IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted, or influenced by any advertising or marketing agency. The key findings presented below represent data from over 4,000 American travelers collected in July 2024.

Travelers’ Financial Outlook Remains Strong Compared to Last Year

Overall, American travelers’ financial outlook remains stable for 2024. This month marks the second consecutive month of a positive trend in the share of American travelers who said their household is better off compared to a year ago. Compared to the relatively lower shares – hovering at 30 percent – early in the second quarter of the year, July (33.9%) saw another incremental increase of +1.4 percentage points compared to June (32.5%). This is a +3.4-percentage point increase against May (30.5%). In addition to one in three American travelers feeling better off financially now, the majority (51.9%) expect to be better off in the future, in another sign of financial optimism. While the outlook on future finances has held relatively strong, never dipping below 45 percent of American travelers in 2024 so far, this month is the first time that this metric has achieved a majority share year-to-date. On a similar note, the share of American travelers who expect the U.S. will enter an economic recession in the next six months (38.6%) is at its lowest point since we began tracking this in September 2022. On the whole, the data suggests a healthy share of American travelers are feeling positive about their financial situations.

The translation of this financial optimism into travel spending, especially as we approach the end of the summer season, is somewhat tempered but holding steady at more positive levels compared to last year. We consistently continue to see one-third of American travelers say that now is a good time to spend on travel (33.8%), which has remained mostly unchanged since seeing an uptick in March of this year. Similarly, well over half (56.8%) of American travelers say that leisure travel will be a high-budget priority for them in the next three months, which continues to hold above the 2023 average (53.9%). American travelers reported an average maximum travel spending of $4,453 for the next 12 months, slightly below the all-time peak of $4,888 reported in March of this year but pacing well above the same time last year ($3,506).

Overnight Leisure Trip Volume Surpasses Summer 2023 Levels

Overnight trip volume is trending upward after being relatively flat throughout most of 2024 so far. While business and convention travel is still just below the previous peak seen in Q4 of 2023, the share of American travelers who took at least one leisure overnight trip is at an all-time high since July 2021. More than half of American travelers (50.9%) took an overnight leisure trip in the past month. Similarly, at 50.6 percent, the majority took an overnight trip to visit friends or relatives in the past month, pointing to a strong summer travel season so far, well above the 2023 summer levels. Looking at the data broken out by generations, Millennial travelers (61.2%) were the most likely to have taken an overnight leisure trip in the past month, followed closely by Gen Z travelers (58.0%). Nearly seven in ten Gen Z travelers (69.5%) reported taking an overnight trip to visit friends and family in the past month. A small majority of Gen X travelers also said they took at least one overnight trip for leisure (51.7%) and/or to visit friends and family (50.5%). On the other hand, Baby Boomer travelers were significantly less likely to say that they took either one of these types of overnight trips in the past month, with just 40.4 percent saying they traveled overnight for leisure, and 38.3 percent reporting an overnight trip to visit friends and family. This suggests that the summer travel volume is being driven largely by younger travelers. Day trips are also looking robust, following similar trends to overnight trips in terms of the highest shares of American travelers reporting a leisure day trip in the past month (53.2%), followed by a day trip to visit friends and relatives (50.7%). Of note, the to-date peak in past-month leisure day trips was recorded in October 2023 (55.1%), so it will be interesting to see how day trips in the upcoming shoulder season shake out compared to last year.

American Travelers’ Destination Consideration and Purchase Sets May be Bigger than You Think

This month, we asked American travelers about the size of their destination consideration set, looking both at the number of destinations they actually visited on their most recent overnight trip as well as the number of destinations they currently have in mind for leisure travel in the next 12 months. In terms of the number of overall destinations Americans have traveled to on their most recent overnight trips, the average was 2.1 destinations, with younger travelers and higher income travelers having a notably higher average. This indicates that American travelers are not just visiting a single destination when they travel overnight. While 53.3 percent did report visiting only 1 destination on this trip, one in five (20.6%) visited at least 2, while over one in four (26.1%) visited 3 or more destinations. Gen Z travelers reported an average of 2.7 destinations visited, with just 31.8 percent saying they only visited 1 destination. Higher income travelers (>$200K) said they visited an average of 2.4 destinations, compared to lower income travelers (<$50K) who reported an average of 1.9 destinations. This suggests that, regardless of demographic markets, American travelers are not just visiting a single destination when they travel overnight.

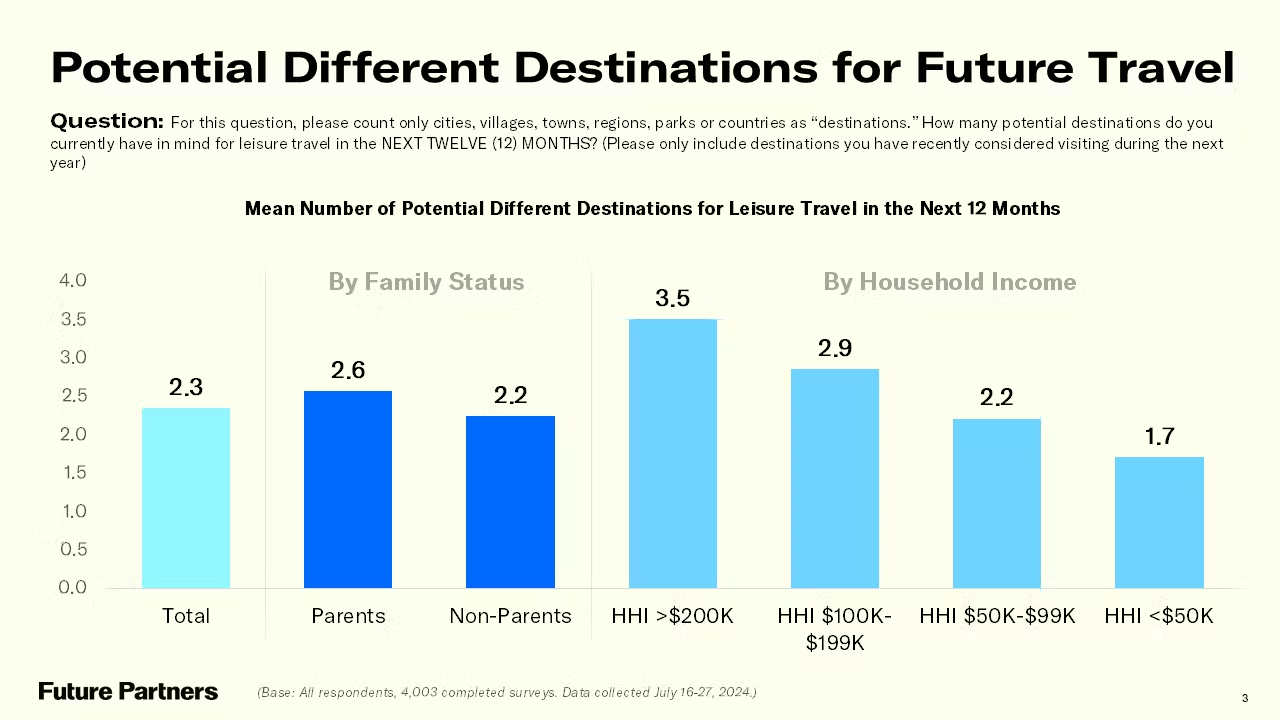

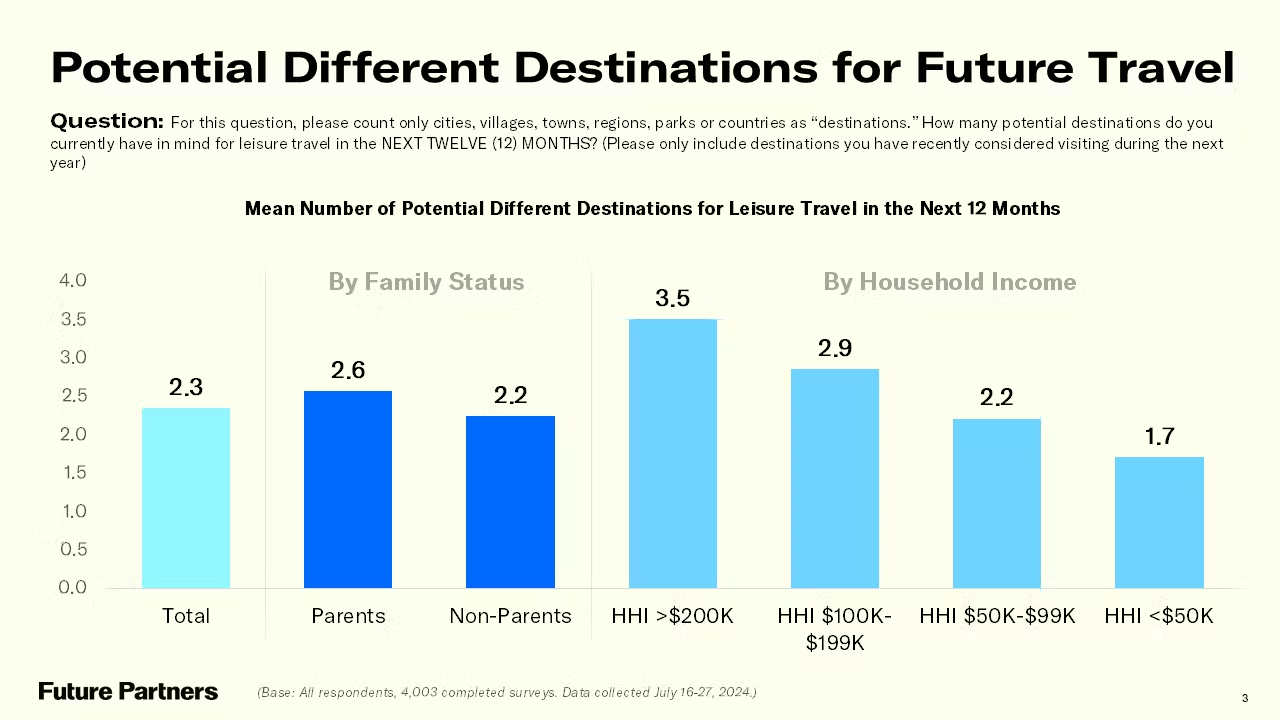

When it comes to the number of destinations they are currently considering for leisure trips in the next year, income bracket and family status are more likely to indicate differences in the size of the consideration set. Higher income travelers are considering an average of 3.5 different leisure destinations for the next 12 months’ travel, while lower income travelers reported an average of 1.7 different destinations in consideration. Though there was a less pronounced difference between travelers who are parents to school-aged children and those who are not, a still notably higher average of 2.6 destinations currently in consideration was reported by parents versus an average of 2.2 destinations for non-parents.

Most American Travelers Avoid Borrowing Money to Cover Travel Costs, But Younger Travelers are Most Likely to Have Done So

Future Partners also did a deep dive into how travelers are financing their travel. In an era where “buy now, pay later” payment options are gaining ground, we wanted to understand how these financial trends are impacting travel. Generally, the majority of American travelers do not need to borrow money to finance their trips, with just 20.2 percent agreeing that they usually need to borrow money that they can’t pay back immediately (e.g., using credit cards or loans). One of the obstacles to doing so seems to be high interest rates, with nearly half of American travelers (48.8%) reporting that interest rates right now are too high for them to be comfortable with borrowing money to finance their trips.

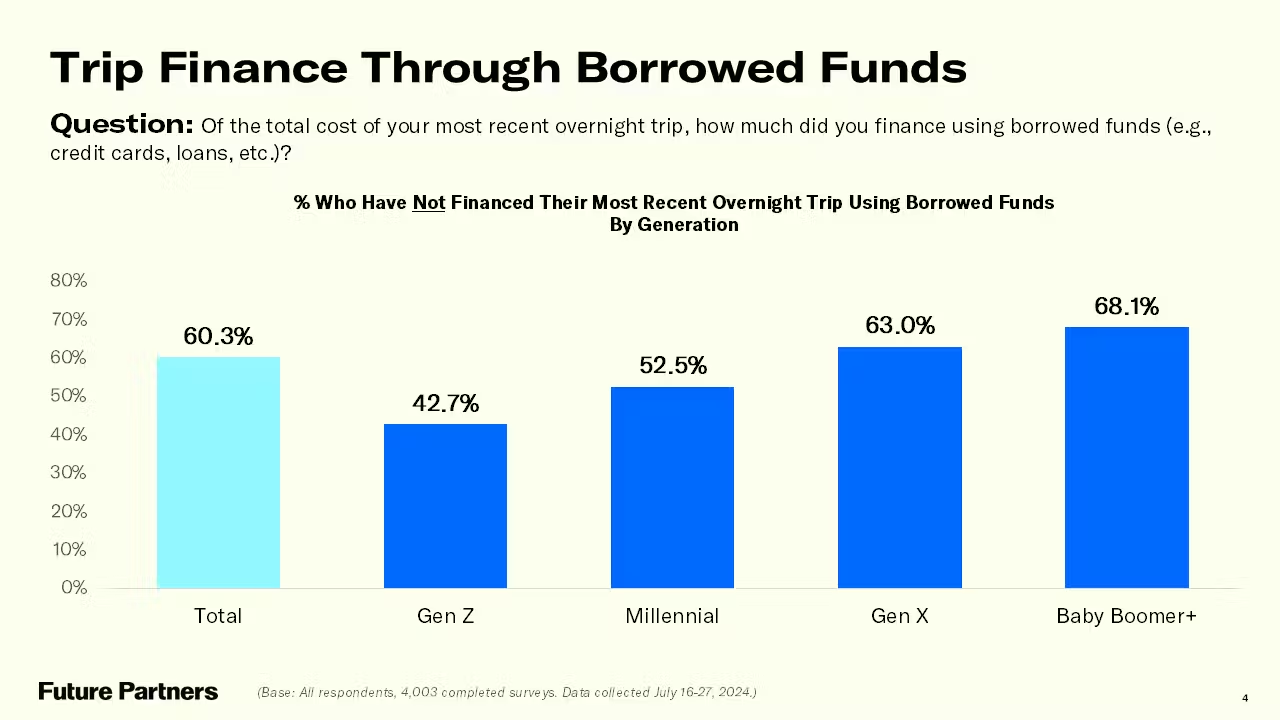

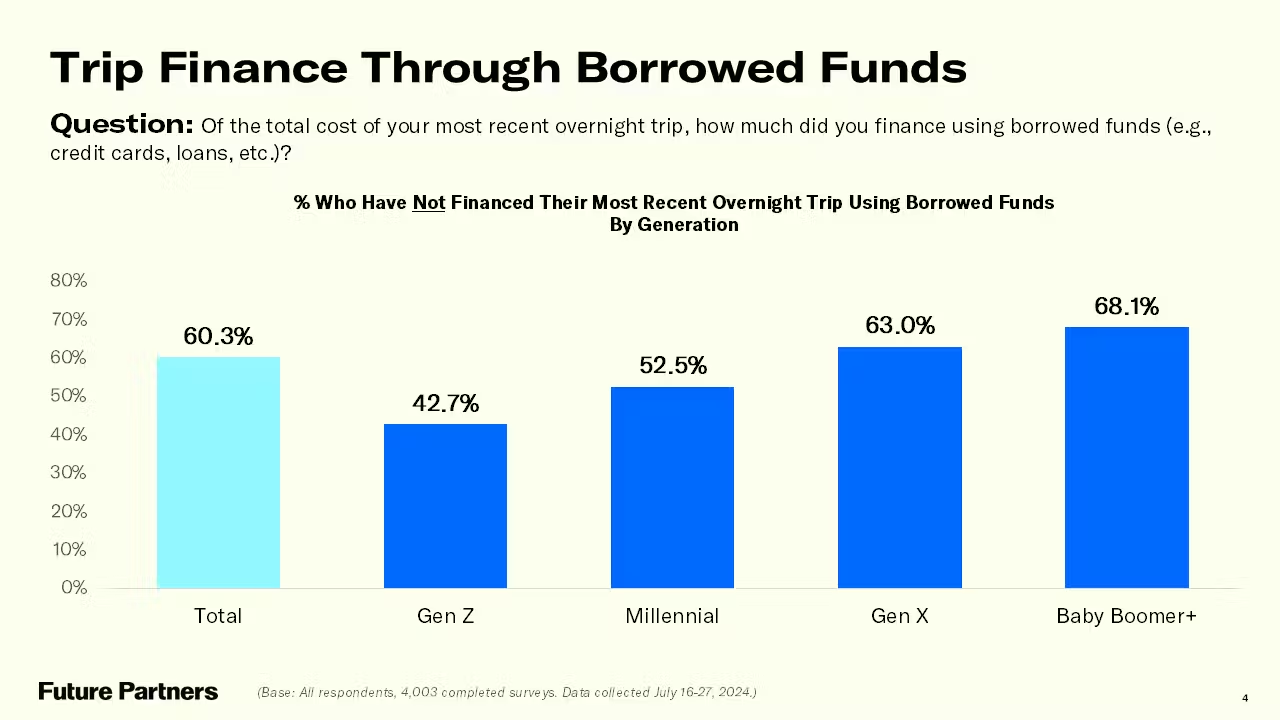

In regards to their most recent overnight trip, the majority (60.3%) did not use any borrowed funds to cover the costs. However, 43.1 percent of Gen Z travelers said they borrowed funds to cover the cost of up to 50 percent of this trip, with the majority (57.3%) saying they borrowed any amount of funds to cover this trip’s cost. Conversely, baby boomer travelers (68.1%) were most likely not to resort to financing their most recent overnight trip, followed by Gen X (63.0%) and Millennials (52.5%), indicating that Gen Z travelers may be either more comfortable with borrowing funds or have not yet acquired as much personal capital as older generations.

For the complete set of findings, including historic data and custom information on your destination or business, purchase a subscription to The State of the American Traveler study.

Sign up for the next livestream below.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.