IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted, or influenced by any advertising or marketing agency. The key findings presented below represent data from over 4,000 American travelers collected in November 2023 by Future Partners.

Read below for the latest on financial stressors weighing in on the traveler mindset, Americans’ commitment to travel, trip planning window compression, the rise of AI, podcasts and streaming services, and the outlook for the ski season.

Financial Stressors: Debt, Household Cash Flow, Ability to Save and More

- With feelings of economic uncertainty still in the national narrative and heading into an election year, while the majority of American travelers are still feeling optimistic about their financial futures, many express sentiments related to financial stress. Fortunately, 61% believe that they will generally be financially secure in the future and 51% say they expect their household to be better off financially a year from now, which is among the highest this met has been in 2023.

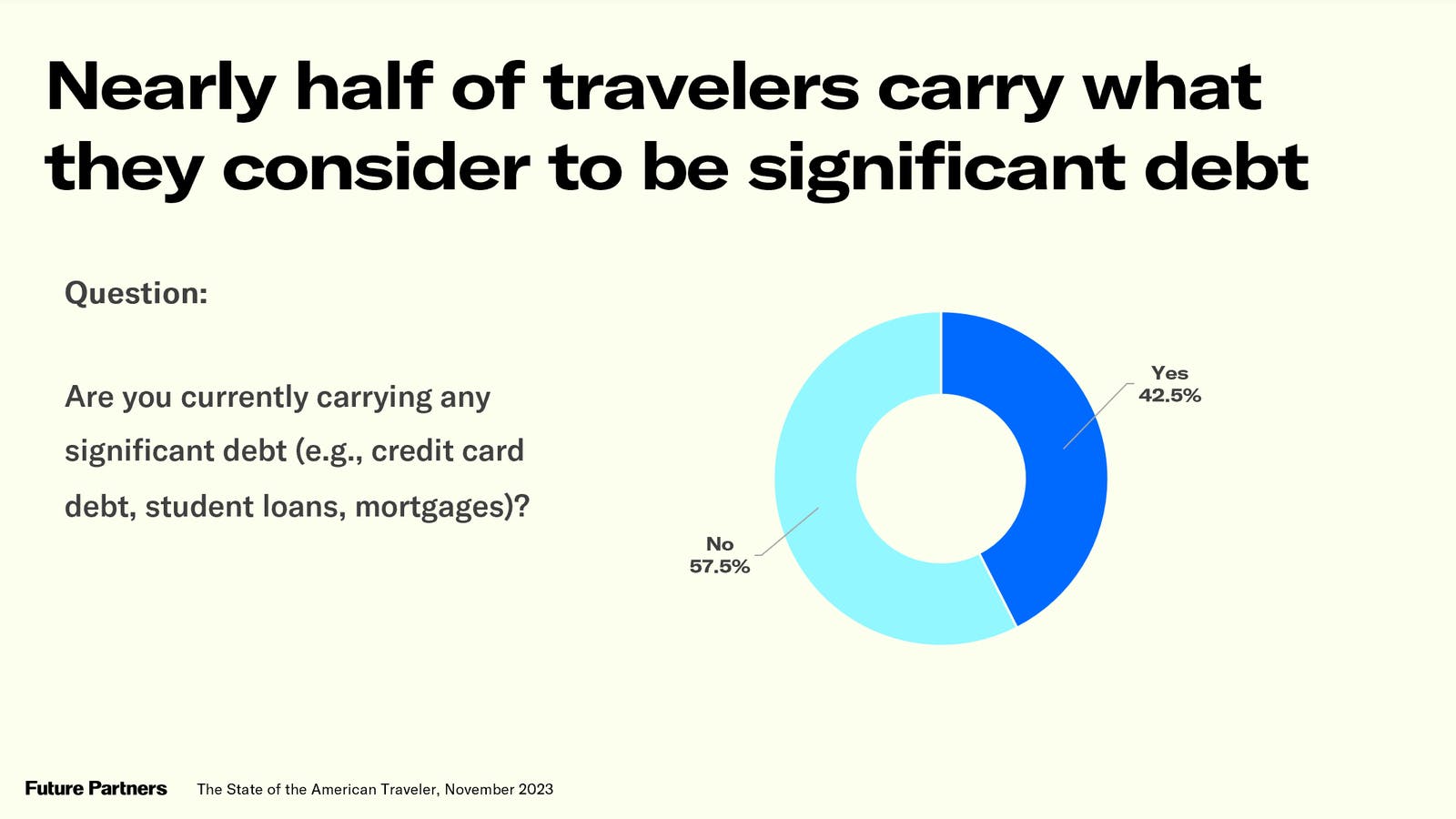

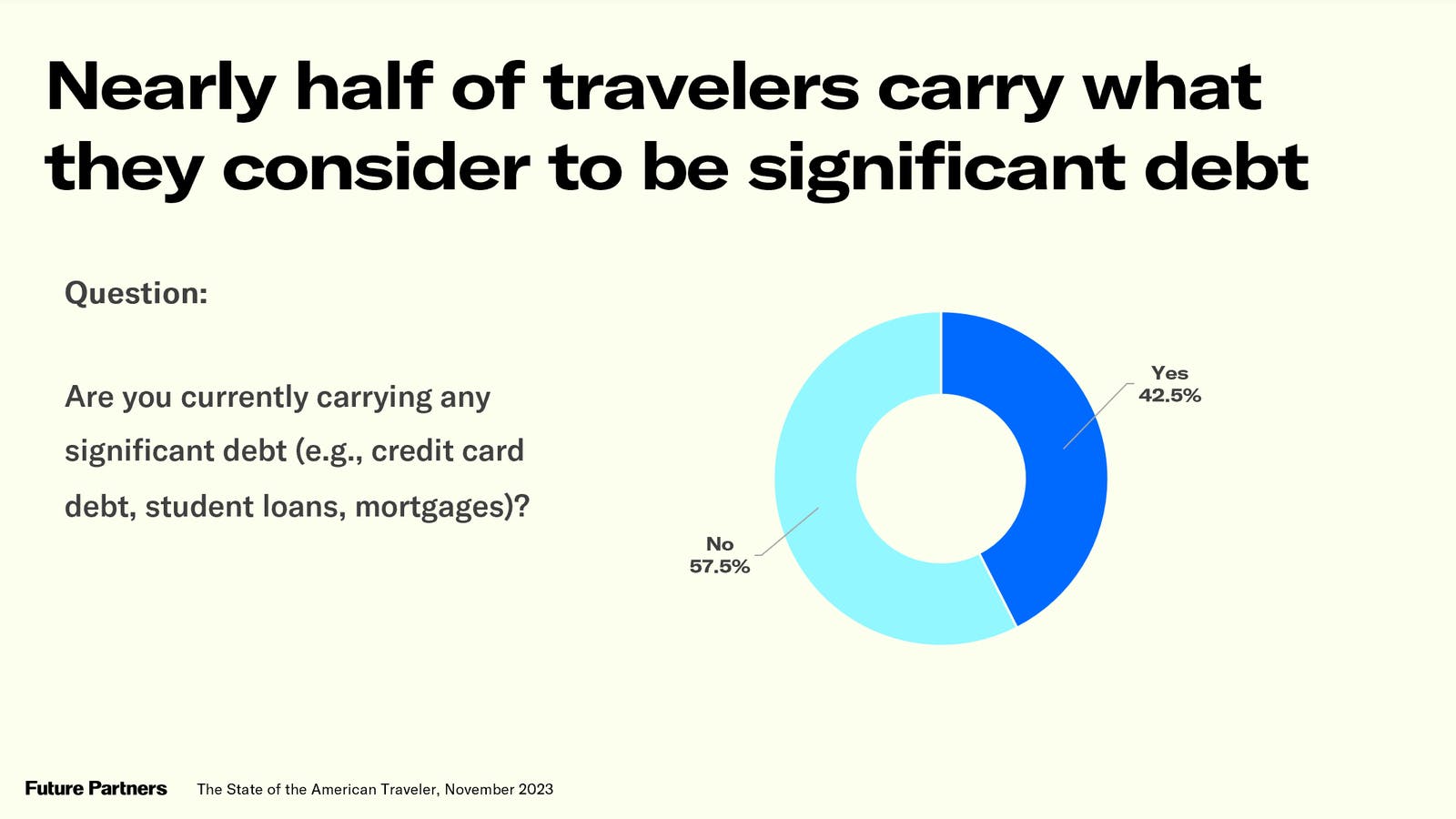

- However, digging further into Americans’ financial sentiments, 43% of travelers say they are currently carrying significant debt (e.g. credit card debt, student loans, mortgages, etc.). This debt reporting is even across Gen Z (45%), Millennials (46%), and Gen X (46%), but notably lower among Baby Boomers (35%). When asked their agreement with the statement “I am living paycheck to paycheck, with little or no ability to save,” 42% of American travelers agreed or strongly agreed. Note, however, that this rate is considerably lower among American travelers compared to the average adult American, 60% of whom report that they are living paycheck to paycheck, according to a report published by LendingClub. As expected, agreement with this statement was highest among Gen Z travelers (51%), however, Millennials (48%) and Gen X (48%) were not too far behind. In comparison, just 29% of Baby Boomer travelers feel they are living paycheck to paycheck.

- As such, half of American travelers say they only set aside 0-10% of their income for savings and/or investment funds. The average American traveler reports putting 20% of their income towards savings and investments. By generation, it appears that younger travelers are saving more of their incomes with Gen Z setting aside an estimated 27% of their income and Millennials setting aside 28% compared to Gen X (16%) and Baby Boomers (14%).

- When asked how much they agree with the statement “I prioritize saving money for the future over enjoying life in the present” just under half of all travelers agreed (47%). However, this varies by generation, with Gen Z being the likeliest to agree with this sentiment at 63%, followed by Millennials at 59% (vs. 41% for Gen X and 36% for Baby Boomers).

Travelers Remain Financially Committed to Travel

- Among American travelers who are indeed saving, travel is a driving force behind this behavior. When asked their reasons for saving money, travel experiences (47%) come in just behind, financial security (57%), retirement (56%), and having an emergency fund (54%). However, these priorities shift for Gen Zers who were likelier to say they are primarily saving for financial security (52%) and saving for major purchases like a car or home (42%)–but also travel (41%).

- When savers were asked about their discretionary spending priorities, domestic travel (36%) is statistically aligned on top with dining out (37%) and clothing (37%). For Baby Boomers, international travel edges out general entertainment as a top spending priority. In looking at high income earners (e.g. those with an annual household income over $200k) their top spending priorities are domestic (48%) and international travel (43%) followed distantly by clothing (34%).

Trip Planning Windows Continue to Decrease, While Use of AI, Podcasts and Streaming Continues to Increase

- Use of AI as a travel planning resource continues to grow with 17% of American travelers now saying they have used AI tools to specifically plan or prepare for trips in the last 12 months (up from 16% last month and 8% in six months ago). ChatGPT remains dominant (cited by 63% of AI-tool using American travelers), with Trip Planner AI (28%) and TripAdvisor’s AI-powered assistant rounding out the top 3.

- Podcast usage amongst American travelers is also on the rise, with 38% of Americans saying they listen to podcasts on a regular basis. This is up 11 points compared to December 2022. The genres American travelers tune into most include health/fitness, pop culture, sports, comedy and news/politics.

- Streaming video services are now among the top resources American travelers cite for getting trip inspiration, along with email campaigns, online content, search engine results, and Facebook, Instagram and TikTok.

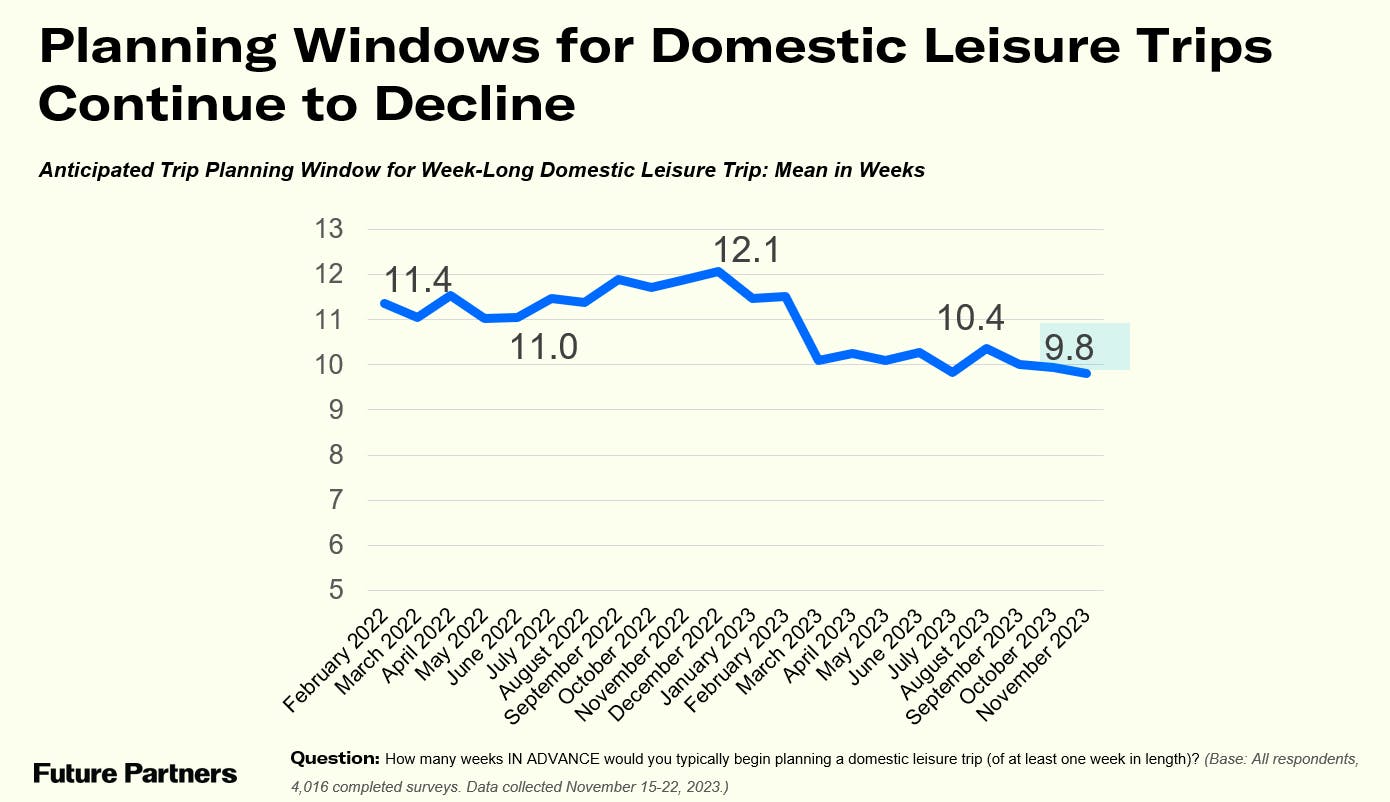

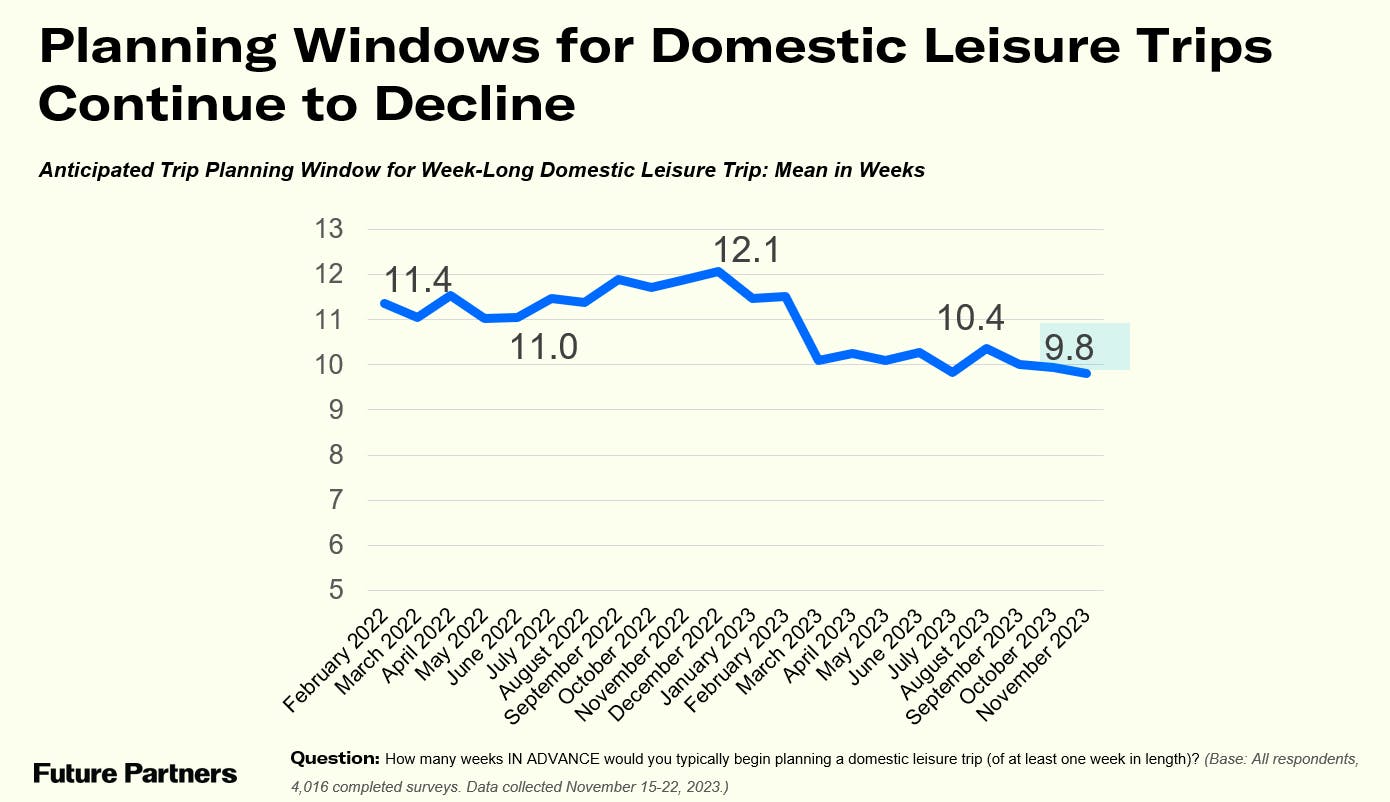

- Trip planning windows continue a pattern of shrinking. On average, American travelers report they would plan a week-long domestic trip just 9.8 weeks in advance, down more than 2 weeks from a year ago.

Strong Outlook for Christmas Trips and Ski Season

- The roads and airports look to be busy this month. Fully one-third of American travelers report they will take a trip for the Christmas holiday this year.

- With winter upon us, we also asked Americans about their outlook for the 2023/24 Ski Season. Among all American travelers, nearly a quarter (24%) say it is likely that they will take an overnight ski or snowboard vacation this season. In terms of timing, December and January look to be the top months travelers plan to take these overnight ski trips.

- When asked which attributes were important to how ski vacation takers select their ski destinations, snow quality (61.1%) tops the list followed by ease of access to the ski resorts (44.1%), off-mountain activities (28.6%) and nightlife (28.3%).

For the complete set of findings, including historic data and custom information on your destination or business, purchase a subscription to The State of the American Traveler study.

Sign up for the next livestream below.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.