IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted or influenced by any advertising or marketing agency. Every week since March 15th, Destination Analysts has surveyed 1,200+ American travelers about their thoughts, feelings, perceptions and behaviors surrounding travel in the wake of the coronavirus pandemic, and explored a variety of topics. The findings presented below represent data collected July 10th-12th.

Key Findings to Know:

- A record low 13.8% of American travelers feel the pandemic will get better in the US in the next month; instead nearly two-thirds feel it will get worse.

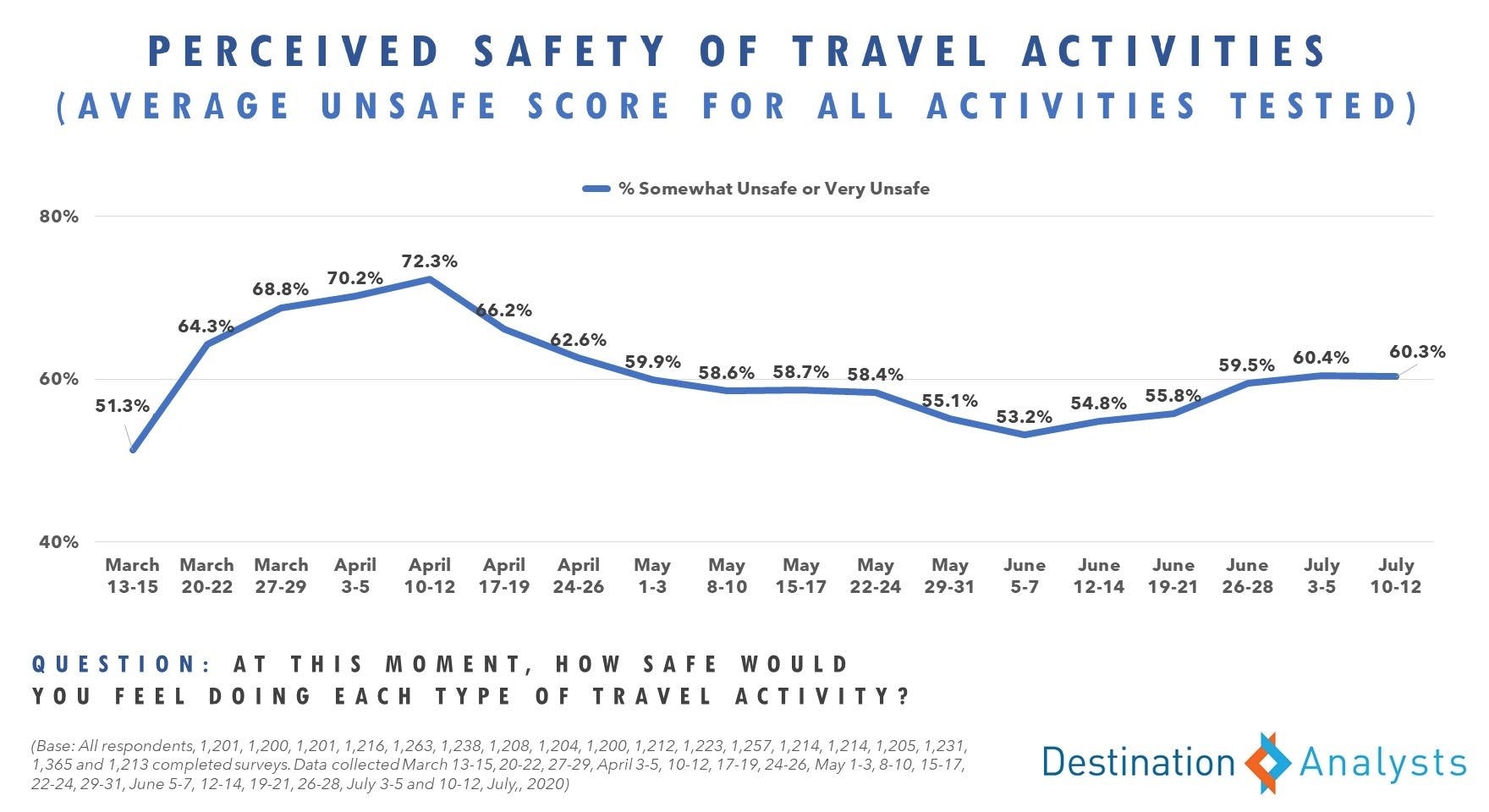

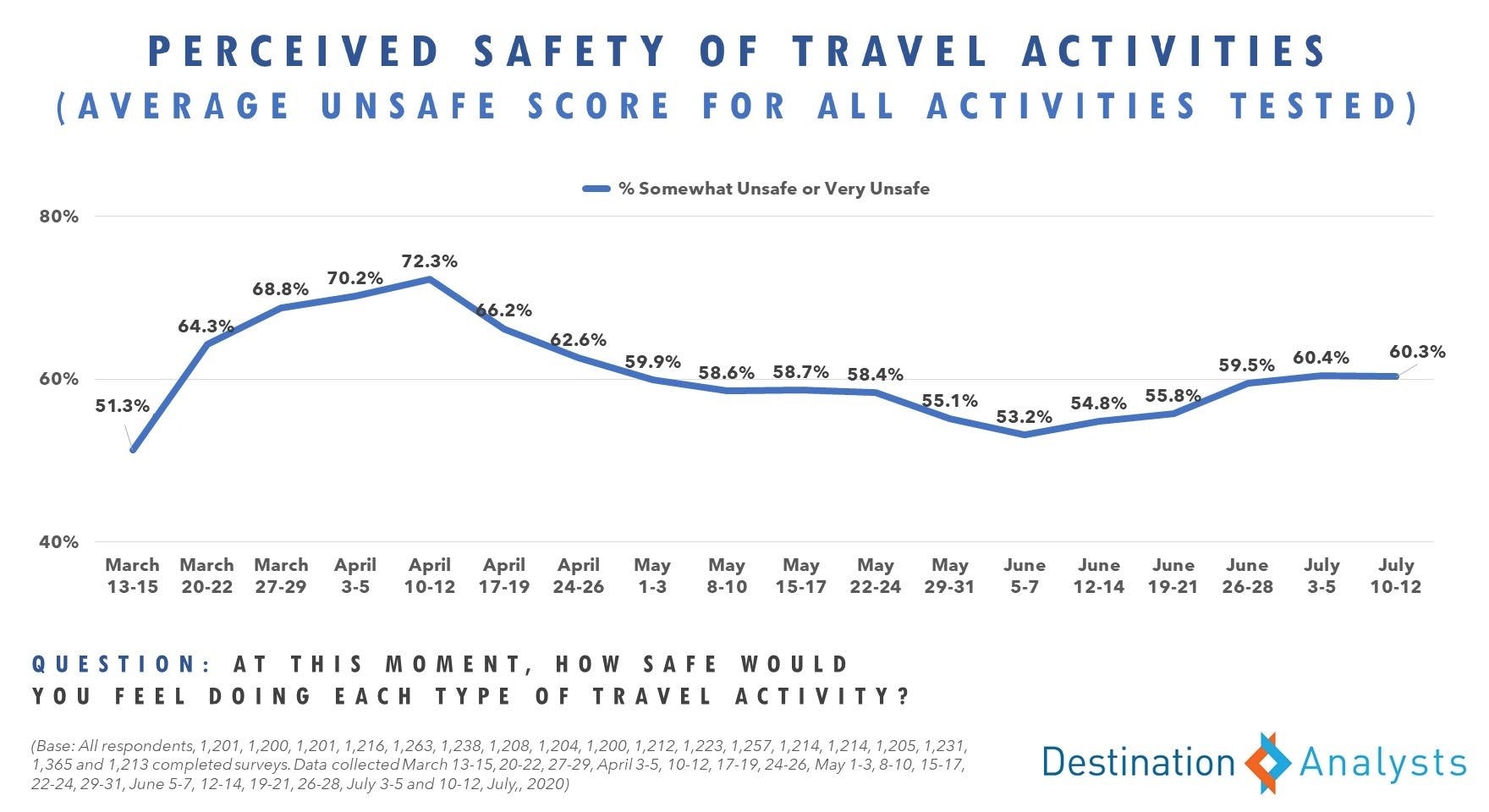

- Personal safety concerns are the highest they have been in three months.

- A record 41.5% of American travelers now say they have no trip plans for the rest of year and only 35.7% agree they will be traveling in the Fall now.

- Americans feel the virus has made travel’s ability to deliver fun and relaxation, as well as culinary and cultural enrichment, especially difficult, if not impossible.

- A majority of American travelers continue to say that too many people in their communities are not wearing face masks and not maintaining the appropriate social distance in public.

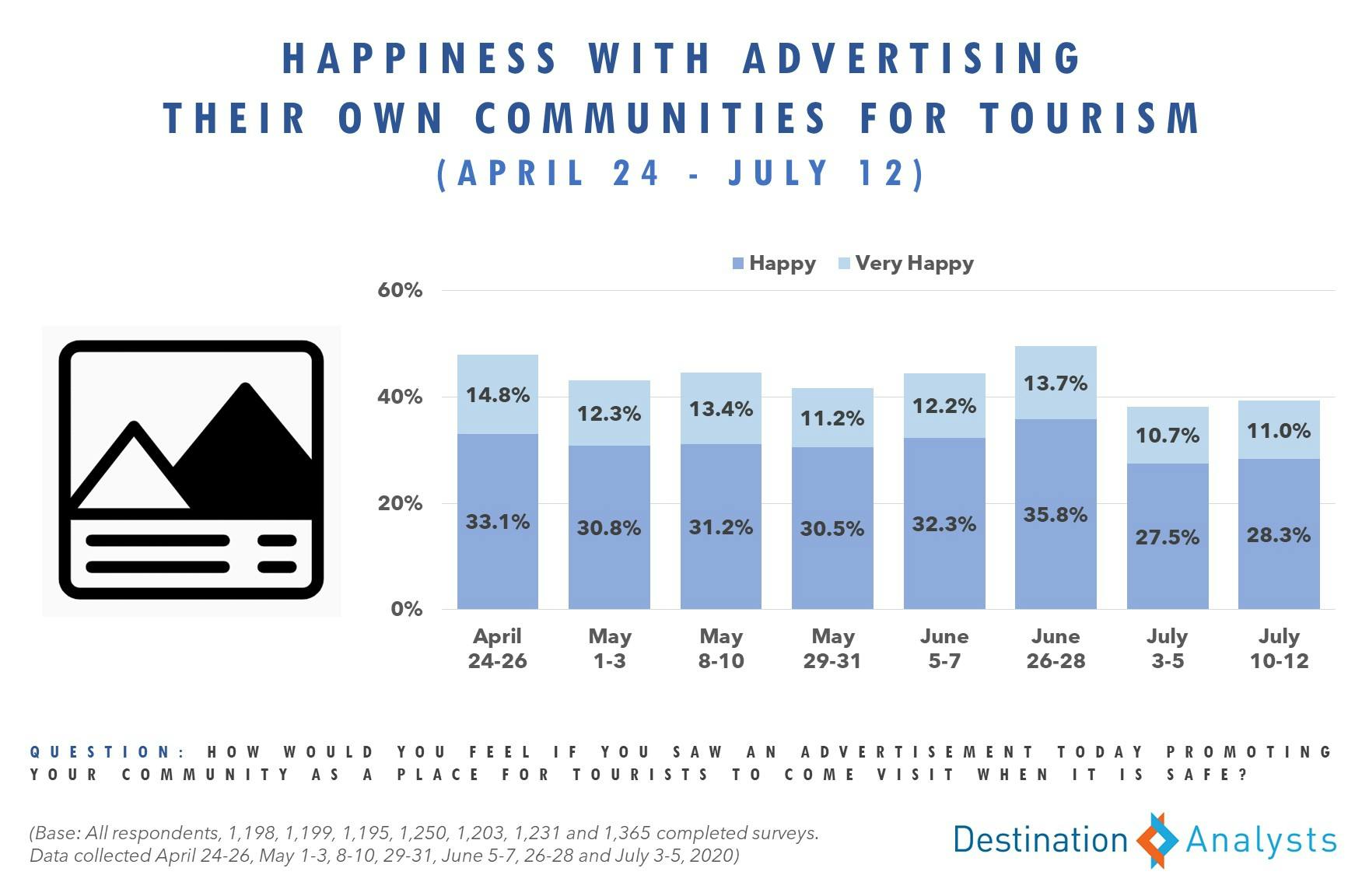

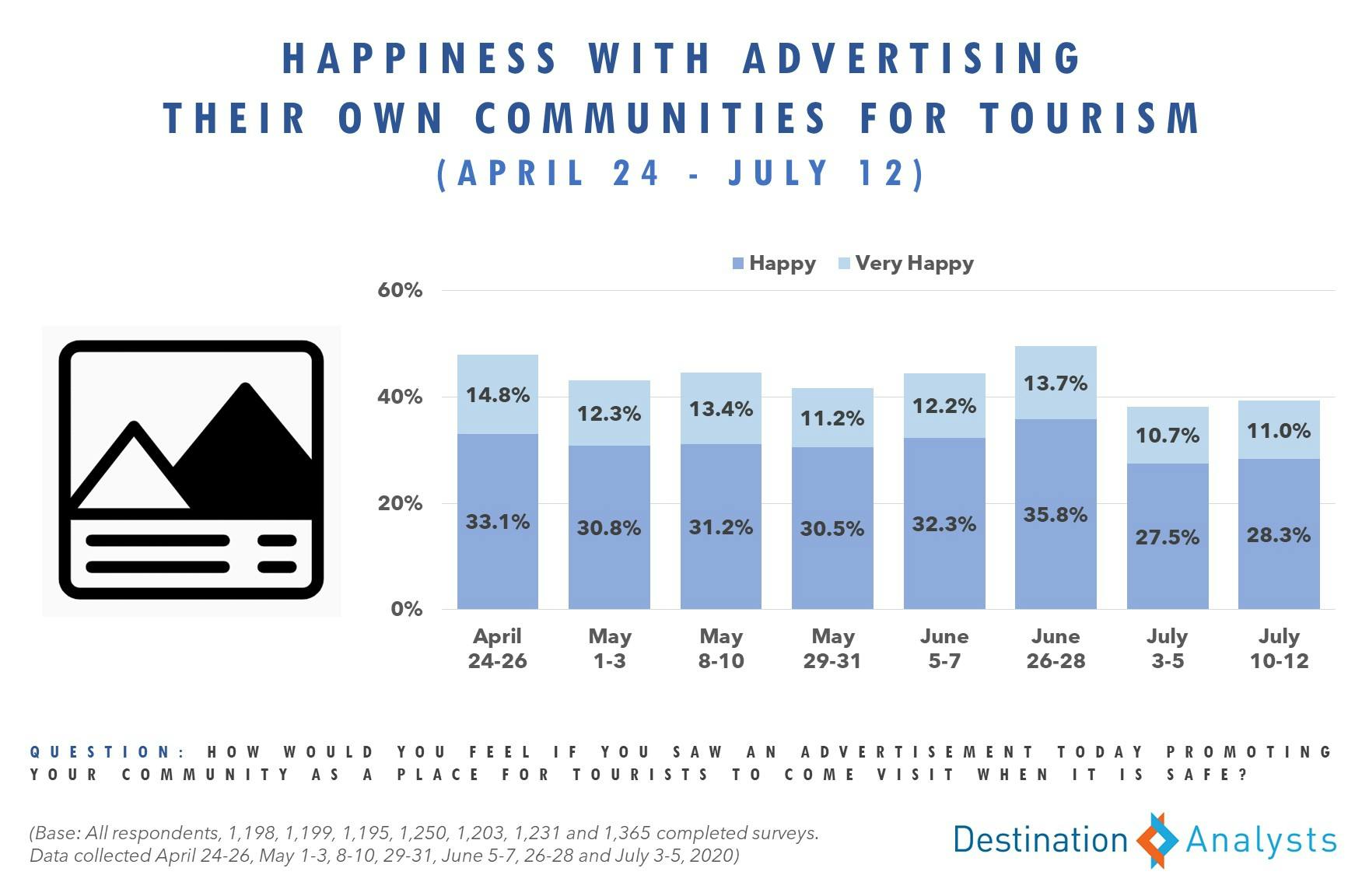

- The percent of Americans who say they would be happy to see an ad promoting their community for tourism when it’s safe remains depressed below 40%.

- Travel marketing potential does exist: Now 11.0% say they are already in a “back traveling” state of mind; another 11.1% say they are ready to travel with no hesitations; 35.3% say they could be convinced to take a trip this year that they hadn’t previously considered.

- Travelers in the Millennial or GenZ generations continue to exhibit less fear and hesitation and more openness and readiness to travel now. Men—particularly those with household incomes above $80K—also continue to index more highly for travel marketability compared to women.

In the last few days, several US states have broken their single day records for coronavirus cases—including Florida, Texas and California, who represent three of the most tourist-ed states in the country. These states, along with Arizona and New York, continue to be cited by Americans as the destinations most associated with the conversation around coronavirus issues.

The impact of COVID-19’s surge can be felt across the American mentality. A record low 13.8% of American travelers feel the pandemic will get better in the US in the next month; instead nearly two-thirds feel it will get even worse. The proportion of American travelers highly concerned about personally or friends/family contracting COVID-19 is the highest it has been in three months. Financial security from the virus is also off from the lows recorded at the start of June. The perception of travel related activities being unsafe has risen to mid-April levels, and the percent agreeing they will be traveling in the Fall has dropped to 35.7%, when it was near 50% only weeks ago on June 5th. Now a record 41.5% of American travelers say they have no leisure trip plans for the remainder of 2020.

When it comes to tourism in their own communities, while nearly 60% say they will take a staycation this summer, the number who feel safe going out for leisure activities locally has declined to 34.2% from 42.1% just three weeks ago (June 19th). A majority of American travelers continue to say that too many people in their communities are not wearing face masks and not maintaining the appropriate social distance in public. Thus the percent of Americans who say they would be happy to see an ad promoting their community for tourism when it’s safe, remains depressed below 40%.

In addition to wreaking havoc on their sense of safety, Americans feel the virus has made travel’s ability to deliver fun and relaxation, as well as culinary and cultural enrichment, especially difficult, if not impossible. The chart below shows the percent of Americans who rated each of these experiences a critical or high priority to them for travel and the percent who said the coronavirus situation would have a significant effect—or make impossible—their ability to have these experiences while traveling for leisure this year. While it is expected that travelers feel the pandemic challenges their ability to experience events and meet new people, it is surprising to see how many feel expected travel benefits like exploration and escaping stress are also challenged by COVID-19.

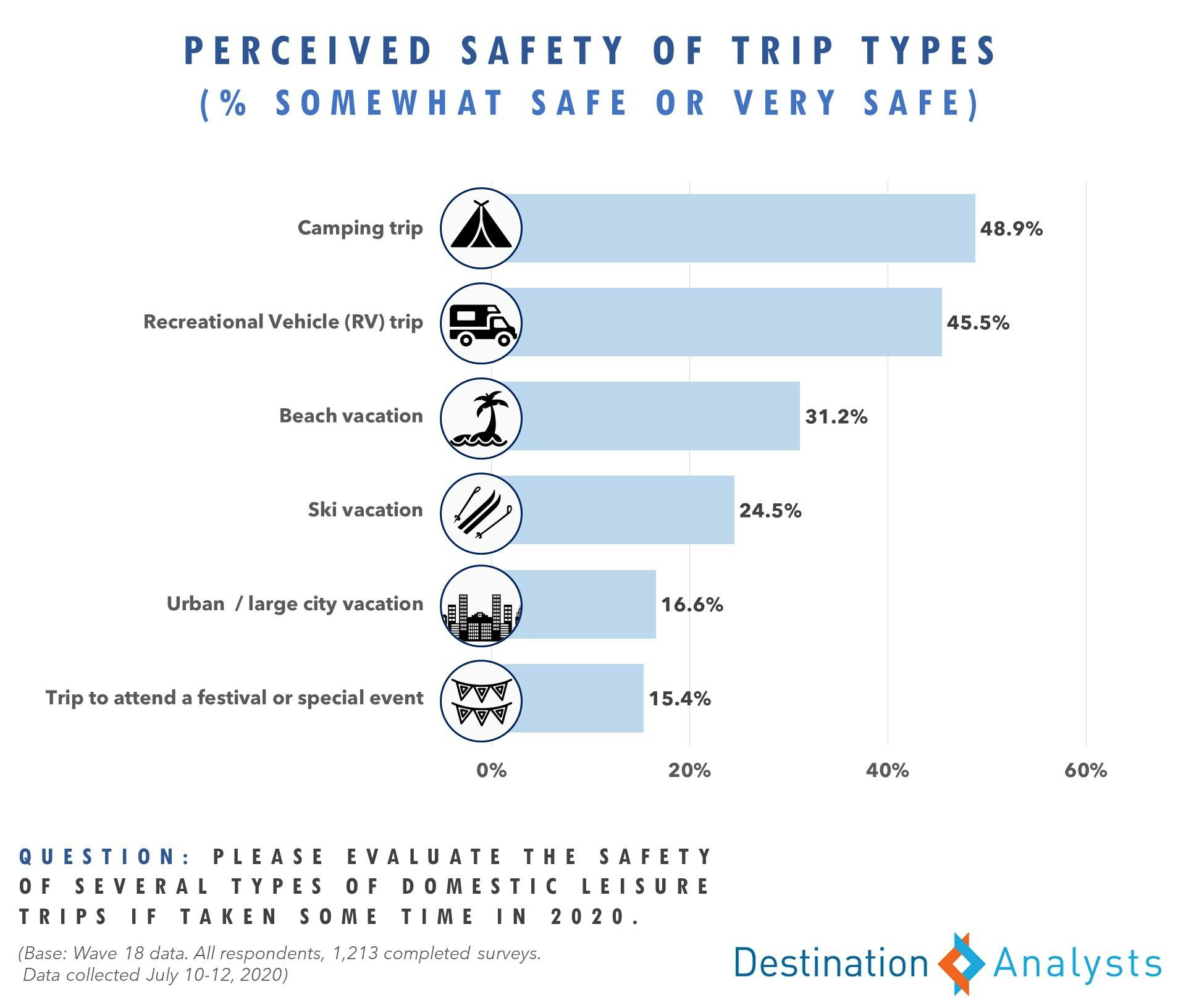

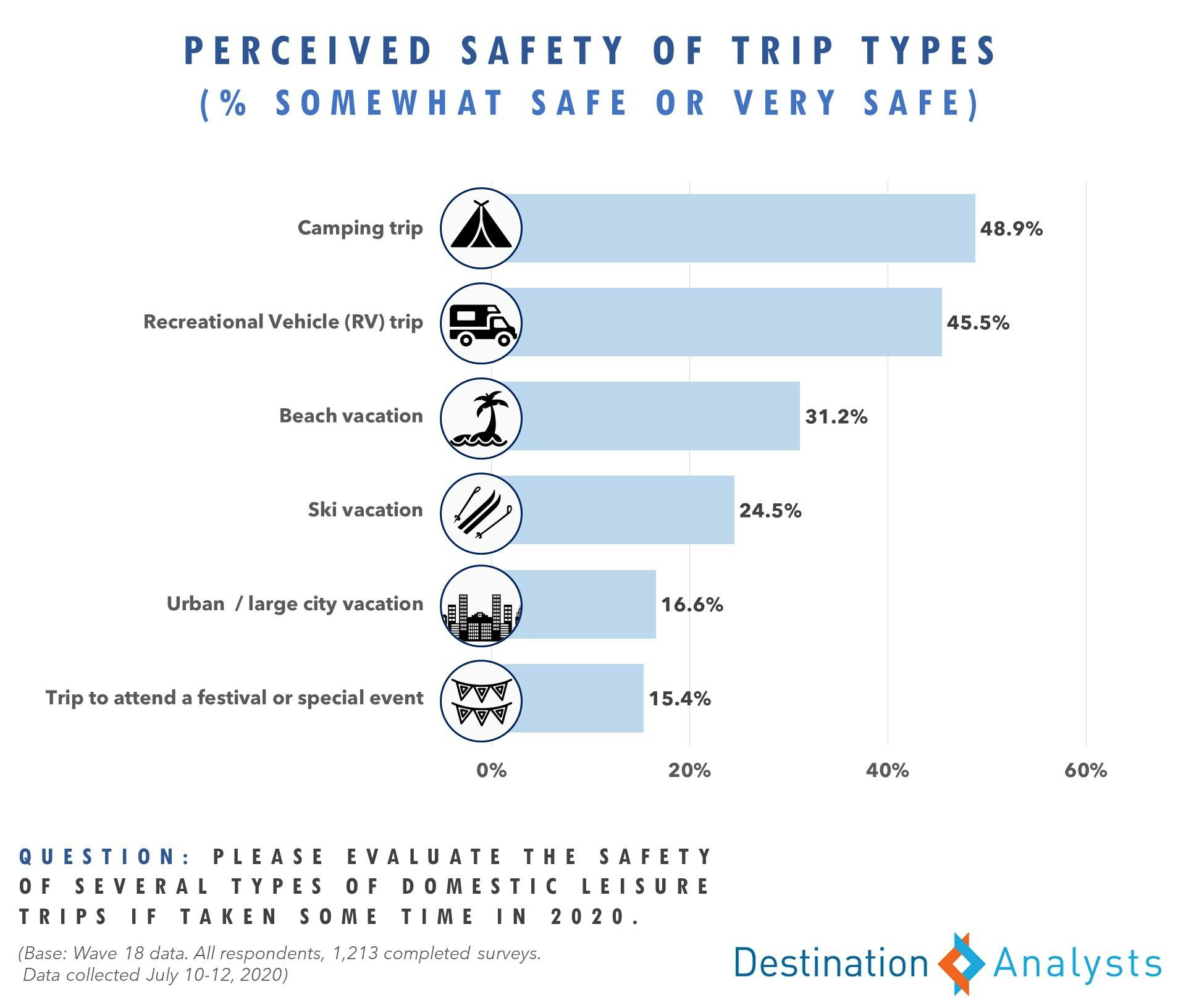

Marketing safe travel in this environment thus poses many challenges—although opportunity exists. Now 11.0% say they are already in a “back traveling” state of mind; and another 11.1% say they are ready to travel with no hesitations. In addition, 35.3% say they could be convinced to take a trip this year that they hadn’t previously considered. Americans agree the safest types of trips one could take this year are camping and RV trips. Across metrics, travelers in the Millennial or GenZ generations continue to exhibit less fear and hesitation and more openness and readiness to travel now. Men—particularly those with household incomes above $80K—also continue to index more highly for travel marketability compared to women.

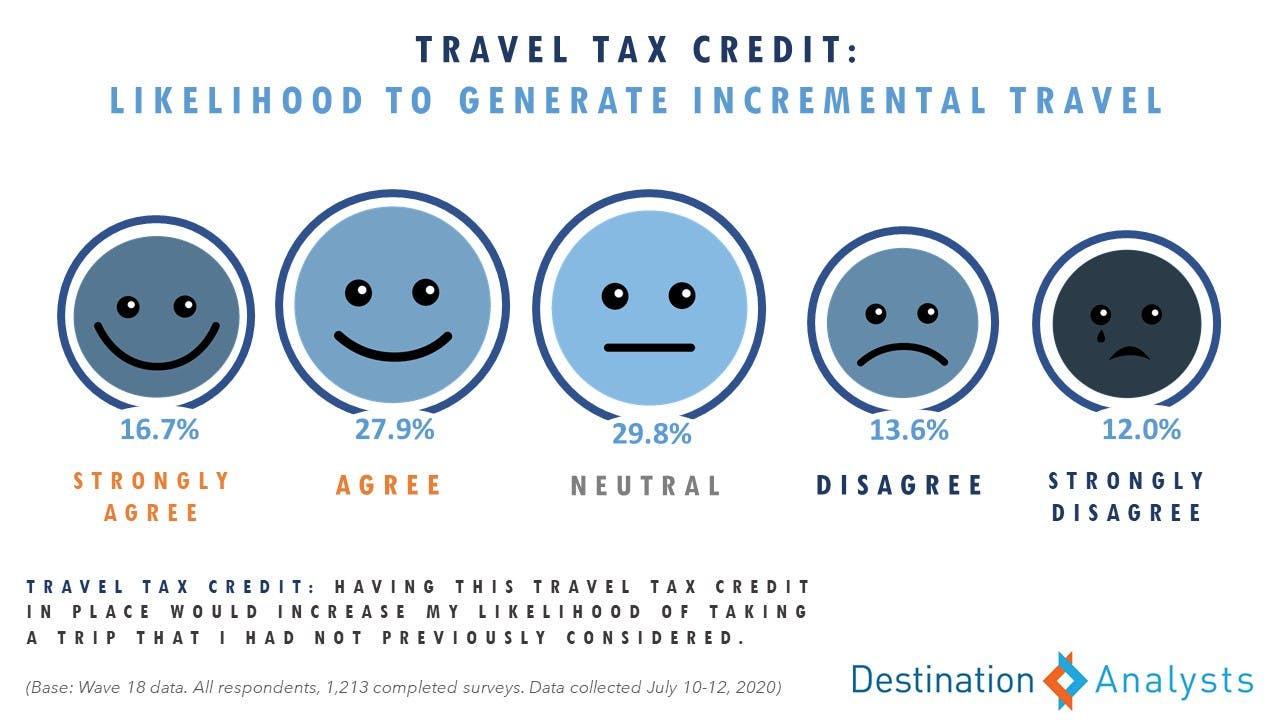

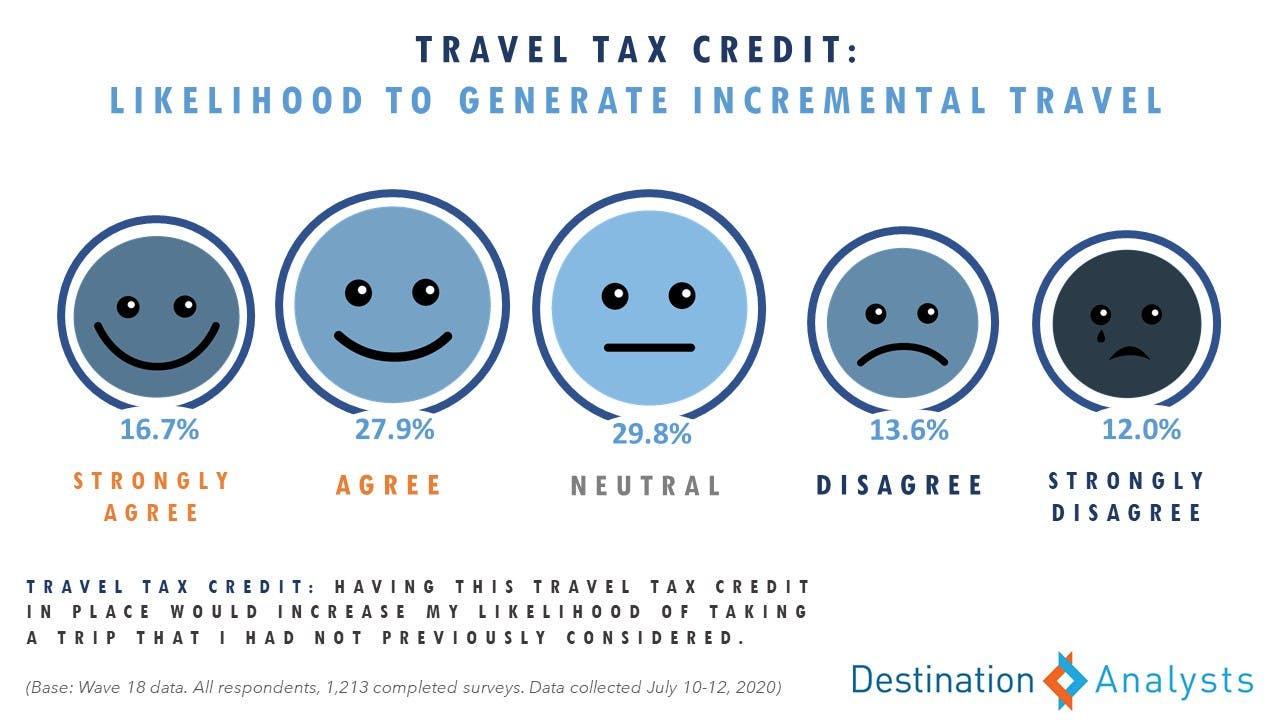

Policy may have a place as a travel stimulus, as well. When American travelers were asked about the potential of a travel tax credit for their leisure travel expenses, 44.6% agreed this would increase their likelihood of taking a trip they had not previously considered.

Follow us on social for infographics of these and other key findings. Need assets for a presentation or something else? Find all the presentation decks from our ongoing traveler research here. And please join us monthly for a live presentation of the latest insights into traveler perceptions and behaviors.

We appreciate your support of this research from our small but mighty team of devoted tourism researchers.

Have a question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our services here.