IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted, or influenced by any advertising or marketing agency. The key findings presented below represent data from over 4,000 American travelers collected in August 2023 by Future Partners (formerly Destination Analysts).

Travel Deterrents & Financial Sentiment

The current travel sentiment index dips to its lowest level in 2023. Travel deterrents continue to rise including travel being too expensive (46.3%) and airfare costs (29.2%). These deterrents have kept Americans from traveling more than they would have preferred in the last 6 months. When asked if their household’s financial status is worse or better off than one year ago, 27.3% now say it is better, but that is a 3 percentage point decrease compared to last month. When it comes to travel spending, fewer feel that now is a good time to spend their dollars on leisure trips. Currently, one-in-four Americans say now is a good time to spend on travel, which is down 5 points from two months ago and is the lowest this metric has been in 2023. Still, half (50.8%) of Americans say travel is a high-budget priority for them in the next 3 months, but this metric has also been on the decline sitting at its lowest level in 2023, dropping 6 points since the start of the year.

Recent Travel Behavior

When asked about overnight trips taken in the past month, 44.3% of Americans said they had taken such a trip for leisure in that time frame. On their most recent overnight leisure trip, the top reasons that factored into their decision to take the trip included relaxation (52.7%), visiting friends/relatives (51.6%), and escaping the stress of daily life (39.3%). Secondary factors included self-care (24.4%), enjoying the outdoors (24.2%), and exploration (21.1%). As for the specific travel activities that also factored into their decision to take their most recent overnight trip, dining in restaurants was by far the top (43.6%) followed distantly by shopping (26.7%), outdoor activities (24.1%) and ‘doing it for the gram’ as the kids say with 18.6% saying taking pictures or videos for their social media posts was a decision making factor.

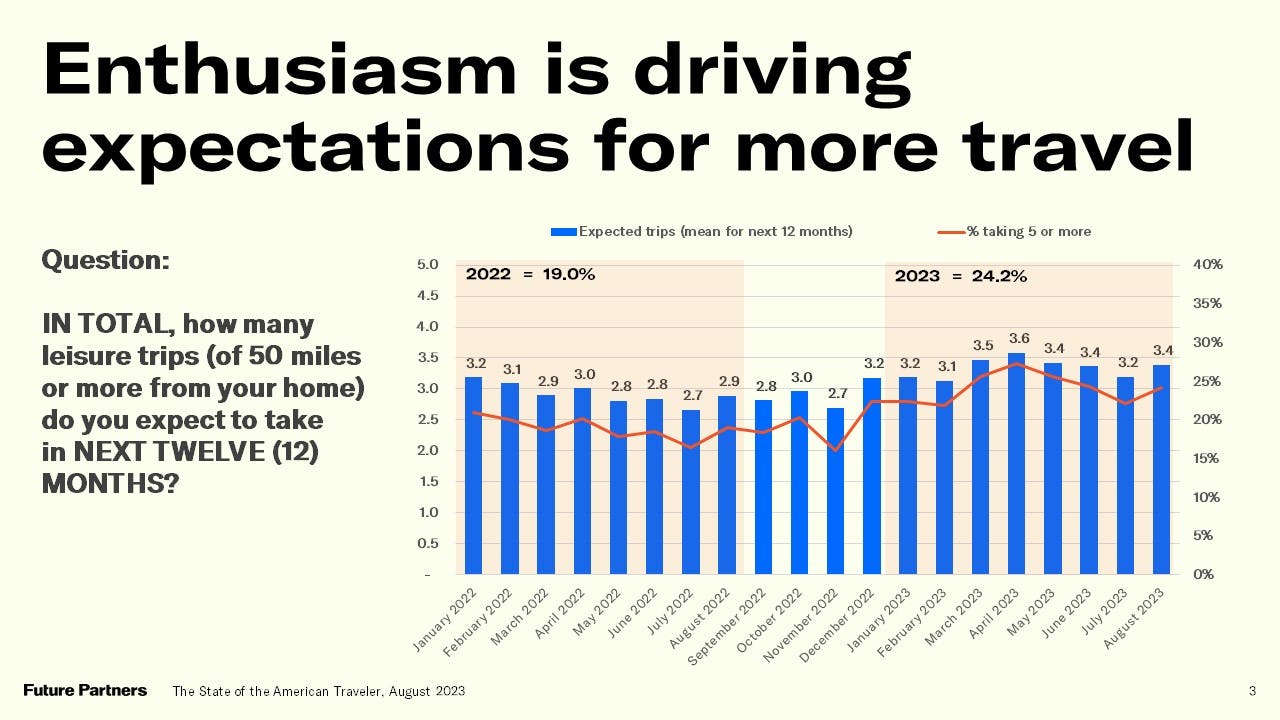

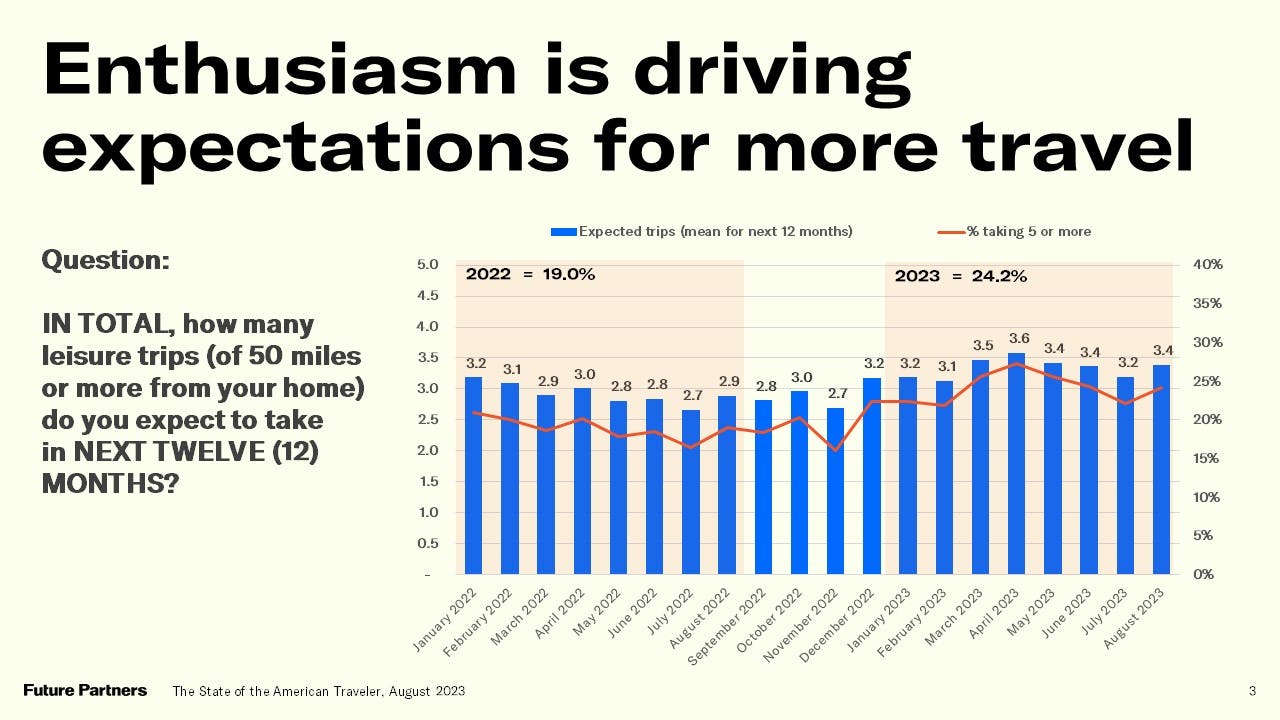

Future Travel Outlook

Despite increased concerns about their financial wellness and continued inflationary worries, American’s excitement for travel still holds strong. The vast majority of travelers (86.3%) still express high levels of excitement to travel in the next 12 months. When asked which months they expect to take upcoming leisure trips, well over a quarter of the American traveling population plans to venture out in September (27.4%), October (28.8%), November (26.1%) and December (27.6%). As for the trip types Americans are most excited to take, family trips garner the most excitement (63.7%) followed by romantic getaways (51.1%), girlfriend trips (36.2%) and solo trips (35.4%). When asked what domestic destinations they most want to visit in the next 12 months, on the city level Las Vegas, Chicago, Miami, Los Angeles, Nashville and New Orleans were top mentions.

For the complete set of findings, including historic data and custom information on your destination or business, purchase a subscription to The State of the American Traveler study.

Sign up for the next livestream below.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.