IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted, or influenced by any advertising or marketing agency. The key findings presented below represent data from over 4,000 American travelers collected in February 2024.

The Travel Outlook

Expectations of a recession happening in the next six months continue to dwindle. This February marks the fourth consecutive month of a decrease in the percentage of American travelers who agree or strongly agree that they expect the U.S. will enter an economic recession in the near term (41.8%). In a continued trend from last month, Gen Z and Millennial travelers are more likely than their older counterparts to expect a recession but are more optimistic about their current and future personal financial situations. Nearly two-thirds of Millennial travelers (62.6%) even say that leisure travel will be a high or extremely high priority for them in the next three months. The average maximum 12-month leisure travel budget has dropped below $4,000 this month, for the first time since October 2023, but the average budget for travelers in the West ($4,494) and Northeast ($4,378) are still well above that mark, and among the generations Baby Boomers still claim the highest average 12-month travel budgets at $4,712.

Travel in general being too expensive is the most cited reason Americans did not travel more in the last six months (35.9%), up slightly from last month’s 34.7% (+1.2pp). Personal finances dropped down to the second-most cited deterrent at 35.1% of American travelers (-2.2pp compared to last month). Gasoline prices have plateaued as a travel deterrent, holding at 24.3 percent (-0.3pp compared to last month). Travelers in the West region of the U.S. were notably more likely than other regions to cite travel prices (41.3%) and/or gasoline prices (29.3%) as deterrents to recent travel. Gen Z travelers are also the most price-sensitive, with more than half citing travel prices being too high (51.5%) and more than one-third citing expensive gasoline prices (35.4%). Interestingly, over one quarter of Gen Z travelers said that not having enough PTO/vacation time (24.7%) was a deterrent to traveling more in the last six months.

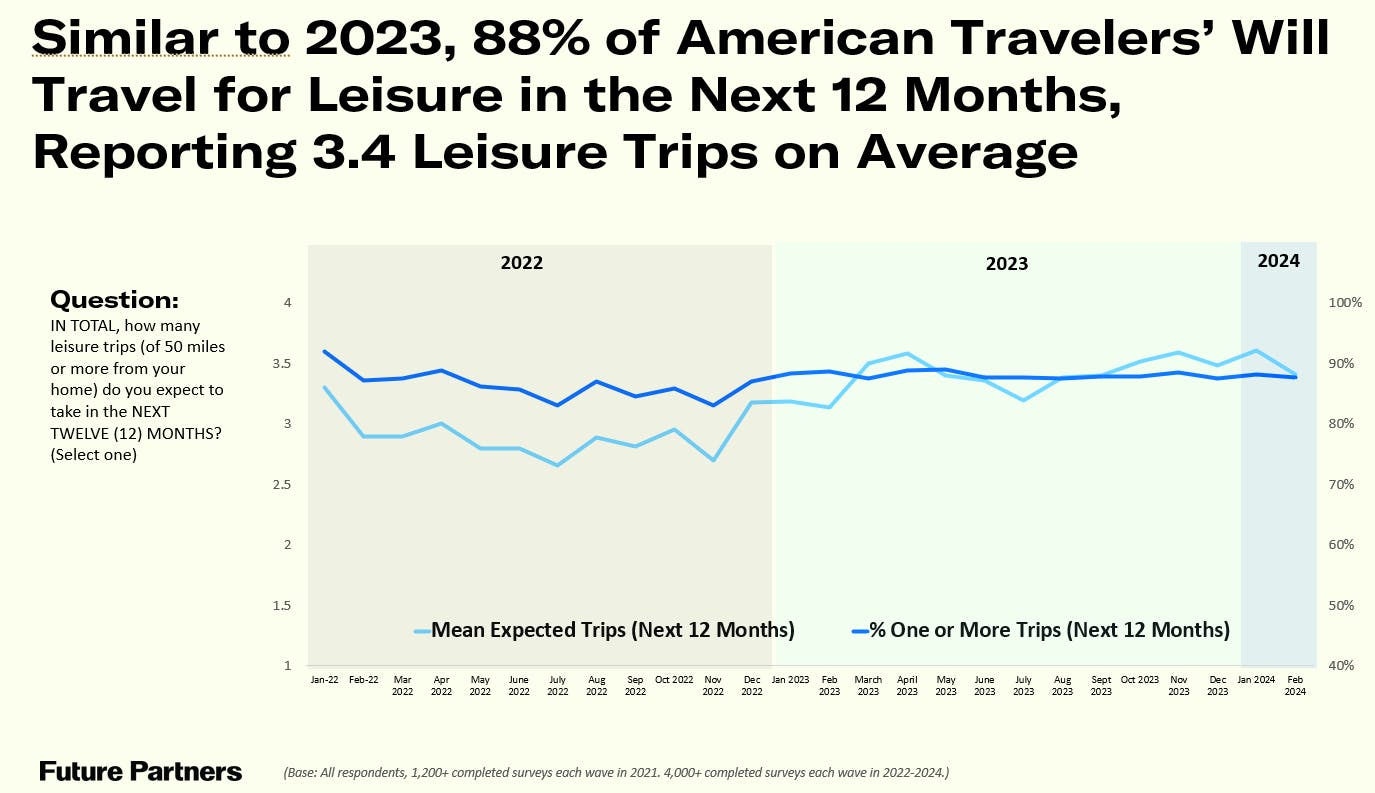

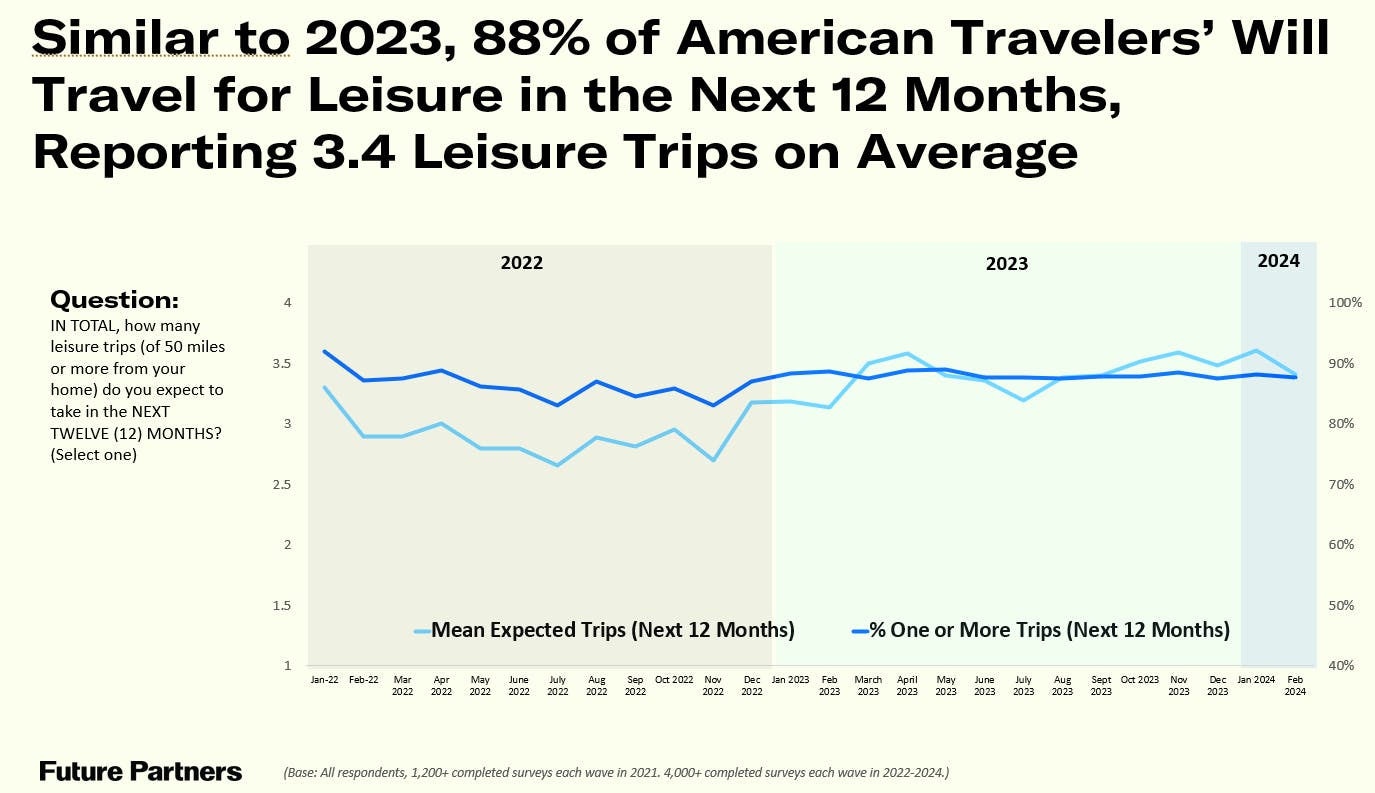

We continue to see robust travel volume with 59.1% of American travelers reporting they took an overnight trip in the past month – up 3.7 points from last month and a healthy 10.8 points from February 2023. Excitement for travel continues to maintain the high levels we have been seeing over the last year, at 8.0 on a scale from 0-10. American travelers anticipate an average of 3.4 leisure trips in the next 12 months, up slightly from the average of 3.1 trips in February 2023.

Travelers’ Media Consumption: Spotlight on Streaming Services & Podcasts

As streaming services continue to tweak their subscription tiers, 2024 will be an interesting year to keep an eye out for any changes in which – and how many – streaming services American travelers are willing to keep paying for. Currently, Amazon Prime Video is the most commonly reported subscription (53.4%), but the recent introduction of ads to the platform may impact this. Disney+, which currently holds third place (35.8% of American travelers currently subscribe or regularly watch), also introduced new ad-supported and ad-free options, as well as made a recent crackdown on password sharing outside of the household. Thus we may potentially see other shifts in Disney+ usage among American travelers.

Likewise, the podcast landscape will be undergoing some changes in the next month, as Google Podcasts gets ready to phase out in favor of Google’s YouTube Music platform. Currently, YouTube already holds the top spot (48.6%) as the podcast service most American travelers who listen to podcasts use to tune in to their programs of choice. As of February 2024, Google Podcasts claims 14.6% of podcast-listening American travelers, so it will be interesting to see how that share is redistributed among other podcast streaming services in the coming months.

Shifts in the Convention Travel Landscape

This month, we asked convention and group meeting travelers (defined as travelers who have taken at least one of these types of trips in the past 12 months) about how their organizations are currently making decisions about convention travel. To start, we asked if convention travelers expect their company will be sending people to travel more, the same, or less for business travel in the next year compared to the last 12 months. While the majority said they expect that people in their company will travel about the same for business (58.2%), over one-in five (21.8%) expect that they will see more or much more business travel in the next year. Notably, this was higher among Gen Z (31.0%) and Millennial (33.5%) convention travelers, which aligns with last month’s The State of the American Traveler analysis on the rise of younger convention attendees.

The decision to travel more for business among younger generations is partly self-driven. Half of Millennial convention travelers (50.1%) say that they decide alone which work-related conventions/conferences they attend, while older generations were more likely to say that their employer makes this decision for them (26.4% of Gen Z, 20.5% of Millennials, 34.3% of Gen X, 30.6% of Baby Boomers). This is key knowledge for destinations looking to attract convention travelers, as Millennials are also the most likely generation to reconsider traveling to a destination for a conference or convention due to a destination’s political issues. In fact, nearly six in ten (57.2%) of Millennial convention travelers agree or strongly agree that they will only travel to a convention if the destination aligns with their personal/political values.

Motivated by Michelin-Stars

This month’s The State of the American Traveler Study also dives into travelers’ awareness of the Michelin restaurant rating system and its role in destination selection. More than half (54.0%) of American travelers are aware of the Michelin restaurant rating system, with travelers in the West (60.1%) and Northeast (56.7%) having greater awareness. Higher income travelers and Asian-American identifying travelers are also significantly more likely to be aware of the Michelin restaurant rating system (69.8% of $200K+ HHI travelers and 68.2% of Asian-American travelers are aware ). When it comes to the impact that Michelin-starred restaurants have on destination selection, among Michelin-aware travelers, 24.5% say that the existence of Michelin-starred restaurants is important or critically important to their destination selection. Those who are Millennial-age (40.2%) and BIPOC (34.1%) are more likely to weigh the importance of Michelin-starred restaurants in their trip decisions. Some of the ways travelers are using the Michelin restaurant rating system include to discover high-quality dining establishments when traveling (23.8%), to stay informed of emerging culinary trends (16.4%) and plan the culinary elements of their trips (14.1%). Millennial-age Michelin-aware travelers are the most likely generation to have taken a trip specifically to dine at a Michelin-starred restaurant (27.7%). On the other side, 44.5% of Boomer age travelers say they are not interested in the Michelin rating program.

April Eclipse Travel

The April 8th eclipse is just around the corner, and one in five American travelers are likely to travel to experience it. Those likely to travel for the event tend to skew Millennial (32.3%), and/or parents of school-aged children (35.7%). While Texas is the most-selected destination among those likely to travel to experience the eclipse, there is significant variance by region. Texas is most-selected among travelers in the West (41.4%), but those living in the other regions are more likely to stick closer to home. Among the South, Texas (42.3%) far outranks other eclipse destinations, while in the Northeast more than half say they would go to New York (51.2%). The Midwest’s top 3 destinations are strictly regional: Indiana (26.5%), Illinois (25.7%), and Ohio (21.0%).

For the complete set of findings, including historic data and custom information on your destination or business, purchase a subscription to The State of the American Traveler study.

Sign up for the next livestream below.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.