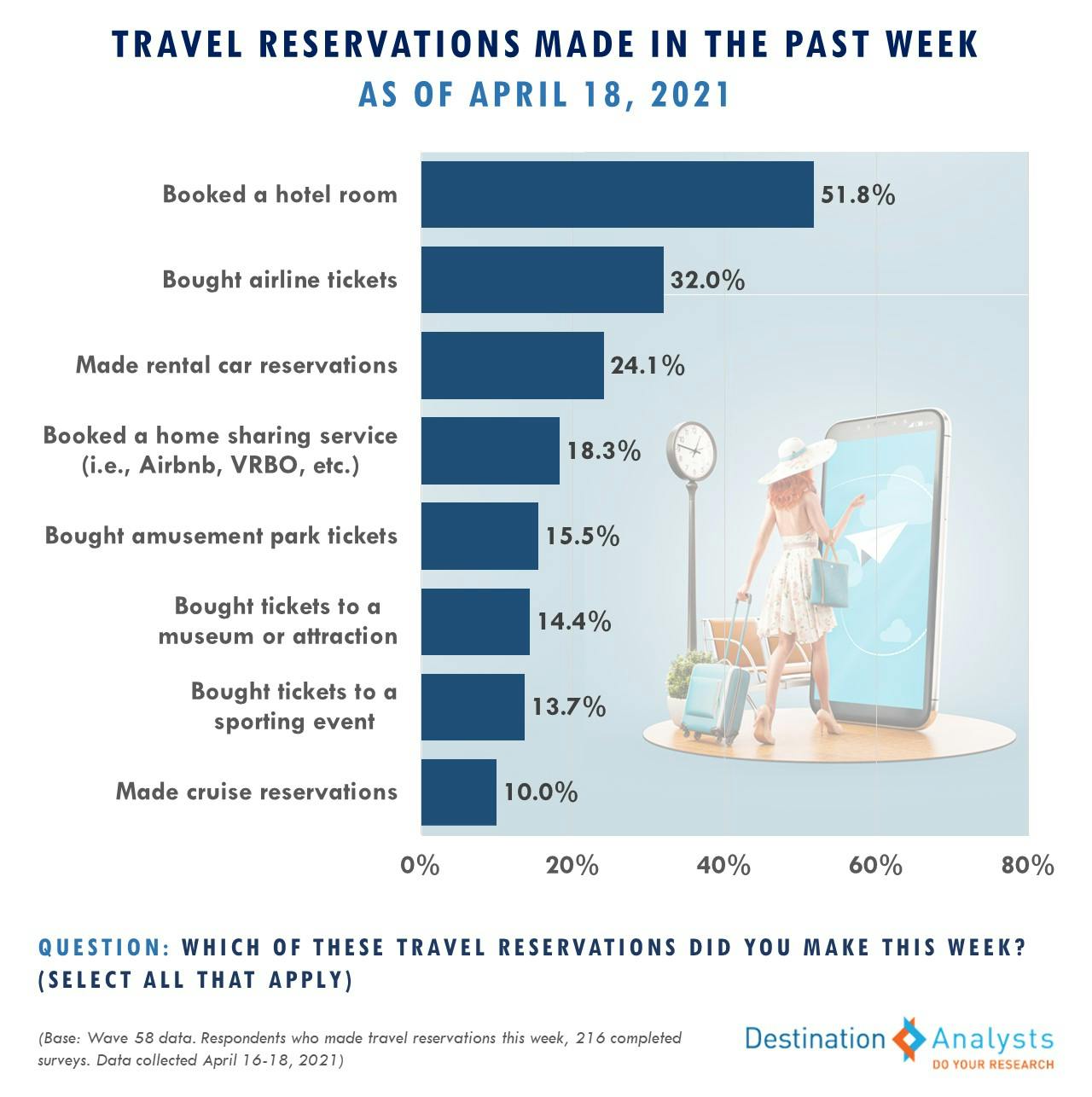

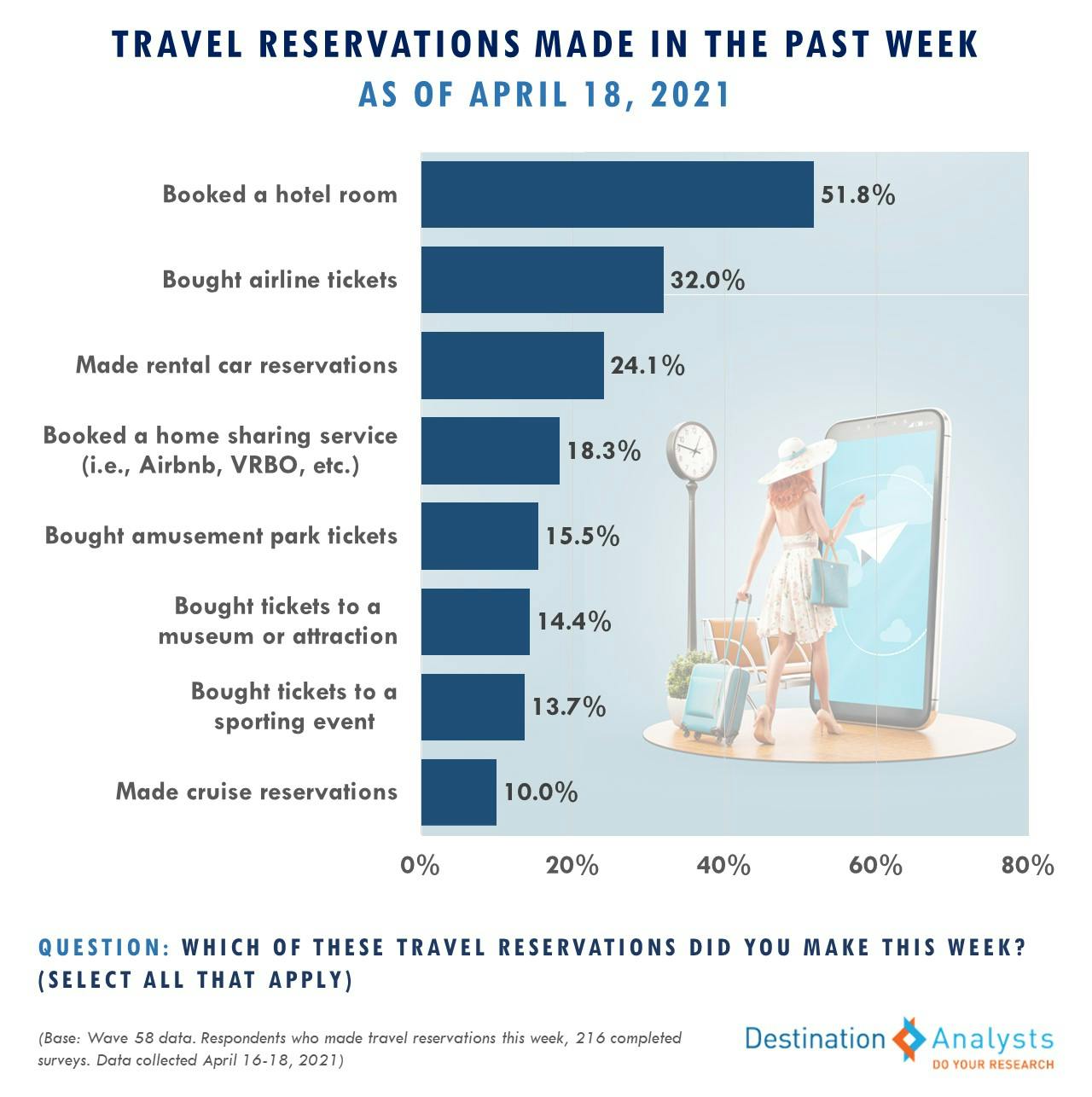

- Three-quarters of American travelers did some travel planning and dreaming in the past week alone, with 16.4% actually making a reservation or booking. Of these bookers, over half made a hotel reservation, nearly a fifth reserved a vacation home/Airbnb and a third bought airline tickets.

- Over 75% of American travelers will take at least one trip in the next 3 months, and a record 88% have at least tentative travel plans for the future.

- Americans are also showing that they are open to even more travel beyond what they may currently have planned. Nearly two-thirds have a high excitement level about the prospect of a trip they had not previously considered, and similarly 63.4% are highly open to travel inspiration right now.

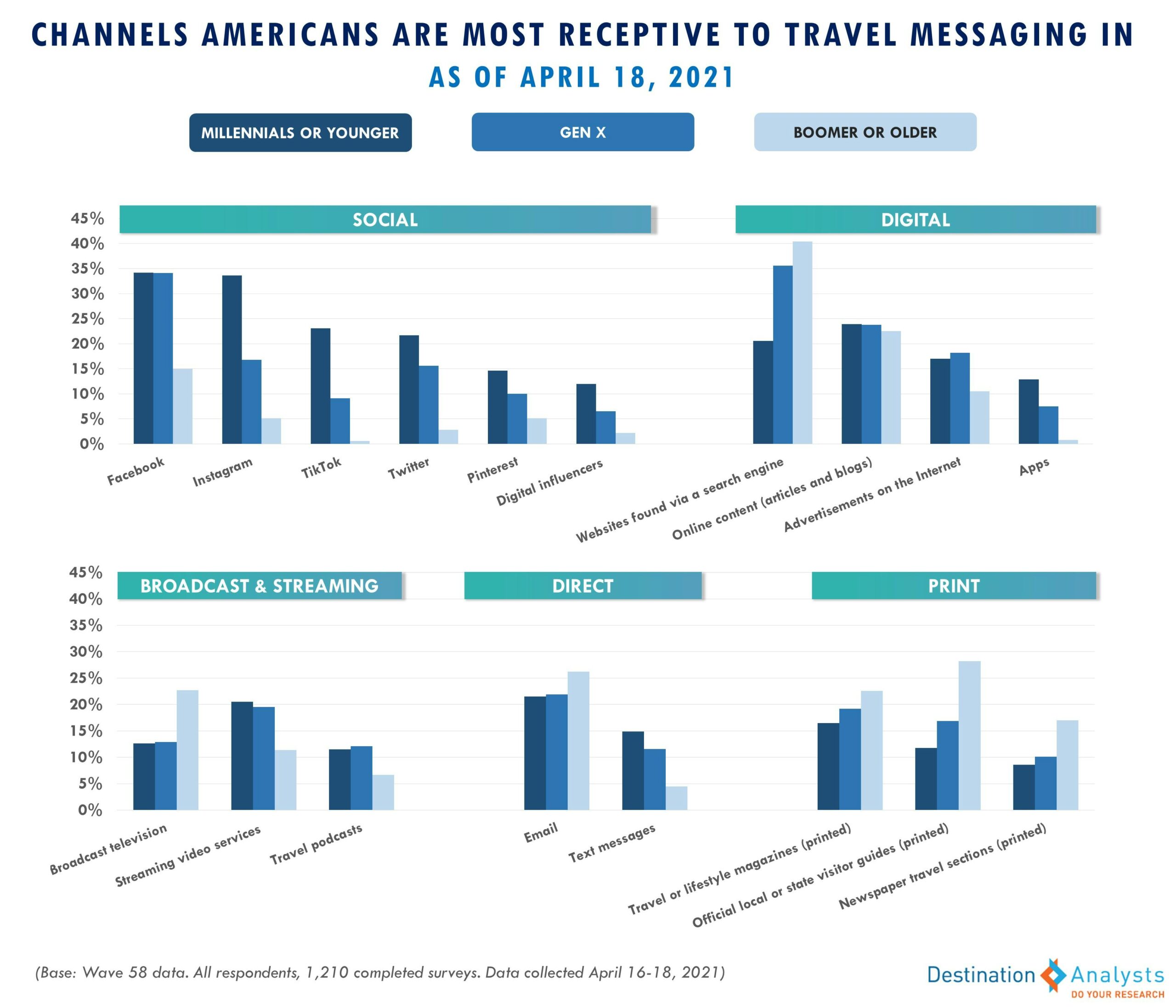

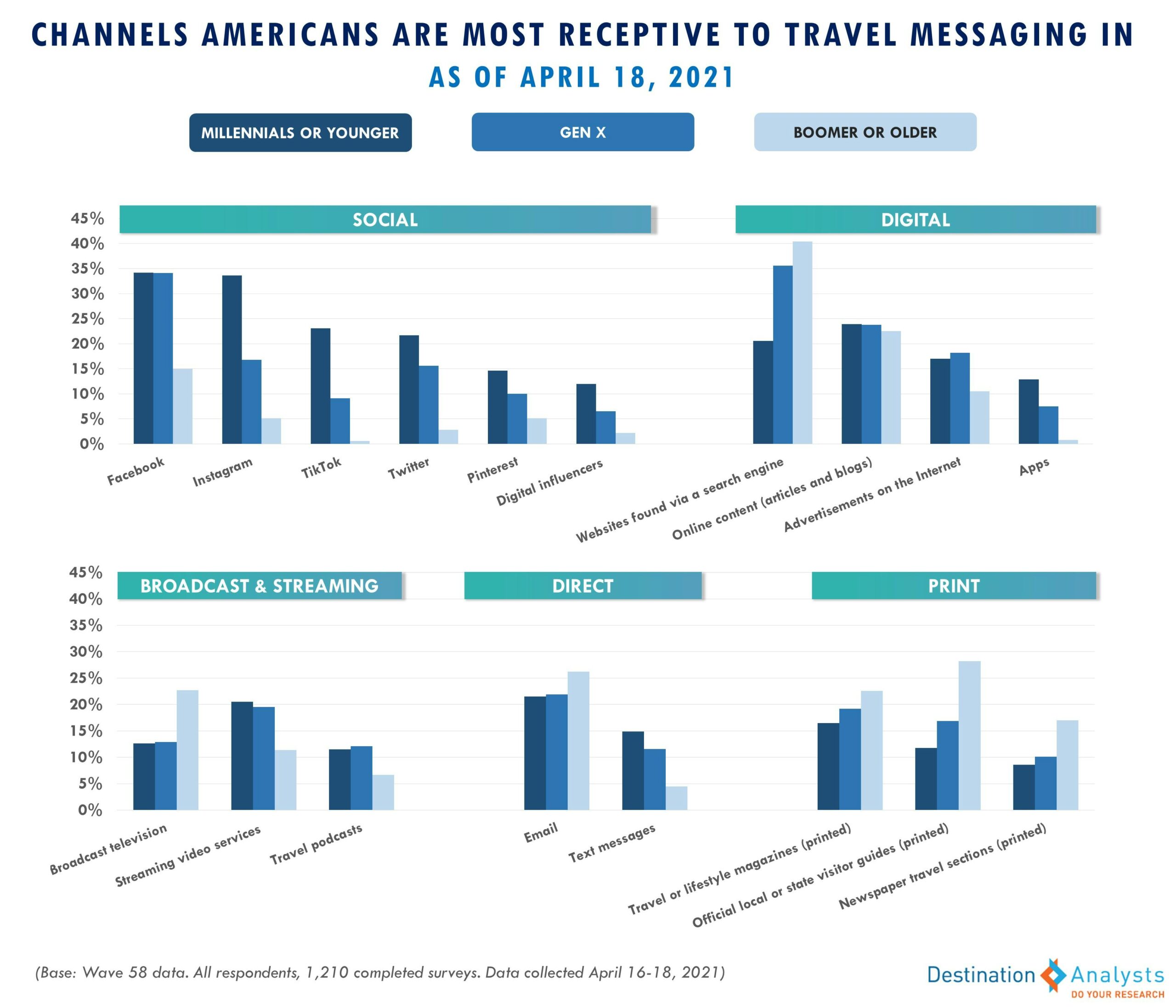

- For travel marketers to reach and capitalize on the high rates of excitement and openness to inspiration, fortunately, American travelers are showing a receptiveness to travel messaging in a variety of channels, including social, print, streaming and direct. TikTok, a rising star throughout the pandemic, is growing as a channel for travel influence, with nearly a quarter of younger travelers saying it is an ideal place to reach them.

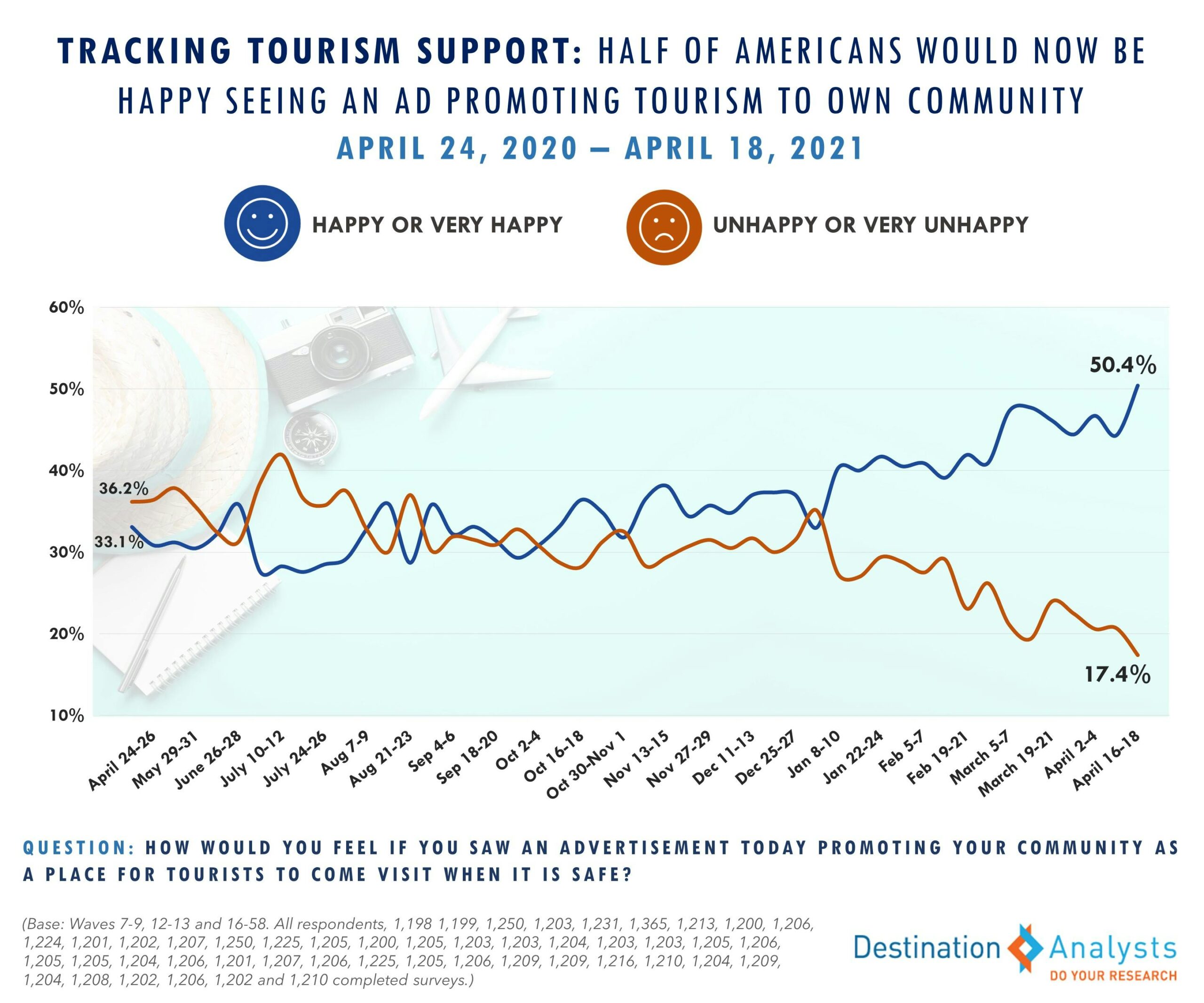

- Americans are demonstrating increased happiness on seeing their own communities advertised for tourism, reflecting a larger trend in support of travel.

- Well over half of those who took a road trip in the pandemic era say their experience has made travel by car more appealing—a sentiment that is even stronger among Millennial and younger travelers. The road trip is likely to sustain its popularity as travel recovers.

- There continues to be more good news about still-slow-but-recovering business travel. Now 56% of those employed by companies in which there is business travel say that this travel has resumed, up 8 percentage points from last month. Perhaps most importantly, the extent of the perceived lasting changes to business travel appears to be retreating.

Although coronavirus cases are rising in nearly half of the U.S., Americans’ COVID anxiety grew only mildly. Even in the Midwest, which is particularly affected by the latest growth in cases, levels of COVID concern remained relatively stable; in fact, it is those in the Northeast who continue to exhibit the highest levels of COVID concerns. Also, despite the pause in Johnson & Johnson vaccine administration, two-thirds of American travelers still say they have or plan to get a COVID-19 vaccine. Of those who report receiving a vaccine, over 70% say they are now fully vaccinated. This combined with optimism about the future (47.6% feel that the pandemic situation will improve in the next month) have contributed to another week of record setting in travel readiness and safety. Americans’ confidence in their ability to travel safely reached a pandemic record, as did the perception of travel activities as safe. Now 72% say they are in a ready-to-travel mindset—up nearly 20 percentage points since the start of the year.

The growth in a readiness mindset has led to an increase in the dreaming, planning, booking—and actual doing of —travel. Three-quarters of American travelers did some travel planning and dreaming in the past week alone, with 16.4% actually making a reservation or booking. Of these bookers, over half made a hotel reservation, nearly a fifth reserved a vacation home/Airbnb and a third bought airline tickets. Over 75% of American travelers will take at least one trip in the next 3 months, and a record 88% have at least tentative travel plans for the future. Americans are also showing that they are open to even more travel beyond what they may currently have planned. Nearly two-thirds have a high excitement level about the prospect of a trip they had not previously considered, and similarly 63.4% are highly open to travel inspiration right now.

For travel marketers to reach and capitalize on the high rates of excitement and openness to inspiration, fortunately, American travelers are showing a receptiveness to travel messaging in a variety of channels. However, save for email and online articles/blogs, desired channels for travel content and advertising are highly impacted by age. Social media is most common for younger travelers, who are open to travel messaging on a variety of these platforms, while older travelers remain largely committed to Facebook. TikTok, a rising star throughout the pandemic, is growing as a channel for travel influence, with nearly a quarter of younger travelers saying it is an ideal place to reach them, surpassing Twitter. Television remains a top source to reach travelers, with younger travelers on streaming services and older travelers on broadcast. Search engine marketing also remains key for travel marketing, particularly to reach older travelers. An important proportion of travelers—even the younger ones—are looking to print resources like travel & lifestyle magazines, as well.

Americans are even demonstrating increased happiness on seeing their own communities advertised for tourism, reflecting a larger trend in support of travel. This week, a record 50.4% said they would feel happy if they saw an ad promoting where they live as a place for tourists to come visit. Conversely, a record-low 39.5% said they aren’t ready for tourists in their community yet.

As we continue to study the ongoing and lingering effects of the coronavirus pandemic on travel attitudes and behaviors, this week we looked at whether and how road trips—the archetype of travel in the COVID era—would sustain its level of popularity. Two-thirds of American travelers road tripped during the pandemic, taking 2.5 of these trips on average. Over 62% of these pandemic-era road trippers agreed that this travel reminded them of how much fun road trips can be. Thus, well over half also say their pandemic road trip experiences have made travel by car more appealing. Interestingly, this sentiment was even stronger among Millennial and younger travelers, 60.5% of whom said that travel by car is now more appealing.

Finally, there continues to be more good news about still-slow-but-recovering business travel. Now 56% of those employed by companies in which there is business travel say that this travel has resumed, up 8 percentage points from last month. Perhaps most importantly, the extent of the perceived lasting changes to business travel appears to be retreating. Somewhat fewer business travelers report that the pandemic will change the way their employer does business travel (47% down from 50% in March). The ways business travelers expect changes are also largely down from last month, with less feeling there will be fewer business trips taken and the replacing of trips with virtual meetings.

For the complete set of findings, including historic data and custom information on your destination or business, purchase a subscription to The State of the American Traveler study.

Sign up for the next livestream below.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.